you position:Home > aphria us stock > aphria us stock

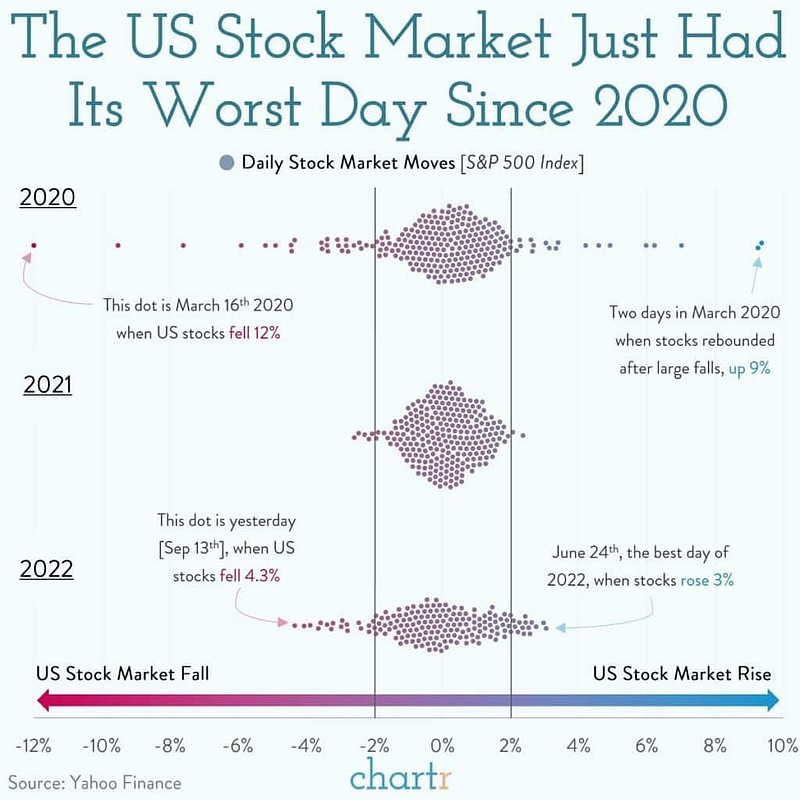

Navigating the US Inflation: How Stocks Are Reacting

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

In recent years, the United States has experienced a surge in inflation rates, prompting many investors to question the stability of their stock portfolios. This article delves into the impact of inflation on the stock market and offers insights into how investors can navigate this challenging landscape.

Understanding Inflation and Its Effects on Stocks

Inflation refers to the general increase in prices of goods and services over time. When inflation rates rise, the purchasing power of money decreases, which can have significant implications for the stock market. Historically, inflation has been a major concern for investors, as it can erode the returns on their investments.

Impact on Stock Valuations

One of the primary ways inflation affects stocks is through its impact on valuation metrics. For instance, when inflation rises, the future cash flows of companies may be discounted at a higher rate, leading to lower stock valuations. This is because investors expect higher returns to compensate for the reduced purchasing power of future cash flows.

Sector-Specific Impacts

Different sectors of the stock market react differently to inflation. Energy and commodity-related stocks often perform well during inflationary periods due to the increased demand for these goods. On the other hand, consumer staples and health care stocks may also hold up well as they tend to be less sensitive to price increases.

Stocks to Consider During Inflation

Inflation can create opportunities for certain stocks. Here are a few examples:

- Inflation-Protected Securities (TIPS): These are government bonds designed to protect investors from inflation. While they offer lower yields than regular bonds, they can be a stable investment during inflationary periods.

- Dividend-Paying Stocks: Companies that can increase their dividends during inflation may be a good investment. These stocks tend to offer a hedge against rising prices.

- Stocks with High Growth Potential: Companies in sectors that are less affected by inflation, such as technology or healthcare, may offer better growth prospects.

Case Study: Microsoft (MSFT)

A prime example of a stock that has performed well during inflationary periods is Microsoft (MSFT). Despite rising inflation, Microsoft has continued to grow its revenue and earnings. This is due to its diversified business model and strong competitive position in the technology sector.

Strategies for Navigating Inflation

To navigate the challenges posed by inflation, investors can consider the following strategies:

- Diversification: Diversifying your portfolio across different asset classes and sectors can help mitigate the risks associated with inflation.

- Active Management: Actively managing your portfolio can help you adjust to changing market conditions and take advantage of opportunities created by inflation.

- Long-Term Perspective: While short-term fluctuations can be unsettling, maintaining a long-term perspective can help you stay focused on your investment goals.

Conclusion

Inflation is a complex issue that can have a significant impact on the stock market. By understanding its effects and adopting the right strategies, investors can navigate this challenging landscape and potentially benefit from the opportunities it presents.

so cool! ()

last:Top Momentum Stocks Today: US Markets Analysis

next:nothing

like

- Top Momentum Stocks Today: US Markets Analysis

- Real Estate vs. Stocks in the US: Which Investment is Right for You?"

- US Money Stocks to But: Top Picks for 2023

- Understanding Today's PE Ratio in the US Stock Market

- Best US Stocks to Buy in 2021: Top Picks for Investors

- Infosys in the US Stock Market: A Comprehensive Analysis

- Unlocking the Potential of Us Steel Canada Stock

- Unlocking the Potential of 601398.ss: A Deep Dive into China's Stock Market

- RDS Stock: A Smart Investment for US Citizens

- Understanding Canadian Capital Gains Tax on US Stocks

- Exchanges to Buy US Stock: Your Ultimate Guide

- How Many US Stocks Have Options? A Comprehensive Guide"

recommend

Navigating the US Inflation: How Stocks Are Re

Navigating the US Inflation: How Stocks Are Re

Us Dow Jones Stock Chart: A Comprehensive Anal

July 2025 US Stock Market Holidays: A Comprehe

Adyen US Stock: A Comprehensive Guide to Inves

Confidence Flight Indicators: How to Navigate

How to Invest in the US Stock Market from Indi

Maca Limited: A Simple Guide to Understanding

US Steel Stock Charts: A Comprehensive Guide t

US Oil Drilling Stocks to Buy: A Comprehensive

Is BYD on the US Stock Market?

US Stock Low PE Rankings: Identifying Value St

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Top Gaining US Stocks This Week: Momentum Anal"

- dividend history"

- Latest US Stock Market News April 30, 2025"

- M&T Bank: A Leading Player in US Stock"

- Title: How Much Was the US Stock Market Down i"

- Is Adidas a US Public Stock?"

- Title: Japan Stock Banks in US Markets: A Comp"

- http stocks.us.reuters.com stocks fulldescript"

- best cheap stocks"

- New US Stocks to Watch: Emerging Opportunities"