you position:Home > us stock market today > us stock market today

Understanding the Total Stock Market Capitalization in the US

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info: Total(73)The(1453)Stock(2770)

The total stock market capitalization in the United States is a critical indicator of the country's economic health and financial markets' performance. It reflects the total value of all publicly traded companies in the US, providing insights into market trends and investor confidence. This article delves into the significance of total stock market capitalization, its current state, and its implications for the future.

What is Total Stock Market Capitalization?

Total stock market capitalization, often referred to as market cap, is the sum of the market values of all publicly traded companies in a country. It is calculated by multiplying the total number of shares of a company by its current market price. This figure represents the total value of all the shares of all the companies listed on the stock exchanges in the country.

The Importance of Total Stock Market Capitalization

The total stock market capitalization serves as a vital barometer of the country's economic health and the performance of its financial markets. It provides several key insights:

- Economic Growth: An increasing total stock market capitalization often indicates economic growth, as it reflects rising share prices and investor confidence.

- Market Performance: It helps investors and analysts assess the overall performance of the stock market, providing a snapshot of market trends and valuation levels.

- Investor Confidence: A high total stock market capitalization can indicate strong investor confidence, while a low figure may suggest market skepticism or economic uncertainty.

Current State of the Total Stock Market Capitalization in the US

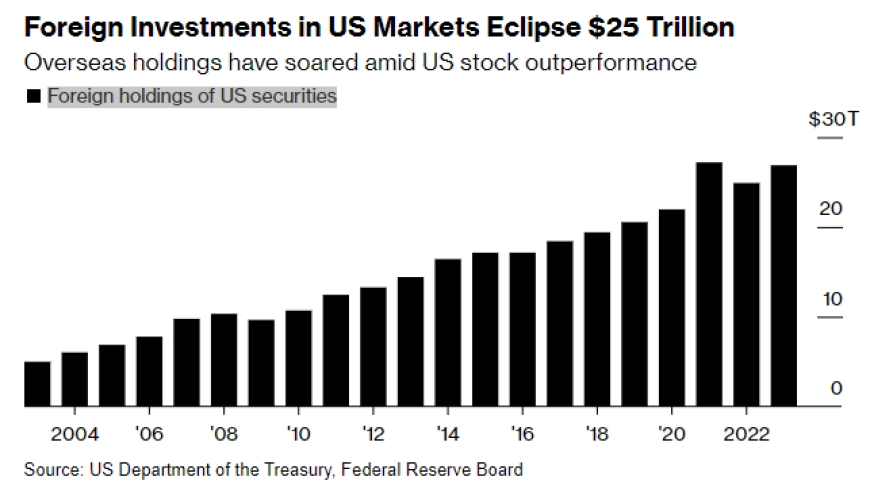

As of the latest available data, the total stock market capitalization in the US is approximately $35 trillion. This figure is a significant increase from the pre-pandemic levels and reflects the strong performance of the stock market in recent years.

Several factors have contributed to this growth, including:

- Low Interest Rates: The Federal Reserve's low-interest-rate policy has made stocks a more attractive investment compared to bonds and other fixed-income instruments.

- Corporate Profits: Strong corporate earnings have driven stock prices higher, contributing to the overall increase in market cap.

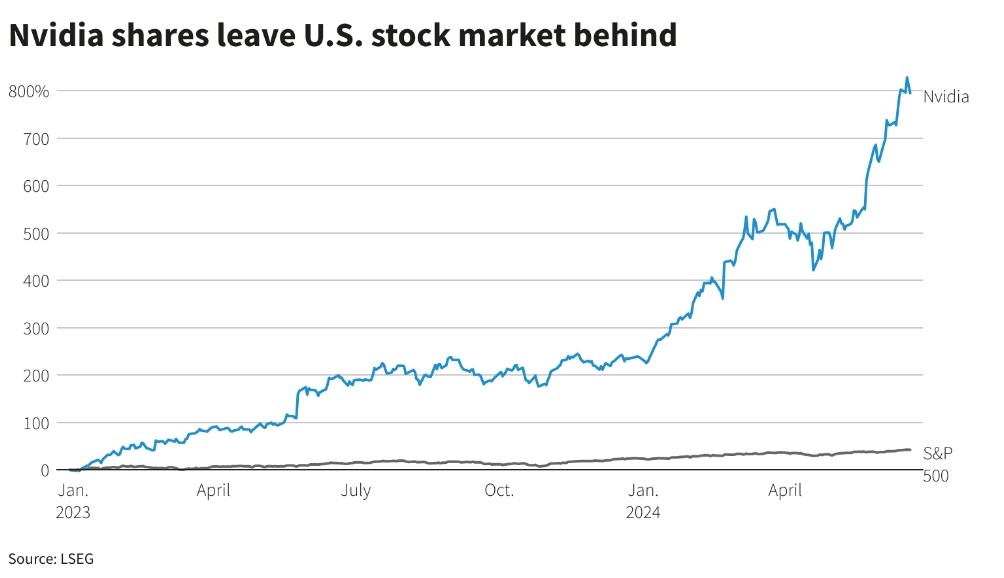

- Technology Stocks: The rise of technology companies, particularly in the tech sector, has significantly contributed to the growth of the total stock market capitalization.

Implications for the Future

The current state of the total stock market capitalization in the US has several implications for the future:

- Investment Opportunities: The high market cap presents numerous investment opportunities, particularly in the tech and healthcare sectors.

- Economic Growth: A robust stock market can contribute to economic growth by generating wealth and encouraging investment.

- Market Volatility: With a high market cap, the US stock market is more vulnerable to global economic and political events, potentially leading to increased market volatility.

Case Study: Facebook's Impact on the Total Stock Market Capitalization

One notable example of how individual companies can influence the total stock market capitalization is Facebook (now Meta Platforms, Inc.). The company's initial public offering (IPO) in 2012 significantly increased the total stock market capitalization in the US. Facebook's market cap at the time of its IPO was approximately $104 billion, contributing to the overall growth of the market.

In conclusion, the total stock market capitalization in the US is a critical indicator of the country's economic health and financial markets' performance. Understanding its current state and implications for the future can help investors and analysts make informed decisions.

so cool! ()

like

- US Mint Proof Set Stock Photos: Capturing the Beauty and Detail of American Coina

- Understanding Canada Capital Gains Tax on US Stocks

- Maximizing Your Investment Potential: The Ultimate Guide to Trading US Stocks on

- Unlocking the Potential of RPC 66: A Deep Dive into http://stocks.us.reuters.com/

- The Spillover Effect of US Monetary Policy on the Chinese Stock Market: Understan

- Us Recovery Stocks: Top Opportunities in the Post-Pandemic Market"

- Unveiling the US Army Stocking: A Comprehensive Guide

- Unlocking the Potential of IBM: A Deep Dive into the Full Description of IBM Stoc

- Northern Dynasty Minerals Ltd: A Deep Dive into Its US Stock Symbol

- US Army Stock Footage: Capturing the Essence of Military Excellence

- Maximizing Returns: Unveiling the World of US Hedge Stock Funds"

- Top US Penny Stocks 2021: Unveiling the Hidden Gems

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

Trade US Stocks from Canada: Your Ultimate Gui

Trade US Stocks from Canada: Your Ultimate Gui

US Auto Parts Stocks: A Comprehensive Guide to

When Does the US Stock Market Open?

Novonix Stock US: A Comprehensive Analysis

Best Company to Buy Stocks in the US: A Compre

Must Invest Stocks in US: Why Now is the Perfe

US Grocery Store Stocks: A Comprehensive Guide

Tencent US ADR Stock Price: A Comprehensive An

US Bank Stock Price Historical Analysis: A Com

Converting US Air Stock Certificates: A Compre

US Hemp Roundtable Stock: A Comprehensive Guid

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- Title: Understanding the Impact of the US Fede"

- Title: "US Oil Stock Price Today: Tre"

- US Defense Contractors Stocks: A Comprehensive"

- Unlocking the Potential of Hiti US Stock: A Co"

- How to Buy US Stocks in Thailand"

- US Solar Penny Stocks: A Lucrative Investment "

- The Current Price of Toys "R""

- Title: Stock Broker Salary in the US: A Compre"

- US Stock Market Bubbles: Understanding the Ris"

- US Large Cap Momentum Stocks Weekly Performanc"