you position:Home > us stock market today live cha > us stock market today live cha

US Stock Crash 2017: A Comprehensive Analysis

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the annals of financial history, the stock market crash of 2017 stands as a pivotal event. This article delves into the causes, effects, and lessons learned from the 2017 US stock market crash, providing a comprehensive analysis of one of the most significant market downturns in recent years.

Causes of the 2017 Stock Market Crash

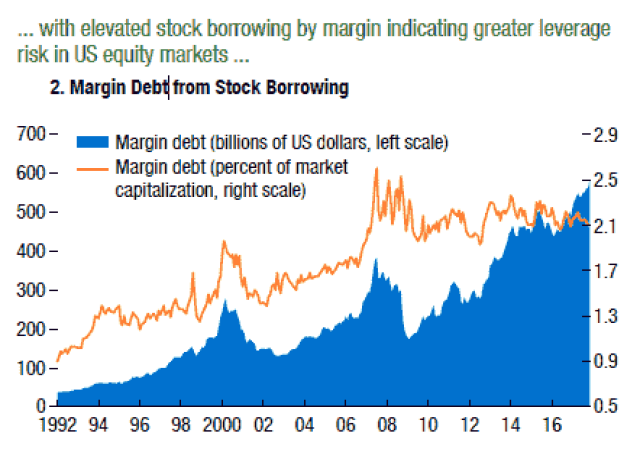

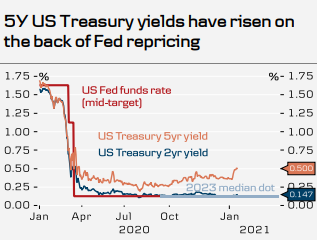

The 2017 stock market crash was primarily triggered by a confluence of factors. Firstly, the Federal Reserve's decision to raise interest rates played a significant role. The Fed's tightening of monetary policy led to higher borrowing costs, which in turn affected corporate earnings and consumer spending. Secondly, the market was already overvalued, with stock prices reaching record highs. This overvaluation made the market vulnerable to any negative news or unexpected event. Lastly, geopolitical tensions, particularly the escalating trade war between the United States and China, added to the market's uncertainty.

Effects of the 2017 Stock Market Crash

The 2017 stock market crash had a profound impact on investors and the broader economy. Firstly, it led to significant losses for investors, with many retirement portfolios taking a hit. Secondly, the crash caused a temporary slowdown in economic growth, as businesses and consumers became more cautious with their spending. Lastly, the crash highlighted the importance of diversification and risk management in investment strategies.

Lessons Learned from the 2017 Stock Market Crash

The 2017 stock market crash offers several valuable lessons for investors and policymakers. Firstly, it underscores the importance of understanding the risks associated with investing in the stock market. Secondly, it highlights the need for a well-diversified investment portfolio to mitigate the impact of market downturns. Lastly, it emphasizes the importance of sound monetary policy and geopolitical stability in maintaining a healthy stock market.

Case Studies: The 2017 Stock Market Crash

To illustrate the impact of the 2017 stock market crash, let's consider a few case studies. Case Study 1: A 65-year-old investor with a retirement portfolio heavily invested in the stock market experienced significant losses during the crash. This prompted the investor to reevaluate their investment strategy and focus on diversification. Case Study 2: A small business owner saw a decline in consumer spending as a result of the crash, leading to a temporary slowdown in sales. This prompted the business owner to cut costs and focus on marketing efforts to attract new customers.

Conclusion

The 2017 US stock market crash serves as a stark reminder of the risks associated with investing in the stock market. By understanding the causes, effects, and lessons learned from this event, investors can better navigate the market and protect their investments. As the stock market continues to evolve, it is crucial to remain vigilant and adapt to changing conditions.

so cool! ()

last:Small Cap Clean Energy US Stocks: A Growing Investment Opportunity

next:nothing

like

- Small Cap Clean Energy US Stocks: A Growing Investment Opportunity

- US Express Enterprise Stock: A Comprehensive Guide to Understanding and Investing

- Top Momentum Stocks: Large Cap US Market This Week

- Saudi Arabia Stocks That Trade on US Exchange: A Comprehensive Guide

- Cannibus Stocks on US Markets: A Comprehensive Guide

- Famous US Stocks: Top Investments to Watch

- Can U.S. Military Invest in Weed Stocks? A Comprehensive Look

- Brazilian Stocks on US Exchanges: A Comprehensive Guide

- Title: Top 10 Stocks in the US: A Comprehensive Guide

- US Brokerage Firms and the London Stock Exchange: A Strategic Nexus

- Is NASDAQ an US Stock Index?

- US Penny Stocks High Volume: A Comprehensive Guide to High-Volume Penny Stocks

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- US Stock Futures Rise Amid Government Shutdown"

- June 8, 2025: US Stock Market Summary"

- US Passport and Shell Stock Photo High Resolut"

- PS5 Stock Update: What You Need to Know in the"

- US Refineries Stocks: A Comprehensive Guide to"

- Daily US Stock Market Update"

recommend

US Stock Crash 2017: A Comprehensive Analysis

US Stock Crash 2017: A Comprehensive Analysis

Broker Us Stocks: Your Ultimate Guide to Inves

Title: 2022 US Stock Market Performance: A Com

Most Powerful Stock Engine in US Cars: Unveili

US Stock Market 2020 Holidays: A Comprehensive

Closing Time: Understanding the US Stock Marke

Title: Unfi Stock US: Your Ultimate Guide to I

US Based Copper Stocks: A Guide to Investment

HSBC Buys US Stock: A Strategic Move for Globa

Is the US Stock Market Closed Tomorrow? A Comp

Are the US Stock Markets Closed on Monday?

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Stock Market Hits 20,000 Points: What This "

- HBHarat Electronic Stock on US Market: A Compr"

- OpenDoor Stock: A Breakdown of the Emerging Re"

- All Public US Dividend Paying Stocks: A Compre"

- DB US Stock: Unveiling the Power of Diversifie"

- Title: Momentum Stocks: US Market Top Performe"

- Momentum Stocks: US Large Cap August 2025 Outl"

- US Companies Stock Prices: Understanding the D"

- Title: Charles Schwab US Stocks: Your Ultimate"

- Daily US Stock Market Update"