you position:Home > aphria us stock > aphria us stock

International Market vs. US Stock Market: A Comprehensive Analysis

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In the ever-evolving global financial landscape, investors often find themselves at a crossroads when deciding where to allocate their capital. The international market and the US stock market are two of the most prominent investment destinations, each offering unique opportunities and challenges. This article delves into a comprehensive analysis of these markets, highlighting their key differences, advantages, and potential risks.

Diversification and Market Size

One of the primary reasons investors consider the international market is for diversification. By investing in companies across various countries, investors can reduce their exposure to any single market's volatility. The international market encompasses a wide array of economies, from emerging markets like China and India to established markets like Japan and Germany.

In contrast, the US stock market is known for its size and depth. It is the largest and most liquid stock market in the world, offering a vast array of investment opportunities. The S&P 500, a widely followed index representing the top 500 companies listed on U.S. exchanges, is often seen as a proxy for the overall US stock market.

Economic Factors and Regulatory Environment

Economic factors and regulatory environments play a crucial role in shaping market dynamics. The international market is influenced by various economic indicators, such as GDP growth, inflation rates, and interest rates. Additionally, political stability and currency fluctuations can significantly impact international investments.

The US stock market, on the other hand, is subject to stringent regulatory oversight by agencies like the Securities and Exchange Commission (SEC). This regulatory environment is designed to protect investors and ensure fair and transparent markets.

Performance and Return on Investment

Historically, both the international and US stock markets have provided impressive returns. However, their performance can vary significantly over different time periods. For instance, during the tech boom of the late 1990s, the US stock market outperformed the international market. Conversely, in recent years, some emerging markets have delivered higher returns.

It is important to note that higher returns often come with increased risk. Investors must carefully assess their risk tolerance and investment goals before allocating capital to either market.

Case Study: China vs. US Tech Stocks

A notable example of the differences between the international and US stock markets is the performance of tech stocks in China and the US. Chinese tech giants like Alibaba and Tencent have grown exponentially in recent years, driven by the country's rapidly growing internet and mobile market.

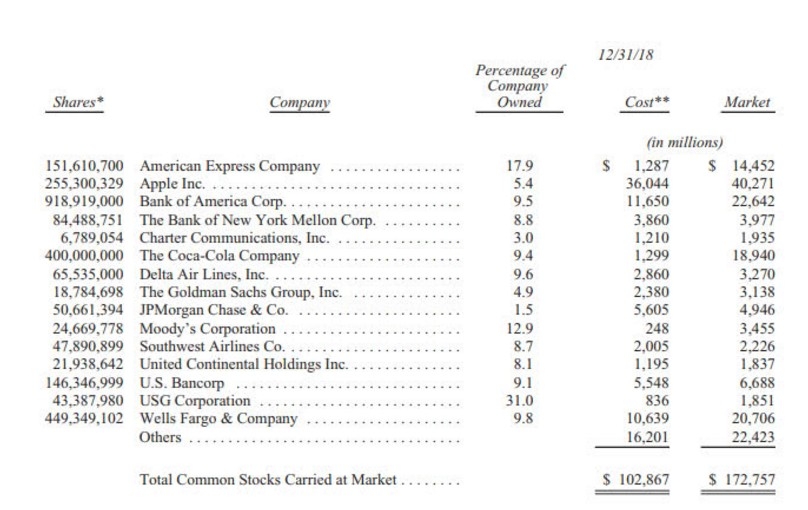

In contrast, US tech companies like Apple, Microsoft, and Google have also experienced significant growth, but at a slower pace. This discrepancy highlights the varying growth drivers and market dynamics in the international and US stock markets.

Conclusion

When deciding between the international market and the US stock market, investors must consider various factors, including diversification, market size, economic factors, and regulatory environments. Both markets offer unique opportunities and challenges, and it is crucial to conduct thorough research and consult with a financial advisor before making investment decisions.

so cool! ()

like

- Two Hands Corporation: A Star Performer on the US Stock Market According to Marke

- PMTs and the US Stock Price: Understanding the Impact

- US Marijuana Stocks to Buy: A Comprehensive Guide for Investors

- Title: Total US Stock Market Capitalization 2025: A Comprehensive Overview

- US Public Holidays 2021: Impact on the Stock Market

- Understanding US Stock Capital Gain Tax for Foreigners

- Title: Size of US Bond Market vs Stock Market: A Comprehensive Comparison

- US Stock Low PE Rankings: Identifying Value Stocks in the Market

- US Stock Index History: A Comprehensive Overview

- Title: US Small-Cap Stocks: The Hidden Gems in the Market

- 2021 US Stocks: A Comprehensive Review of the Year's Performance

- SLW Stock Price US: A Comprehensive Analysis

recommend

International Market vs. US Stock Market: A Co

International Market vs. US Stock Market: A Co

Stock Drive Yellow Sign: Understanding the US

Title: Total US Stock Market Capitalization 20

Understanding the US Bank Sector Stocks: A Com

Stock Market Hours: Understanding the Closing

Site Co.frio.tx.us Live Stock: Your Ultimate R

Title: Best US Stock for Long-Term Investment

Title: US Stock Hedging Strategies Backfire Du

How to Buy Shares in the US Stock Market

Top Short-Term Momentum Stocks in the US Marke

Best US Electric Utility Stocks to Buy in 2025

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- meta price target"

- Jamie Dimon Says Stock Prices in the US Are In"

- US Stock Exchange Symbols Ending with X: A Com"

- Buffet Dumps Us Stocks: What It Means and How "

- Major Stock Brokers in the US: Your Ultimate G"

- Iron Mountain US Stock Price: A Comprehensive "

- hydrogen stocks"

- Title: Path Us Stock: A Comprehensive Guide to"

- insurance stocks"

- Trillions of Dollars Wiped from the US Stock M"