you position:Home > aphria us stock > aphria us stock

Current US Stock Market Valuation Levels: A Comprehensive Analysis

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

In the ever-evolving landscape of the financial world, understanding the current valuation levels of the US stock market is crucial for investors and market enthusiasts alike. This article delves into the latest figures, trends, and insights to provide a comprehensive overview of the current state of the US stock market.

Market Overview

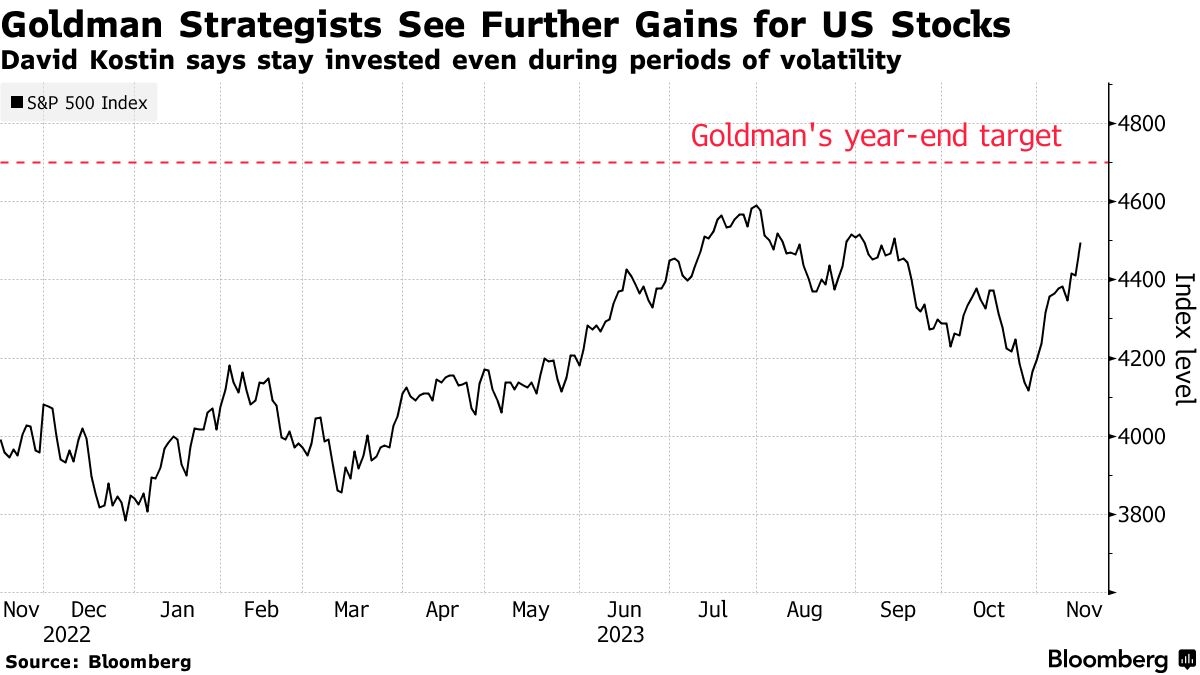

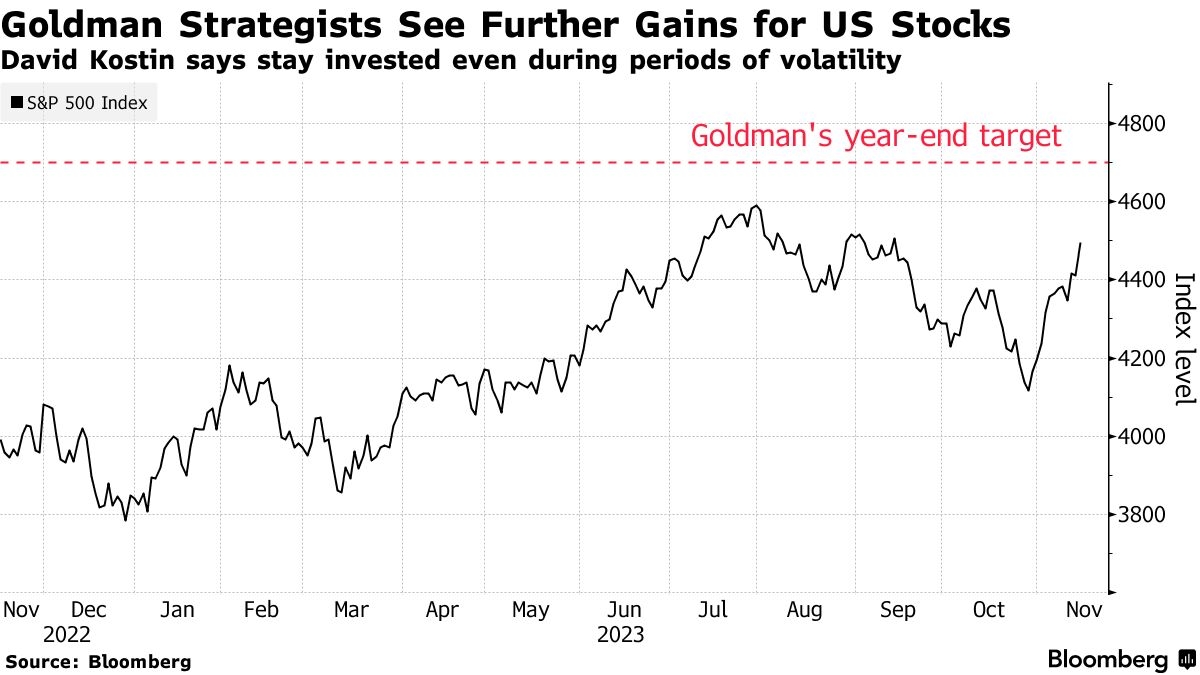

As of the latest data, the US stock market has reached unprecedented valuation levels. The S&P 500, a widely followed index representing the top 500 companies listed on US exchanges, has seen significant growth over the past few years. This surge can be attributed to various factors, including strong economic indicators, low interest rates, and robust corporate earnings.

Valuation Metrics

To gauge the current valuation levels of the US stock market, several key metrics are commonly used. These include the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and the cyclically adjusted price-to-earnings (CAPE) ratio.

Price-to-Earnings (P/E) Ratio: This ratio compares the current market price of a stock to its per-share earnings. A P/E ratio above 20 is generally considered to indicate an overvalued market, while a ratio below 10 suggests an undervalued market. As of now, the S&P 500 has a P/E ratio of around 22, indicating a moderately valued market.

Price-to-Book (P/B) Ratio: The P/B ratio compares the market price of a stock to its book value per share. A P/B ratio above 1 indicates that the stock is overvalued, while a ratio below 1 suggests an undervalued market. The S&P 500 currently has a P/B ratio of approximately 3.2, indicating a moderately valued market.

Cyclically Adjusted Price-to-Earnings (CAPE) Ratio: This ratio is a more comprehensive measure of valuation, taking into account the average earnings of a company over a longer period. The CAPE ratio for the S&P 500 currently stands at around 32, indicating a moderately valued market.

Sector Performance

While the overall market is moderately valued, sector performance can vary significantly. Technology, healthcare, and consumer discretionary sectors have seen strong growth, while energy and financials have lagged behind.

Case Studies

To illustrate the current valuation levels, let's consider two companies from different sectors:

Apple Inc. (AAPL): As a leading technology company, Apple has seen significant growth in its stock price. With a P/E ratio of around 29 and a P/B ratio of 5.5, Apple is considered moderately valued in the technology sector.

Exxon Mobil Corporation (XOM): As a major player in the energy sector, Exxon Mobil has seen slower growth compared to tech companies. With a P/E ratio of around 15 and a P/B ratio of 1.5, Exxon Mobil is considered undervalued in the energy sector.

Conclusion

In conclusion, the current US stock market valuation levels indicate a moderately valued market. While certain sectors, such as technology and healthcare, have seen strong growth, others, like energy and financials, remain undervalued. As always, it is crucial for investors to conduct thorough research and consider their own risk tolerance before making investment decisions.

so cool! ()

like

- US Nationals Indianapolis 2019: A Thrilling Pro Stock Motorcycle Showdown

- Is the US Stock Market Open on Columbus Day 2025?

- Low Price US Stocks: Hidden Gems for Investors

- ICCLabs US Stock: A Comprehensive Guide to Investing in Cutting-Edge Tech

- Unlock the Potential of DNN Stocks: A Comprehensive Guide

- End of Day US Stock Prices: A Comprehensive Guide

- Unveiling the Power of US Stock Fundamental Analysis

- Understanding Stock Symbols: The Key to US Investing Success

- Track Us Stock Market: A Comprehensive Guide to Monitoring the American Market

- Top Metal Stocks to Watch in the US Market

- New Cannabis Stocks in the US: A Growing Market to Watch

- US Large Cap Momentum Stocks: Best Performers and Why They Thrive

recommend

Current US Stock Market Valuation Levels: A Co

Current US Stock Market Valuation Levels: A Co

Yahii Finance: Revolutionizing Personal Financ

Cannabis Stocks: A Growing Opportunity in the

How Much US Companies Spent on Stock Buyback:

Is the US Stock Market Open Today? Live Update

ODM US Stock Sex Dolls: The Ultimate Guide to

President Trump's New Tariffs Cause US St

Polymer Black Stock Set NATO US: The Ultimate

TG Therapeutics: A Promising Player in the US

5 Elite US Stocks to Explode in 2018: Louis Na

Stocks and Shares ISA: A Comprehensive Guide f

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Tax on Stock Exchange Transactions in the US: "

- Best Performing US Stocks: Top 5 for Momentum "

- Robotic Stocks in the US: A Comprehensive Guid"

- US Stock Futures Live Chart: Your Ultimate Gui"

- Unlocking the Secrets of Wall Street: A Compre"

- RSX US Stock Price: Everything You Need to Kno"

- Open Time of the Australian Stock Exchange to "

- alibaba stock forecast"

- US Stell Stock Price: A Comprehensive Analysis"

- Hot Momentum Stocks US: The Top Picks for 2023"