you position:Home > aphria us stock > aphria us stock

Can I Buy US Stocks in Singapore? A Comprehensive Guide

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

Are you a Singaporean investor looking to expand your portfolio with US stocks? The thought of buying stocks from a different country might seem daunting, but it's actually quite accessible. In this article, we'll explore the process of purchasing US stocks from Singapore, the benefits, and some key considerations to keep in mind.

Understanding the Process

The first step in buying US stocks from Singapore is to open a brokerage account with a reputable international brokerage firm. This account will allow you to trade stocks listed on US exchanges, such as the New York Stock Exchange (NYSE) and the Nasdaq.

Choosing a Brokerage Firm

When selecting a brokerage firm, it's important to consider factors such as fees, customer service, and the range of investment options available. Some popular brokerage firms that cater to Singaporean investors include Charles Schwab, TD Ameritrade, and E*TRADE.

Account Opening

Once you've chosen a brokerage firm, you'll need to complete the account opening process. This typically involves providing personal information, proof of identity, and financial details. Some brokers may also require you to undergo a verification process to comply with anti-money laundering (AML) regulations.

Funding Your Account

After your account is opened, you'll need to fund it with Singaporean dollars. Most brokerage firms offer various funding methods, including bank transfers, credit/debit cards, and third-party payment services. It's important to note that currency exchange rates may apply when transferring funds.

Trading US Stocks

Once your account is funded, you can start trading US stocks. Simply log in to your brokerage account, select the stock you want to buy, and specify the number of shares and the price you're willing to pay. Your order will be executed based on the current market price.

Benefits of Buying US Stocks in Singapore

1. Diversification: Investing in US stocks can help diversify your portfolio, reducing your exposure to local market risks.

2. Higher Growth Potential: The US stock market is known for its innovation and growth potential, offering access to some of the world's largest and most successful companies.

3. Liquidity: US stocks are among the most liquid in the world, making it easy to buy and sell shares at any time.

4. Access to World-Class Companies: Investing in US stocks allows you to gain exposure to some of the most renowned companies in various industries, such as technology, healthcare, and consumer goods.

Key Considerations

1. Currency Risk: As you'll be investing in US dollars, fluctuations in the SGD/USD exchange rate can impact your investment returns. It's important to monitor exchange rates and consider the potential impact on your investment.

2. Tax Implications: Singapore has a favorable tax system for investors, but it's important to understand the tax implications of investing in US stocks. You may need to pay taxes on dividends received from US stocks, depending on your income level.

3. Regulatory Compliance: Be aware of the regulatory requirements for investing in foreign stocks, including AML and know your customer (KYC) regulations.

Case Study: Singaporean Investor Buys Apple Stock

Let's consider a hypothetical scenario where a Singaporean investor decides to buy Apple Inc. (AAPL) stock through a brokerage firm. The investor funds their account with SGD 10,000, which is equivalent to approximately USD 7,200 at the current exchange rate. After conducting thorough research, the investor decides to buy 50 shares of Apple stock at USD 145 per share, for a total investment of USD 7,250.

If the investor's investment grows by 20% over the next year, their investment would be worth approximately USD 8,700. Assuming the exchange rate remains constant, the investor's investment would be worth SGD 12,100, resulting in a gain of SGD 1,100.

In conclusion, buying US stocks from Singapore is a viable option for investors looking to diversify their portfolio and gain exposure to the world's largest and most successful companies. By understanding the process, choosing the right brokerage firm, and considering key factors such as currency risk and tax implications, you can successfully invest in US stocks from Singapore.

so cool! ()

like

- Trump Tariffs: How They've Impacted the US Stock Market Performance"

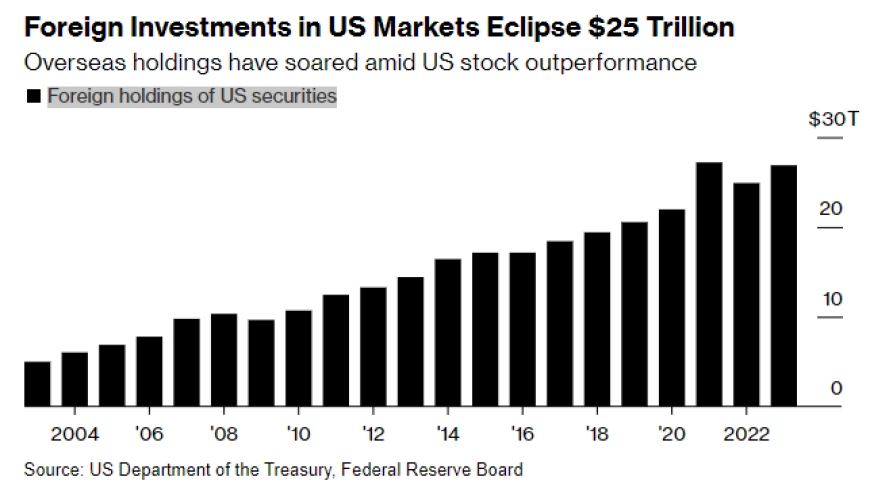

- "Money Invested in US Stock Market by Foreigners: A Lucrative Trend Expl

- Best US Stock Analysis App: Unveiling the Ultimate Tool for Investors

- Luxury Brands Stocks: The Ultimate Investment in Exclusivity and Prestige

- Best US Marijuana Penny Stocks: Your Guide to the Top Investments

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol gale.

- Morgan Stanley Sees Near-Term US Stock Market Rally: What You Need to Know

- Bape US Ladies in Stock: Your Ultimate Guide to the Latest Styles

- Does the U.S. Government Own Intel Stock? A Comprehensive Analysis

- Pre-Market Movers: A Deep Dive into US Stocks

- Tesla US Stocks: A Comprehensive Guide to Investing in the Electric Vehicle Giant

- How Did the US Stock Market React to Nixon's Impeachment?"

recommend

Can I Buy US Stocks in Singapore? A Comprehens

Can I Buy US Stocks in Singapore? A Comprehens

July 2025 US Stock Market Holidays: A Comprehe

Stock International vs US Ratio: A Comprehensi

List All US Marijuana Related Stocks: Your Ult

Top US Blue Chip Dividend Stocks: Secure Your

Analysts' Recommendations: Your Ultimate

Theatre Stocks Us: Unveiling the Transformativ

Cambricon Stock US: A Comprehensive Guide to I

Best Site for US Stock Market: Unveiling the U

US Stock Market Annual Growth Rate Calculator:

Title: Stock Invest Us.com - Your Ultimate Gui

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- Dbs Vickers: Mastering the Art of Buying US St"

- clean energy stocks"

- Toys "R" Us Canada Stock: A "

- US Silica Stock Forecast: A Comprehensive Anal"

- Stocks to Watch Next Week: US Market Insights"

- Just Vegan Company Stock Symbol: A Comprehensi"

- Investing in Canadian Stocks from the US: Navi"

- Understanding the US Stock Market: Boom-Bust C"

- Best Growth Stocks US: Top Picks for Investors"

- today us stock market live"