you position:Home > us stock market live > us stock market live

Stocks Definition: A Deep Dive into US History

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

In the United States, stocks have been a cornerstone of the financial market since the nation's inception. Understanding the definition of stocks and their historical significance in the US is crucial for anyone looking to navigate the stock market today. This article delves into the definition of stocks, their historical impact, and how they have shaped the economic landscape of the United States.

The Definition of Stocks

At its core, a stock represents a share of ownership in a company. When you purchase a stock, you become a partial owner of that company, albeit a very small one. This ownership comes with certain rights, such as voting on major corporate decisions and receiving dividends, which are a portion of the company's profits distributed to shareholders.

Historical Context

The concept of stocks in the United States dates back to the colonial period. The first stock exchange, the Philadelphia Stock Exchange, was established in 1790. However, the modern stock market as we know it today began to take shape in the early 19th century.

One of the most significant milestones in the history of stocks was the establishment of the New York Stock Exchange (NYSE) in 1792. This exchange became the central hub for stock trading in the United States, and its influence continues to this day.

The Roaring Twenties and the Great Depression

The 1920s marked a period of significant growth in the stock market. The so-called "Roaring Twenties" saw the stock market boom, with the Dow Jones Industrial Average (DJIA) reaching new heights. However, this period of growth was unsustainable, and the stock market crash of 1929, often referred to as the "Black Tuesday," led to the Great Depression.

This event highlighted the vulnerabilities of the stock market and the need for regulatory measures to protect investors. In response, the Securities Act of 1933 and the Securities Exchange Act of 1934 were enacted, establishing the Securities and Exchange Commission (SEC) and laying the groundwork for modern securities regulation.

The Post-World War II Era

After World War II, the stock market experienced a steady period of growth. The post-war era saw the rise of the middle class, which led to increased participation in the stock market. Additionally, technological advancements and the growth of the internet made it easier for individuals to invest in stocks.

The Dot-Com Bubble and Beyond

The late 1990s saw the rise of the dot-com bubble, which was fueled by the rapid growth of technology companies. However, this bubble burst in 2000, leading to a significant decline in stock prices. The aftermath of the dot-com bubble prompted further regulatory changes and an increased focus on risk management in the stock market.

Recent Developments

In recent years, the stock market has continued to evolve. The rise of exchange-traded funds (ETFs) has made it easier for individuals to invest in a diversified portfolio of stocks. Additionally, advancements in technology have made it possible to trade stocks online with ease.

Case Studies

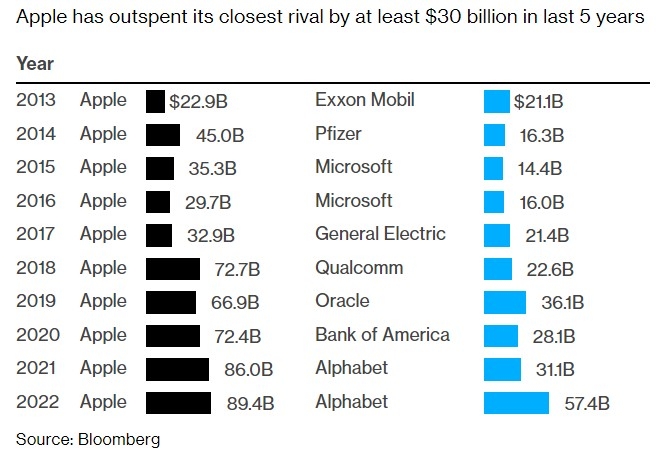

One notable case study is the rise of Apple Inc. Since its initial public offering (IPO) in 1980, Apple has become one of the most valuable companies in the world. This case study highlights the potential for significant returns on investment in the stock market, as well as the importance of long-term investing.

Another example is the 2008 financial crisis, which was triggered by the collapse of mortgage-backed securities. This event highlighted the interconnectedness of the financial markets and the importance of regulatory oversight.

Conclusion

The definition of stocks and their historical significance in the United States is a complex topic that has evolved over time. From the early days of the Philadelphia Stock Exchange to the modern stock market, stocks have played a crucial role in shaping the economic landscape of the United States. Understanding this history is essential for anyone looking to navigate the stock market today.

so cool! ()

last:Small Pox Stocks: US vs Russia – A Comparative Analysis

next:nothing

like

- Small Pox Stocks: US vs Russia – A Comparative Analysis

- High Price Stocks in the US: Understanding the Market Dynamics

- Market Predictions: US Stock Market 2024 So Far

- The Two Major Stock Markets in the US: A Comprehensive Overview

- US Stock Buybacks Total Volume: A Comprehensive Insight

- Total Value of the US Stock Market in 2013: A Comprehensive Analysis

- Questrade Fees for US Stocks: A Comprehensive Guide"

- US Stock Market Hits All-Time High: What It Means for Investors

- Market Cap of US Stock Market Total: An In-Depth Look"

- Top Performing US Bank Stocks to Watch in 2025

- Stock.Invest Us: Unleashing the Power of Equity Investment in the USA"

- Stock Symbols List: Your Ultimate Guide to Understanding US Stocks

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- US Stock Exchange Holiday List 2018: A Compreh"

recommend

Stocks Definition: A Deep Dive into US History

Stocks Definition: A Deep Dive into US History

Ape.US Stock: The Ultimate Guide to Understand

Title: US Citizen Investing in Stock Market in

Recent Drops in the Stock Market in the US: Wh

US Large Cap Momentum Stocks: Best Performers

How to Buy Big Hit Entertainment Stock in the

US Foods Stock Yards Meat Aurora IL 60502: A C

Title: T. Rowe Price US Stock Index: A Compreh

Is the US Stock Market Closed Right Now?

Understanding the US Residential Housing Stock

Samsung Stock During US Recession: What You Ne

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Top US Homebuilder Stocks: A Guide to Investme"

- Penny Stocks in the Oil Sector: A Lucrative US"

- Oil Company Stocks in the US: A Comprehensive "

- Title: Stock Price for US Robotics: What You N"

- Luxury Brands Stocks US: A Thriving Market for"

- US CPI Impact on Stock Market: Understanding t"

- Toys 'R' Us Stock Market Check: A Co"

- Title: Best US Stock Broker for Foreigners"

- US Construction Stock Index: A Comprehensive G"

- US Holidays 2022: How Stock Market Performance"