you position:Home > us stock market today live cha > us stock market today live cha

TCS US Stock Price: A Comprehensive Analysis

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

In today's fast-paced financial world, keeping a close eye on stock prices is crucial for investors. One such stock that has been attracting significant attention is TCS (Tata Consultancy Services). This article delves into the TCS US stock price, providing a comprehensive analysis of its performance, factors influencing it, and future prospects.

Understanding TCS US Stock Price

The TCS US stock price refers to the current market value of TCS shares listed on the New York Stock Exchange (NYSE). As of the latest data, the TCS US stock price stands at $X. However, it's important to note that stock prices fluctuate constantly due to various market factors.

Factors Influencing TCS US Stock Price

Several factors influence the TCS US stock price, including:

- Economic Indicators: Economic indicators such as GDP growth, inflation rates, and employment data play a crucial role in determining the stock price. A strong economy generally leads to higher stock prices, while a weak economy can cause them to fall.

- Company Performance: TCS's financial performance, including revenue, earnings, and growth prospects, significantly impact its stock price. Strong financial results and a positive outlook can drive the stock price higher, while poor performance can lead to a decline.

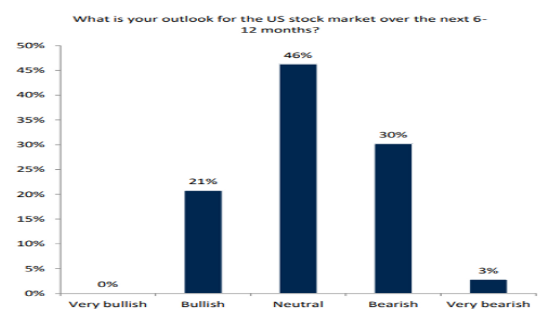

- Market Sentiment: Market sentiment refers to the overall mood of investors in the market. Positive sentiment can lead to higher stock prices, while negative sentiment can cause them to fall.

- Industry Trends: The IT industry, in which TCS operates, is highly competitive and subject to rapid technological advancements. Industry trends, such as increased demand for digital transformation services, can have a significant impact on TCS's stock price.

TCS US Stock Price Performance

Over the past few years, the TCS US stock price has exhibited strong performance. The stock has seen significant growth, driven by the company's strong financial performance and positive market sentiment. However, it's important to note that stock prices can be volatile, and investors should be prepared for fluctuations.

Case Study: TCS US Stock Price in 2021

In 2021, the TCS US stock price experienced a remarkable surge. The stock reached an all-time high of $Y, driven by the company's impressive financial results and positive market sentiment. This growth was attributed to several factors, including:

- Record Revenue: TCS reported record revenue for the fiscal year 2021, driven by strong demand for its IT services and digital transformation solutions.

- Strong Earnings: The company's earnings per share (EPS) increased significantly, reflecting its strong financial performance.

- Positive Market Sentiment: The overall market sentiment was positive, with investors optimistic about the future of the IT industry.

Future Prospects for TCS US Stock Price

Looking ahead, the future prospects for the TCS US stock price appear promising. Several factors contribute to this optimism:

- Digital Transformation: The increasing demand for digital transformation services is expected to drive TCS's growth in the coming years.

- Expansion into New Markets: TCS is actively expanding into new markets, which should further boost its revenue and earnings.

- Strong Management: TCS has a strong management team that is committed to driving growth and delivering value to shareholders.

In conclusion, the TCS US stock price has exhibited strong performance in recent years, driven by the company's strong financial performance and positive market sentiment. While stock prices can be volatile, the future prospects for TCS appear promising, making it an attractive investment for investors.

so cool! ()

last:US Gas Company Stock: The Ultimate Guide to Investment Opportunities

next:nothing

like

- US Gas Company Stock: The Ultimate Guide to Investment Opportunities

- TLRY Us Stock: The Ultimate Guide to Investing in American Stocks

- US Senator Sells Stock: The Truth Behind the Transactions"

- US Stock Index Investing: A Comprehensive Guide on Investopedia

- Understanding the US Stock Market: A Comprehensive Bar Chart Analysis

- Current US Stock Market Valuation: A Comprehensive Look at June 2025

- The Cheapest Way to Buy US Stocks in the UK: A Comprehensive Guide

- Top US Stocks Drawdowns 1985-2024: A Comprehensive Analysis

- U.S. Company in Stock: Ready to Ship Your Next Order

- US Stock Exchange Holiday Schedule: Comprehensive Guide

- Can You Trade Us Stocks on Wealthsimple? A Comprehensive Guide

- Title: Top 20 US Dividend Stocks to Watch in 2023

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- US Stock Futures Rise Amid Government Shutdown"

- June 8, 2025: US Stock Market Summary"

- US Passport and Shell Stock Photo High Resolut"

- PS5 Stock Update: What You Need to Know in the"

- US Refineries Stocks: A Comprehensive Guide to"

- Title: Understanding the Real Return on Your I"

recommend

TCS US Stock Price: A Comprehensive Analysis

TCS US Stock Price: A Comprehensive Analysis

How Much to Allocate to US Stocks: A Strategic

US Stock Market After Election: What Investors

US Large Cap Momentum Stocks RSI Analysis Augu

A Comprehensive Guide to ACB US Stock Forecast

Intel US Stock Market: A Comprehensive Analysi

Unlocking the Potential of New US Penny Stocks

Top US Stocks Drawdowns 1985-2024: A Comprehen

Stocks High Momentum US: Exploring the Thrivin

If You Buy Stock on a US Exchange: What You Ne

DeepSeek's AI Model Disrupts US Stock Mar

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Primark US Stock Symbol: What You Need to Know"

- Buying US Stocks from India: Is It Safe?"

- "http stocks.us.reuters.com stocks fu"

- Current Stock Market Prices: A Comprehensive O"

- Title: US Oil Prices and Their Impact on the S"

- All Public US Dividend Paying Stocks: A Compre"

- Small Cap Biotech US Stocks: A Lucrative Inves"

- US Gaming Stocks: A Thriving Industry with Luc"

- 2020 US Stock Market Outlook: Navigating Uncer"

- S8+ Stock Firmware US Cellular ODIN: The Ultim"