you position:Home > aphria us stock > aphria us stock

Current Stock Market Valuation: A Comprehensive US Perspective

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

In the ever-evolving landscape of the financial world, understanding the current stock market valuation in the United States is crucial for investors and traders alike. This article delves into the latest trends, key metrics, and influential factors shaping the stock market's valuation in the US.

Market Trends and Valuation Metrics

The stock market valuation is a critical indicator of the overall health and potential of the market. Currently, several key metrics are being closely monitored to gauge the market's valuation:

Price-to-Earnings (P/E) Ratio: This ratio compares the current share price of a company to its per-share earnings. A higher P/E ratio often suggests that investors are willing to pay more for a company's earnings, reflecting optimism about its future growth prospects.

Price-to-Book (P/B) Ratio: The P/B ratio compares a company's current market value to its book value, which is the company's assets minus its liabilities. A high P/B ratio may indicate that the stock is overvalued, while a low P/B ratio may suggest undervaluation.

Earnings Yield: This metric is the inverse of the P/E ratio and represents the return on investment based on a company's earnings. A higher earnings yield indicates a better investment opportunity.

Influencing Factors

Several factors are currently influencing the stock market valuation in the US:

Economic Conditions: The overall economic climate, including GDP growth, inflation rates, and unemployment levels, can significantly impact stock market valuations.

Central Bank Policies: The actions of the Federal Reserve, such as interest rate adjustments and quantitative easing, can have a profound effect on market valuations.

Technological Advancements: The rapid pace of technological innovation continues to drive market valuations, with tech giants like Apple, Amazon, and Google leading the charge.

Political Factors: Global political events, including elections and trade agreements, can also influence market sentiment and valuation.

Case Studies

To illustrate these factors, let's consider a few case studies:

Apple Inc.: As one of the most valuable companies in the world, Apple's stock has seen significant growth over the years. Its strong earnings and innovative products have contributed to its high valuation.

Tesla Inc.: Tesla's stock has experienced a rollercoaster ride, with its valuation often driven by market sentiment and expectations for future growth.

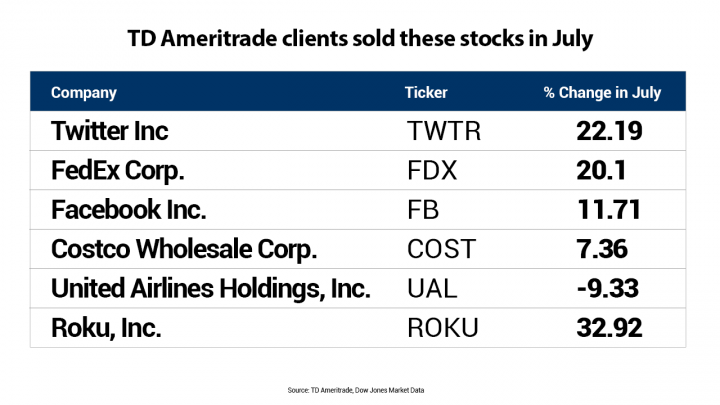

Facebook Inc.: After facing criticism over privacy concerns, Facebook's stock has struggled to maintain its previous valuation levels.

Conclusion

In conclusion, understanding the current stock market valuation in the US is essential for making informed investment decisions. By monitoring key metrics, keeping an eye on influential factors, and analyzing case studies, investors can gain valuable insights into the market's potential and risks.

so cool! ()

last:US Steel Stock: A Comprehensive Wikipedia Overview

next:nothing

like

- US Steel Stock: A Comprehensive Wikipedia Overview

- US Customs Importing Rifle Stocks: Everything You Need to Know

- Top US Growth Stocks 2021: Unveiling the Future Market Leaders

- Liquor Stocks: Your Ultimate Guide to Investing in the US Spirits Industry

- Motorsport Gaming US LLC Stock: A Thrilling Investment Opportunity in the Gaming

- CO2 Laser Engraving Machine US Stock: Your Ultimate Guide to Top-Quality Equipmen

- Maximizing Returns: A Deep Dive into Marathon Petroleum US Stocks

- Unlocking the Potential of Hexagon US Stocks: A Comprehensive Guide

- The Largest Stock Market Crash in US History: The 1929 Stock Market Crash

- Rare Earth Stocks Rise on US-China Tensions Over Export Controls

- Current US Stock Market Valuation Levels: A Comprehensive Analysis

- US Nationals Indianapolis 2019: A Thrilling Pro Stock Motorcycle Showdown

recommend

Current Stock Market Valuation: A Comprehensiv

Current Stock Market Valuation: A Comprehensiv

Unlocking the Secrets of Wall Street: A Compre

Australian Companies on the US Stock Exchange:

Unlocking Opportunities: A Deep Dive into US C

TG Therapeutics: A Promising Player in the US

SM-P600 Stock Firmware: The Ultimate Guide for

Mean and Deviation of US Stock Market Returns:

Top 10 US Stocks by Market Cap 2025: A Compreh

US Stock Before Market: What You Need to Know

Renewable Energy Stocks: The Future of Investm

The NASDAQ Stock Market: A Hub of Innovation a

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- US Gypsum Stock Quote: A Comprehensive Guide t"

- US Share Market Chart: Decoding the Stock Mark"

- 2020 US Election: How the Stock Market Reacted"

- How to Invest in UK Stocks from the US: A Step"

- Trading US Stocks in South Africa: A Comprehen"

- Dow Closing Prices: Understanding the Stock Ma"

- Latest News on US Stock Market Crash: What You"

- US Stock Futures: PPI and Powell's Influe"

- Momentum Stocks US Large Cap August 2025: Top "

- coca cola dividend"