you position:Home > aphria us stock > aphria us stock

Bank Earnings on the US Stock Exchange: A Comprehensive Analysis

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the ever-evolving landscape of the financial world, bank earnings on the US stock exchange have always been a topic of great interest. This article delves into the latest trends, key factors influencing bank earnings, and how these figures reflect the overall health of the financial sector. By examining various aspects, we aim to provide a comprehensive understanding of bank earnings on the US stock exchange.

Understanding Bank Earnings

Bank earnings, also known as net income, represent the profit a bank generates over a specific period. It is calculated by subtracting the bank's expenses from its revenue. This figure is crucial for investors, regulators, and the general public as it reflects the financial stability and performance of the bank.

Factors Influencing Bank Earnings

Several factors can impact bank earnings, including:

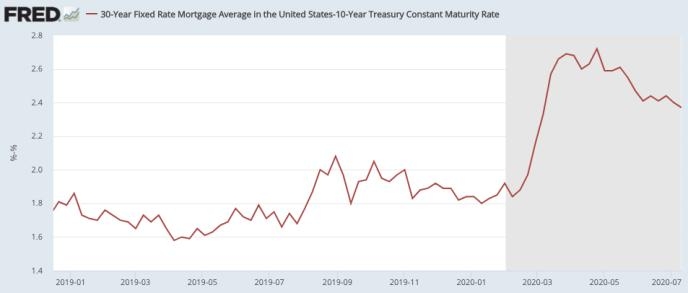

- Interest Rates: The interest rate is a critical factor in determining bank earnings. Higher interest rates can lead to increased net interest income, while lower rates can have the opposite effect.

- Loan Quality: The quality of loans a bank holds significantly impacts its earnings. Higher defaults or delinquencies can lead to increased provisions for loan losses, thereby affecting earnings.

- Non-Interest Income: Non-interest income, such as fees and commissions, plays a vital role in bank earnings. An increase in non-interest income can boost overall earnings.

- Regulatory Changes: Changes in regulations can have a significant impact on bank earnings. For instance, stricter capital requirements can limit a bank's ability to lend, thereby affecting its earnings.

Latest Trends in Bank Earnings

In recent years, several trends have emerged in bank earnings on the US stock exchange:

- Increased Non-Interest Income: Many banks have seen a rise in non-interest income, driven by higher fees and commissions.

- Improved Loan Quality: The quality of loans held by banks has improved, leading to lower provisions for loan losses.

- Moderate Growth in Net Interest Income: While net interest income has grown, it has not seen the same level of growth as non-interest income.

Case Studies

To illustrate the impact of bank earnings on the US stock exchange, let's consider two case studies:

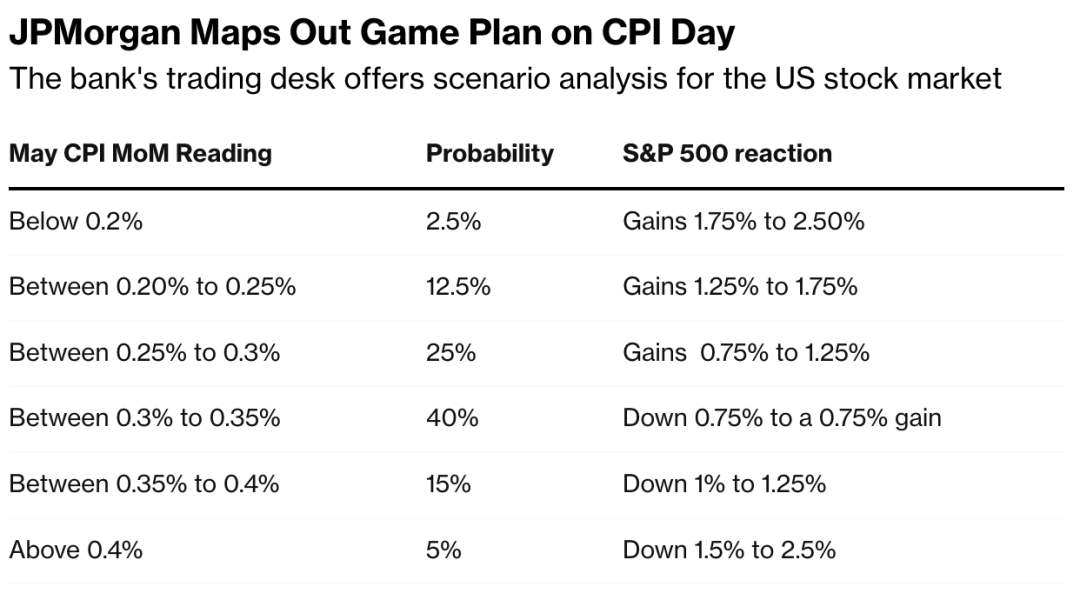

- JPMorgan Chase: JPMorgan Chase has consistently reported strong earnings, driven by its diverse business segments and robust non-interest income. The bank's ability to adapt to changing market conditions has played a significant role in its success.

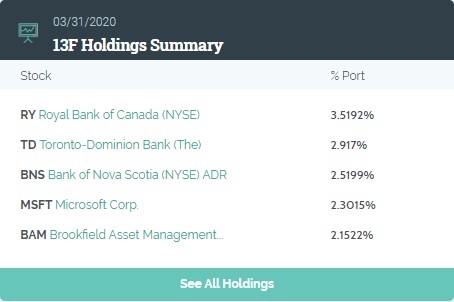

- Bank of America: Bank of America has faced challenges in recent years, including higher provisions for loan losses. However, the bank has made strides in improving its non-interest income, which has helped offset some of the negative impacts on its earnings.

Conclusion

Bank earnings on the US stock exchange are a critical indicator of the financial health of the banking sector. By understanding the factors influencing bank earnings and the latest trends, investors and stakeholders can gain valuable insights into the performance of banks. As the financial landscape continues to evolve, staying informed about bank earnings remains essential for making informed decisions.

so cool! ()

like

- In-Depth Analysis of Matrix Semiconductor: A Leading Stock to Watch"

- US Stock Futures Live Chart: Your Ultimate Guide to Real-Time Market Insights

- Stock Volume Tracker: Master the Art of Monitoring Market Activity

- Cannabis US Stocks: A Comprehensive Guide to Investing in the Growing Industry

- Dow Jones CNN Money: The Ultimate Guide to Financial News and Insights

- Is the US Stock Market Open on Monday, November 12th? What You Need to Know

- Stock Market US Close Today: Key Takeaways and Analysis

- Maximizing Your Investment Potential with US Stock Earnings Releases

- Best Website for US Stock Market News: Your Ultimate Resource"

- Understanding the Intricate Correlation Between the US Dollar and the Stock Marke

- Cheapest Stock in the US: Your Guide to Investing Wisely"

- Reлиance Jio Stock in US: A Comprehensive Guide to Investing"

recommend

Bank Earnings on the US Stock Exchange: A Comp

Bank Earnings on the US Stock Exchange: A Comp

Two Hands Corporation: A Star Performer on the

Best Model for Predicting Option Price of US S

US Stock Market August 9, 2017 Fall Prediction

US Presidents and Stock Market Performance: A

Unlocking the Potential: A Deep Dive into US S

Interactive Brokers Buying Stocks in London: A

Lufthansa US Stock: A Comprehensive Analysis

Best US Dividend Stocks 2018: Top Picks for In

International Market vs. US Stock Market: A Co

Title: Discover the Least Correlated Foreign S

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Small US Stocks to Buy: Top Picks for 2023"

- US Stock Futures Mildly Decline After S&am"

- target date fund"

- US Stock Market Bubble Debate 2025: A Closer L"

- Today's Top Momentum Stocks: A Dive into "

- Stocks More Than $1000: The High-End Investmen"

- Title: Dow Jones US Total Stock Market Index v"

- Average Return of the US Stock Market from 200"

- US Share Market Chart: Decoding the Stock Mark"

- Bristol Motor Speedway US Stock Car Nationals "