you position:Home > aphria us stock > aphria us stock

Kuvera Invest in US Stocks: Your Guide to Successful Investments

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the vast world of investing, finding the right platform can make all the difference. If you're considering diversifying your portfolio and investing in US stocks, Kuvera could be the answer you're looking for. This comprehensive guide will delve into the ins and outs of investing in US stocks through Kuvera, covering everything from the platform's features to potential benefits and strategies.

What is Kuvera?

Kuvera is a popular investment platform that offers a wide range of investment options, including stocks, bonds, and ETFs. With Kuvera, users can easily invest in US stocks, making it an attractive choice for those looking to expand their investment horizons.

Benefits of Investing in US Stocks with Kuvera

1. Diversification: Investing in US stocks allows you to diversify your portfolio, reducing the risk of market volatility. By spreading your investments across various sectors and companies, you can potentially maximize your returns.

2. Access to Top Companies: The US stock market is home to some of the world's most successful and innovative companies. Investing in US stocks through Kuvera gives you the opportunity to invest in these top-performing companies.

3. Low Fees: Kuvera offers low fees, making it an affordable option for investors of all levels. This can help you keep more of your hard-earned money.

4. User-Friendly Platform: Kuvera's platform is easy to navigate, making it a great choice for both beginners and experienced investors. The platform offers a range of tools and resources to help you make informed investment decisions.

How to Invest in US Stocks with Kuvera

Investing in US stocks with Kuvera is a straightforward process. Here's a step-by-step guide:

Sign Up: Create a Kuvera account by visiting their website and completing the registration process.

Fund Your Account: Transfer funds to your Kuvera account through your preferred payment method.

Research Stocks: Before investing, research potential stocks to find ones that align with your investment goals and risk tolerance.

Place Your Order: Once you've chosen a stock, place an order through the Kuvera platform.

Monitor Your Investments: Regularly review your portfolio to ensure it aligns with your investment strategy.

Strategies for Investing in US Stocks

When investing in US stocks through Kuvera, it's essential to have a well-defined strategy. Here are a few strategies to consider:

1. Dividend Investing: Investing in companies with a strong track record of paying dividends can provide a steady income stream.

2. Value Investing: Look for companies that are undervalued compared to their peers. This strategy involves identifying companies with strong fundamentals but are currently trading below their intrinsic value.

3. Growth Investing: Focus on companies with high growth potential. These companies may have volatile stock prices but offer the potential for significant returns.

Case Studies

Let's look at a couple of case studies to illustrate the potential of investing in US stocks through Kuvera:

Case Study 1: A beginner investor with a risk tolerance of 70% decides to invest in a tech ETF through Kuvera. Over the next five years, the investor's portfolio grows by 15%, demonstrating the potential of investing in the tech sector.

Case Study 2: An experienced investor with a long-term investment horizon invests in a dividend-paying utility company through Kuvera. The investor receives regular dividend payments and enjoys a steady increase in their investment value over time.

In conclusion, investing in US stocks through Kuvera can be a great way to diversify your portfolio and potentially maximize your returns. By understanding the platform's features, benefits, and strategies, you can make informed investment decisions and achieve your financial goals.

so cool! ()

last:US Bank Stocks in 2018: A Comprehensive Review

next:nothing

like

- US Bank Stocks in 2018: A Comprehensive Review

- Title: Path Us Stock: A Comprehensive Guide to Investing in the Stock Market

- US Stock Market: A Comprehensive Guide to Understanding the Dynamic World of Stoc

- Can You Buy Oppo Stock in the US?

- Buffet Dumps Us Stocks: What It Means and How It Impacts the Market

- US Bank ETF Stock Price: A Comprehensive Guide

- US Stock Exchange Open Hours: A Comprehensive Guide

- US Stock Buybacks Total Volume: The Impact on the Market

- Niu US Stock: A Comprehensive Guide to Investing in the Electric Scooter Giant

- Loc 94 Silk Stocking Lane Akron, AL, US: A Prime Real Estate Treasure

- US Blue Chip Stocks: A Blueprint for Investment Success

- Title: Percentage of US Citizens Who Own Stocks: Understanding the Numbers

recommend

Kuvera Invest in US Stocks: Your Guide to Succ

Kuvera Invest in US Stocks: Your Guide to Succ

Dash Stock US: A Comprehensive Guide to Invest

American Tower US Real Estate Stocks: A Compre

Jim Rogers Sold All US Stocks: What It Means f

Haleon US Stock Price: What You Need to Know

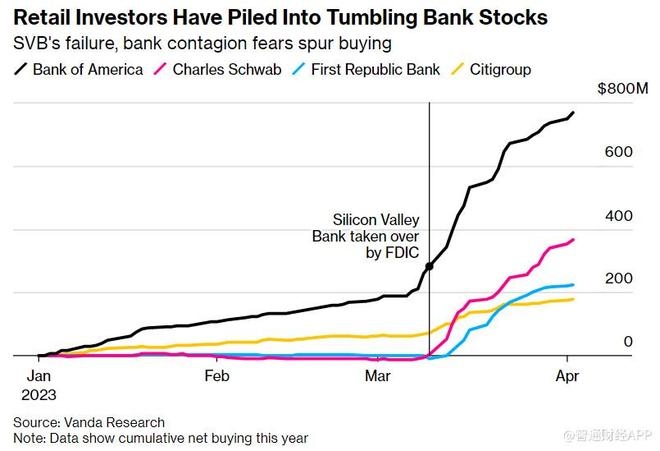

Citi Says Buyers Plow $21 Billion into US Stoc

Dividend Stocks Traded in the US: A Comprehens

US Marijuana Stock: The Future of Legal Cannab

US Energy Development Corporation Stock: A Com

Fidelity US Focus Stock: A Strategic Investmen

Is the US Stock Market Open Today July 19, 202

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Large Cap Stocks Momentum Leaders: Unveilin"

- US Large Cap Stocks: Highest Gains and Momentu"

- military stocks"

- robotics stocks"

- semiconductor stocks"

- IPOs March 2022: A Comprehensive List of US St"

- uber stock forecast"

- How to Buy Taiwan Stock in the US"

- List of US Stocks by Price: A Comprehensive Gu"

- silver etf"