you position:Home > aphria us stock > aphria us stock

How Does War Affect the US Stock Market?

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The stock market is often viewed as a barometer of economic health and stability. One of the most significant factors that can impact the US stock market is war. Whether it's a local conflict or a global war, the effects can be profound and long-lasting. This article delves into how war affects the US stock market, highlighting key areas of influence and providing real-world examples.

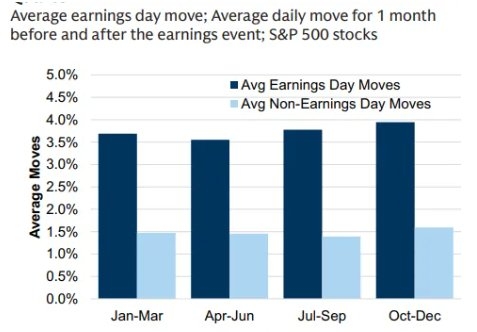

Market Volatility

One of the most immediate effects of war on the stock market is increased volatility. War creates uncertainty and fear, leading to rapid and unpredictable movements in stock prices. Investors often sell off their stocks to avoid potential losses, causing the market to fluctuate wildly.

For instance, during the Gulf War in 1991, the S&P 500 index fell by nearly 20% in just a few months. This drop was primarily due to the uncertainty surrounding the conflict and its potential impact on the global economy.

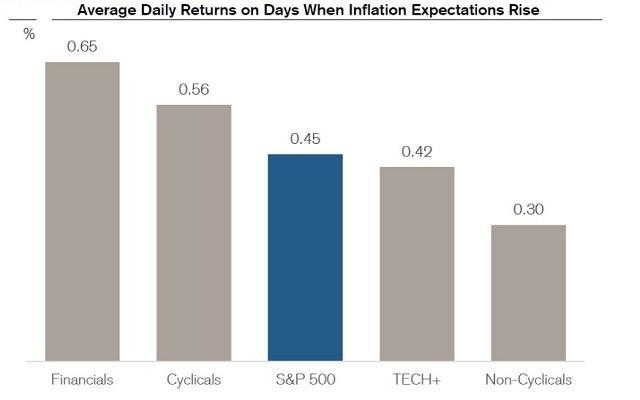

Sector-Specific Impacts

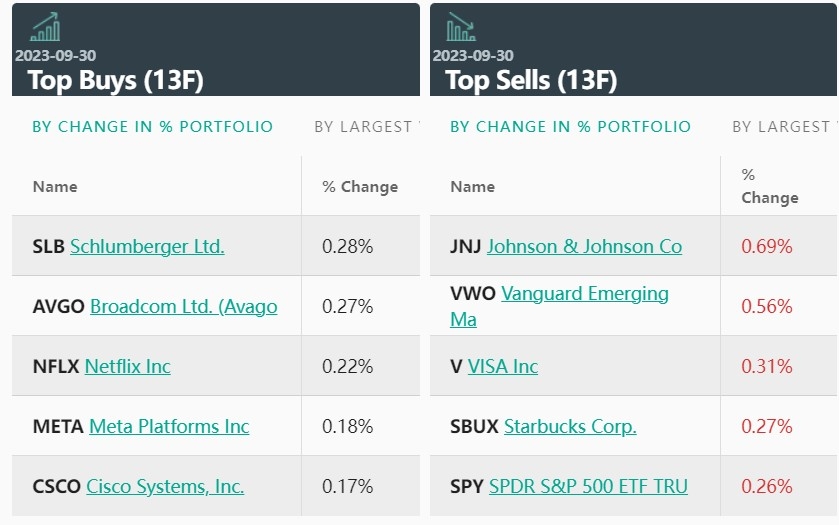

Certain sectors of the stock market are more susceptible to the effects of war than others. Defense and aerospace companies often see a boost in their stock prices during times of conflict. This is because governments increase their spending on military equipment and services.

Conversely, consumer discretionary sectors such as retail and entertainment can suffer. Consumers may cut back on spending as they become more concerned about their safety and the economic outlook.

Economic Consequences

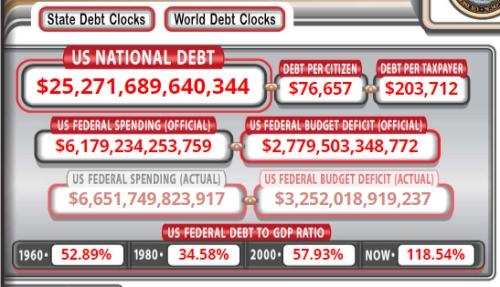

War can have significant economic consequences, which in turn affect the stock market. Inflation can rise as governments increase spending on military operations and as resources become scarce. This can lead to higher interest rates, which can hurt the stock market.

Moreover, war can disrupt global supply chains and lead to higher energy prices. This can increase the cost of goods and services, further impacting consumer spending and corporate profits.

Real-World Examples

The COVID-19 pandemic serves as a prime example of how a global event can affect the stock market. While not a traditional war, the pandemic caused widespread fear and uncertainty, leading to a significant drop in stock prices. However, as the situation improved and vaccines were developed, the market recovered.

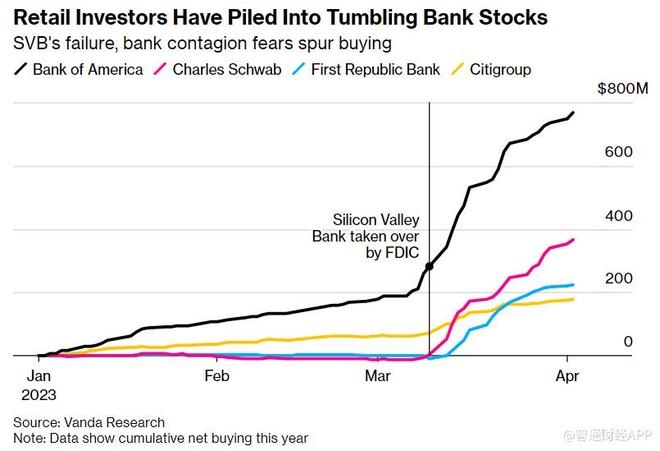

Similarly, the war in Ukraine has caused a surge in energy prices and supply chain disruptions, leading to volatility in the stock market. Companies that rely on energy or have supply chains affected by the conflict have seen their stock prices fluctuate accordingly.

Conclusion

In conclusion, war can have a significant impact on the US stock market. It creates uncertainty, affects specific sectors, and can lead to broader economic consequences. While the market can recover from these events, the effects can be long-lasting and unpredictable. As investors, it's important to stay informed and understand the potential risks associated with war and other global events.

so cool! ()

like

- Today's Stock Earnings: Unveiling the Financial Fortunes of Leading Companie

- Will the Stock Market Go Up or Down Tomorrow?

- Unlocking Opportunities: A Deep Dive into Asian Markets Finance

- Contrarian Small Cap Stocks: Navigating the US Market for Unconventional Opportun

- Yahoo Finance: Your Ultimate Resource for Stock Market Insights

- Unlocking the Secrets of the US Cotton Stock Ticker: A Comprehensive Guide

- Us Stock Figures: Unveiling the Latest Trends and Insights

- Maximizing Market Insights with Effective Reading Techniques

- Bank Earnings on the US Stock Exchange: A Comprehensive Analysis

- In-Depth Analysis of Matrix Semiconductor: A Leading Stock to Watch"

- US Stock Futures Live Chart: Your Ultimate Guide to Real-Time Market Insights

- Stock Volume Tracker: Master the Art of Monitoring Market Activity

recommend

How Does War Affect the US Stock Market?

How Does War Affect the US Stock Market?

US Healthcare Stocks: Bigger Forces Than Polit

Unlocking Potential: The World of US Small Gro

Top Momentum Stocks: 5-Day Performance in the

CarClayCard US Stock Purchase Plan Match: Maxi

Bid Us Stock: A Comprehensive Guide to Stock T

Yaoofinance: Revolutionizing the Financial Wor

Title: Stock Markets Predicting the US Electio

Maximizing Market Insights with Effective Read

Lithium Mining Stocks: A Lucrative Investment

AMD Stock: The US Dollar Connection

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Interactive Brokers Buying Stocks in London: A"

- Stocks Yesterday Closing Chart: A Comprehensiv"

- Stocks More Than $1000: The High-End Investmen"

- Unlock the Potential of US Stock Investment Gr"

- Top 5 Best US Dividend Aristocrats Stocks for "

- Biggest Losers Today: Stock Market Declines Un"

- Best Performing US Stocks YTD 2025: A Deep Div"

- How to Buy US Stock from Hang Seng Bank"

- Understanding the US Smokeless Tobacco Stock S"

- Stock Market Losses Since Trump Took Office: A"