you position:Home > us stock market live > us stock market live

US Stock Market Analysis: June 2025 Outlook

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

As we approach June 2025, investors are keen to understand the current state of the US stock market and what the future may hold. This article delves into the latest trends, key indicators, and potential risks and opportunities that could impact the market in the coming months.

Market Trends

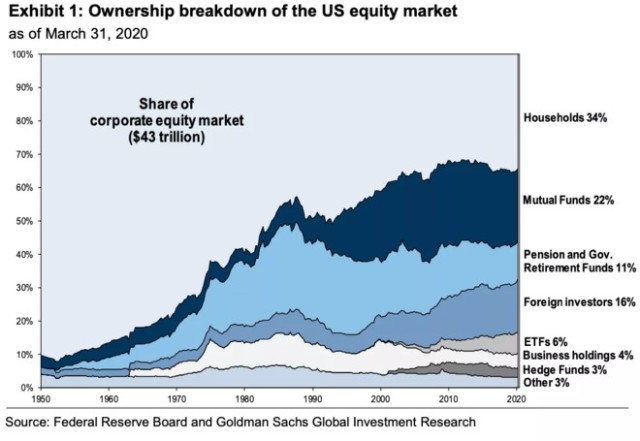

The US stock market has experienced significant growth over the past few years, driven by strong economic fundamentals, low interest rates, and technological advancements. However, the market has also faced challenges, including geopolitical tensions, inflation concerns, and shifting investor sentiment.

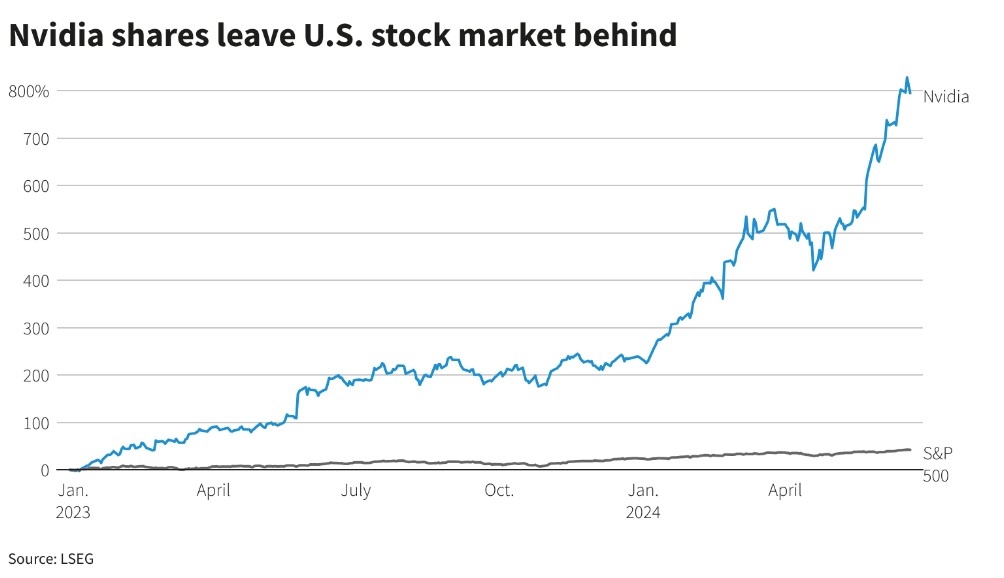

One of the key trends in the US stock market is the rise of technology stocks. Companies like Apple, Amazon, and Microsoft have seen strong performance, driven by their innovative products and services. Additionally, the growth of the gig economy and remote work has further fueled the demand for technology stocks.

Another trend is the increasing focus on sustainable and ethical investing. More investors are looking for companies that prioritize environmental, social, and governance (ESG) factors, leading to a growing number of ESG-focused funds and indices.

Key Indicators

Several key indicators can provide insights into the current state of the US stock market and its potential future direction. Here are some of the most important ones:

Economic Growth: Strong economic growth can lead to higher corporate profits and, in turn, higher stock prices. Key economic indicators to watch include GDP growth, unemployment rates, and consumer spending.

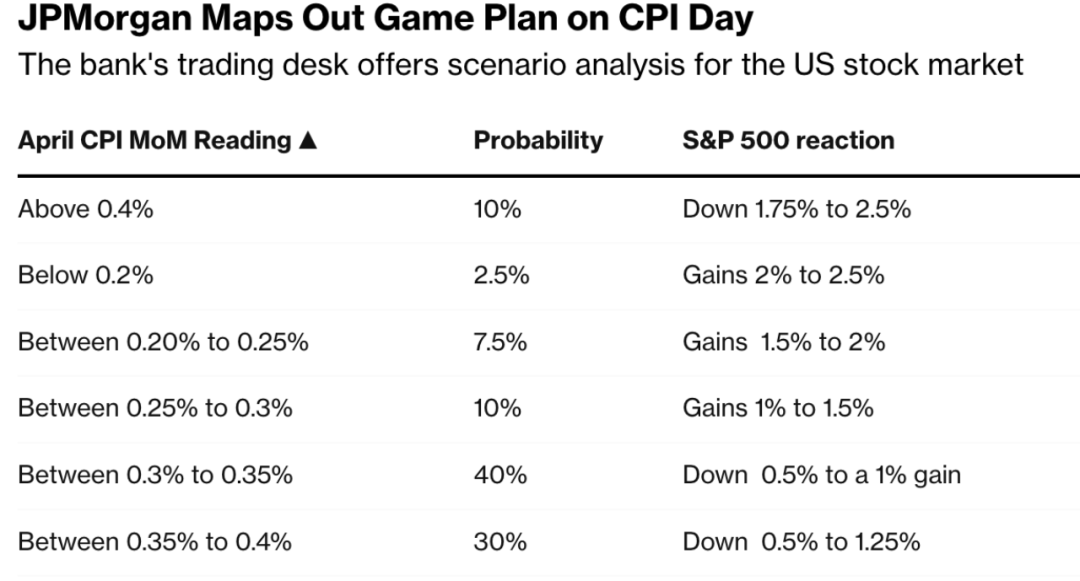

Inflation: Inflation can erode purchasing power and impact corporate profits. The Federal Reserve's policies on interest rates and inflation are crucial in determining market trends.

Corporate Earnings: Strong corporate earnings can boost investor confidence and drive stock prices higher. It's important to keep an eye on earnings reports from major companies across various sectors.

Market Valuations: High market valuations can indicate that the market is overvalued and may be due for a correction. Conversely, low valuations can present attractive investment opportunities.

Potential Risks and Opportunities

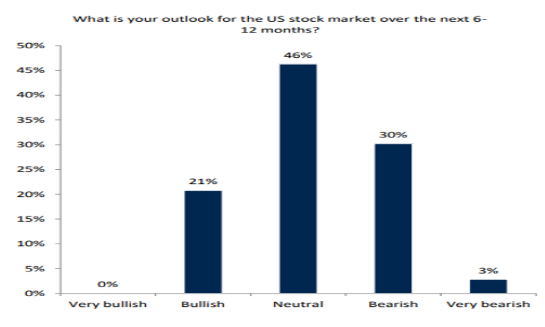

Despite the positive trends, the US stock market faces several potential risks and opportunities:

Geopolitical Tensions: Ongoing geopolitical tensions, such as those in Eastern Europe and the Middle East, can impact global markets and investor sentiment.

Inflation Concerns: Rising inflation can lead to higher interest rates, which can negatively impact stock prices.

Technological Advancements: The rapid pace of technological innovation can create new opportunities for investors, but it also poses risks to established companies.

ESG Investing: The growing focus on ESG factors can lead to increased investment in sustainable companies and a shift away from those with poor ESG practices.

Case Study: Tesla

A prime example of a company that has capitalized on market trends and opportunities is Tesla. The electric vehicle (EV) manufacturer has seen remarkable growth, driven by its innovative products, strong brand, and commitment to sustainability. Tesla's success has not only benefited the company itself but has also influenced the broader market, with other EV manufacturers and traditional automakers investing heavily in the sector.

In conclusion, the US stock market in June 2025 presents a complex mix of opportunities and risks. Investors should stay informed about market trends, key indicators, and potential risks to make informed decisions. By focusing on innovative companies, sustainable practices, and geopolitical developments, investors can position themselves for success in the evolving US stock market landscape.

so cool! ()

last:US Stock Dividend Yield Ranking: A Comprehensive Guide

next:nothing

like

- US Stock Dividend Yield Ranking: A Comprehensive Guide

- IPO Differences Between US and International Stocks

- US Citizen Investing in the Stock Market in India: A Comprehensive Guide

- Canopy Rivers Stock Symbol: A Guide to Understanding the Investment Potential

- Title: Total US Stock Market Capitalization 2014: A Comprehensive Analysis

- US Savings Bonds vs Stock Market: A Comprehensive Guide

- US Mid Cap Stock Portfolio: A Strategic Approach to Diversification and Growth

- US Stock Futures Index: A Comprehensive Guide

- Infra Stocks: A Strategic Investment in the US Economy

- July 3 US Stock Market: A Deep Dive into the Day's Highlights

- Is NYSE a Major US Stock Market Exchange?

- Current US Stock Market Outlook: April 2025

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- US Stock Exchange Holiday List 2018: A Compreh"

recommend

US Stock Market Analysis: June 2025 Outlook

US Stock Market Analysis: June 2025 Outlook

Indian Stocks on the US Stock Exchange: A Comp

Momentum Stocks: The Best Performers Over the

Kraken Launches Commission-Free Trading of US

Stock Us Foods: Revolutionizing the Way We Buy

http stocks.us.reuters.com stocks fulldescript

Matthew Stock US Waterproofing: Your Ultimate

Food Delivery Stocks: A Growing Trend in the U

Rare Earth Mining Stocks: A Lucrative Investme

US Stock Exchange Circuit Breaker Rules: What

Title: Standard US Ledger for Stocks: A Compre

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Investing in US Stocks from UAE: A Guide to Na"

- Stock Quote: Sonneborn US Holdings Inc – A C"

- Toys "R" Us Stocker Job Desc"

- US Stock Earnings Calendar 2025: A Comprehensi"

- Understanding the Potential of US Stocks in In"

- Understanding the Difference Between REITs and"

- Buying Stocks in the US: A Comprehensive Guide"

- Top Momentum Stocks to Watch in the US for Oct"

- 3 Stock Exchanges in the US: A Comprehensive G"

- How Did the US Stock Market Do in May 2019?"