you position:Home > aphria us stock > aphria us stock

US Blue Chip Stocks: A Blueprint for Investment Success

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the vast landscape of the stock market, blue chip stocks stand out as the cream of the crop. These are the companies that have proven their worth over time, offering stability, reliability, and potential for growth. If you're looking to invest in the stock market, understanding the allure of blue chip stocks is crucial. In this article, we delve into what makes a blue chip stock, their benefits, and how you can incorporate them into your investment strategy.

What is a Blue Chip Stock?

A blue chip stock is a term used to describe shares of companies that are considered to be financially stable, with a strong history of profitability and growth. These companies are often leaders in their respective industries and are known for their reliable performance, strong management, and solid financials.

Characteristics of Blue Chip Stocks

- Strong Financials: Blue chip companies typically have a strong balance sheet, with low debt levels and consistent earnings.

- Market Leadership: These companies are market leaders in their industry, often with a significant market share.

- Stable Dividends: Blue chip stocks are known for their consistent dividend payments, which can provide investors with a steady income stream.

- Resilience to Market Volatility: These companies are often less affected by market fluctuations, making them a safer bet during turbulent times.

Benefits of Investing in Blue Chip Stocks

- Stability: Blue chip stocks offer stability, making them a good choice for conservative investors.

- Potential for Growth: Despite their stability, these companies still have the potential for growth, especially as they expand into new markets or develop new products.

- Dividend Income: Consistent dividend payments can provide investors with a reliable income stream.

- Long-Term Performance: Historically, blue chip stocks have outperformed the market over the long term.

How to Identify Blue Chip Stocks

Identifying blue chip stocks involves researching companies with a strong financial track record, market leadership, and a history of consistent performance. Some popular blue chip stocks in the United States include:

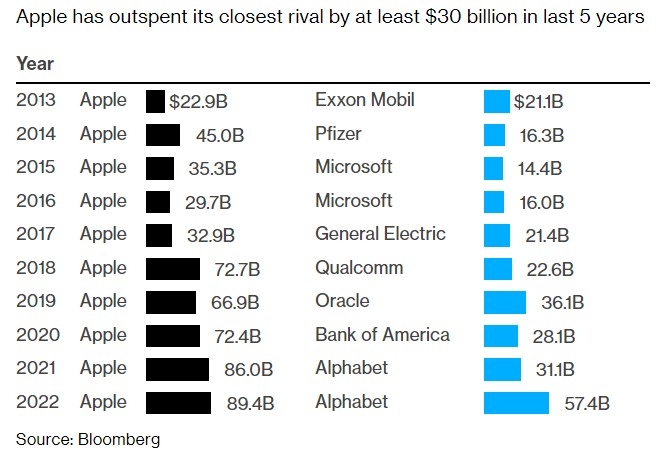

- Apple (AAPL): A leader in the technology industry, known for its innovative products and strong financials.

- Microsoft (MSFT): A dominant player in the software industry, with a strong presence in cloud computing and gaming.

- Johnson & Johnson (JNJ): A leader in the healthcare industry, with a diverse portfolio of products and a strong track record of innovation.

Case Study: Procter & Gamble (PG)

Procter & Gamble (PG) is a classic example of a blue chip stock. With a long history of innovation and market leadership, PG has consistently delivered strong financial results. Over the past decade, PG has increased its dividend by an average of 7% per year, providing investors with a reliable income stream. Additionally, the company has grown its earnings per share by an average of 5% per year, outperforming the market.

In conclusion, blue chip stocks are a valuable component of any investment portfolio. Their stability, potential for growth, and consistent dividend payments make them an attractive option for investors seeking long-term returns. By understanding what makes a blue chip stock and conducting thorough research, you can identify and invest in these market leaders for your own financial success.

so cool! ()

like

- Title: Percentage of US Citizens Who Own Stocks: Understanding the Numbers

- Predictions: How Trump's Presidency Affects the Stock Market

- US Cellular Stock Drop: What You Need to Know

- Do Foreign Investors Pay Taxes on US Stocks?

- Indian Brokers for US Stocks: How to Invest in the American Market from India

- Fidelity US Focus Stock: A Strategic Investment Approach

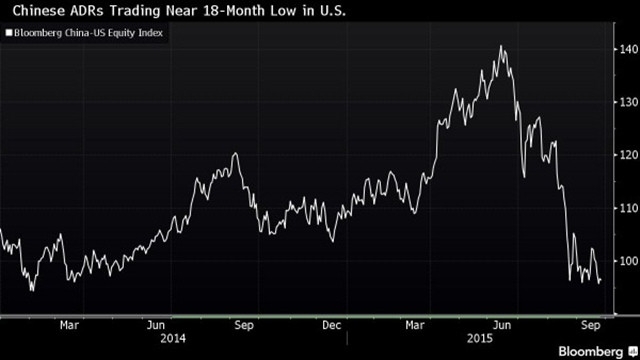

- Title: Domestic Stocks Outperform Foreign-Facing Stocks: US vs. China

- US Stock Losers: Understanding the Factors Behind the Decline

- Philippine Stock Market PSEi US Downgrade: What It Means for Investors

- Bid Us Stock: A Comprehensive Guide to Stock Trading for Beginners

- US Micro Cap Stocks Under $300 Million Market Cap List: A Comprehensive Guide

- US Corn Stock Price: A Comprehensive Guide

recommend

US Blue Chip Stocks: A Blueprint for Investmen

US Blue Chip Stocks: A Blueprint for Investmen

Tax on US Stock: Understanding the Implication

Title: Stock Markets Predicting the US Electio

All the Us Stocks Penny: A Comprehensive Guide

US Oil Stocks: A Comprehensive Guide to API an

Best US Stocks for Short-Term Trading: Unveili

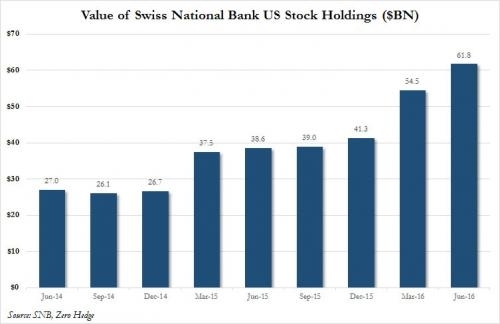

Foreign Governments Own Us Stocks: The Implica

StockInvest US on MSFT Stock: A Strategic Move

US Blue Chip Stocks: A Blueprint for Investmen

Indian Brokers for US Stocks: How to Invest in

Title: Domestic Stocks Outperform Foreign-Faci

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Large Cap Value Stocks: Market Cap Over 2 B"

- Title: Purchasing Heritage Cannabis US Stock: "

- nvda price target"

- Title: Japan Stock Banks in US Markets: A Comp"

- US Stock Market Bottom: A Comprehensive Guide "

- financial etf"

- How to Buy Eutelsat Stock in the US"

- Title: EV Stocks US: The Future of Electric Ve"

- Top 10 in US Stocks Market Review"

- disney stock forecast"