you position:Home > us stock market today live cha > us stock market today live cha

Can TFSAs Hold U.S. Stocks? A Comprehensive Guide

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

Investing in U.S. stocks can be a lucrative venture, but many Canadians often wonder if they can include these investments in their Tax-Free Savings Accounts (TFSAs). The answer is a resounding yes! In this article, we'll delve into the details of whether TFSAs can hold U.S. stocks, the benefits of doing so, and how to go about it.

Understanding TFSAs and U.S. Stocks

A Tax-Free Savings Account (TFA) is a popular investment vehicle in Canada that allows individuals to save and invest money tax-free. Contributions to a TFSA are not tax-deductible, but any earnings, including interest, dividends, and capital gains, grow tax-free and can be withdrawn at any time without incurring taxes.

U.S. stocks, on the other hand, are shares of ownership in U.S. companies. Investing in U.S. stocks can offer exposure to a diverse range of industries and markets, potentially leading to higher returns.

Can TFSAs Hold U.S. Stocks?

Yes, TFSAs can indeed hold U.S. stocks. This means you can invest in U.S. companies directly within your TFSA, just as you would with Canadian stocks. However, there are a few important considerations to keep in mind.

Benefits of Investing in U.S. Stocks Through a TFSA

- Diversification: Investing in U.S. stocks can help diversify your portfolio, reducing your exposure to the Canadian market and potentially enhancing your returns.

- Access to a Larger Market: The U.S. stock market is the largest and most liquid in the world, offering a wide range of investment opportunities.

- Potential for Higher Returns: U.S. companies often have higher growth potential compared to Canadian companies, which can lead to higher returns over the long term.

How to Invest in U.S. Stocks Through a TFSA

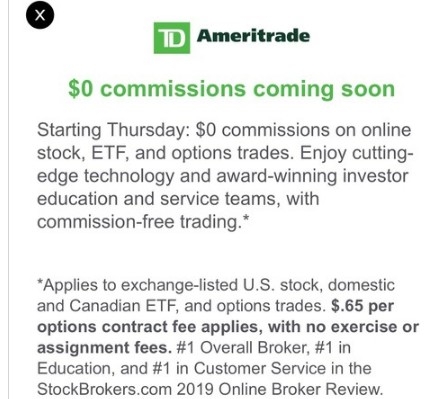

- Choose a Broker: To invest in U.S. stocks through your TFSA, you'll need to open a brokerage account with a firm that offers access to U.S. markets. Many Canadian brokers, such as TD Direct Investing and Questrade, offer this service.

- Fund Your TFSA: Ensure that you have enough funds in your TFSA to make the investment. Remember that you can only contribute to your TFSA if you have earned income in the previous year.

- Research and Select U.S. Stocks: Conduct thorough research to identify U.S. stocks that align with your investment goals and risk tolerance.

- Place Your Order: Once you've identified the stocks you want to invest in, place your order through your brokerage account.

Case Study: Investing in U.S. Stocks Through a TFSA

Let's consider an example. John, a 35-year-old Canadian investor, decides to invest $10,000 in his TFSA in U.S. stocks. He selects a mix of technology, healthcare, and consumer discretionary stocks, which he believes will perform well in the long term.

After five years, John's investments have grown to $15,000, thanks to the strong performance of the U.S. stock market. By investing in U.S. stocks through his TFSA, John has enjoyed the benefits of tax-free growth and potential higher returns.

Conclusion

In conclusion, TFSAs can indeed hold U.S. stocks, offering Canadian investors a valuable opportunity to diversify their portfolios and potentially achieve higher returns. By carefully selecting U.S. stocks and working with a reputable broker, you can take advantage of the benefits of investing in U.S. stocks through your TFSA.

so cool! ()

last:Understanding the US Stock Estate Tax: A Comprehensive Guide

next:nothing

like

- Understanding the US Stock Estate Tax: A Comprehensive Guide

- US Stock Futures Current Status: A Comprehensive Overview

- Title: Stock Market US Buying Assets: The Current Trends and Implications

- How to Invest in US Stocks from Singapore: A Comprehensive Guide

- Title: US Stock Market Averages Today: A Comprehensive Overview

- Title: US Stock Market Bubble 2017: What Caused It and What It Meant for Investor

- Top Momentum Stocks in the US Market: A Look Back at August 2025

- Education Stocks in US: A Comprehensive Guide

- US News & World Report Best Stocks in 2017: Top Picks for Investors

- Title: US Large Cap Stocks: Best Performers in 5-Day Momentum

- Title: US High Growth Stocks Momentum

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol ftr.o

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- US Stock Futures Rise Amid Government Shutdown"

- June 8, 2025: US Stock Market Summary"

- US Passport and Shell Stock Photo High Resolut"

- PS5 Stock Update: What You Need to Know in the"

- US Refineries Stocks: A Comprehensive Guide to"

- Title: Understanding the Real Return on Your I"

recommend

Can TFSAs Hold U.S. Stocks? A Comprehensive Gu

Can TFSAs Hold U.S. Stocks? A Comprehensive Gu

HDFC US Stock Investment: A Strategic Approach

Stock Photo of Us Marine: Capturing the Essenc

Accenture Stock Price US: A Comprehensive Anal

Title: US Large Cap Stocks: Best Performers in

Can I Still Buy Stocks When the US Market Clos

US-China Stock Trade Guy: Navigating the Compl

US Cannabis Stock IPO: What You Need to Know

US Stock Crash 2019: Causes, Effects, and Less

HSBC Buys US Stock: A Strategic Move for Globa

US Coal Companies Stock Prices: What You Need

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Momentum Stocks: US Large Cap August 2025 Outl"

- How Much Can I Invest in US Stocks?"

- Macroeconomic Indicators for the US Economy an"

- Hive Stock: A Breakdown of Its Presence on the"

- Can TFSAs Hold U.S. Stocks? A Comprehensive Gu"

- US Stock Brokers Using MetaTrader 5: The Ultim"

- MMEN Stock Price: What You Need to Know"

- Understanding the US Oil Stock Symbol: A Compr"

- Closing Time: Understanding the US Stock Marke"

- US Cirremcy Paper Stock Supplier: The Ultimate"