you position:Home > us stock market live > us stock market live

Is It Good to Buy US Stocks Now?

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the ever-evolving world of investing, the question of whether it's a good time to buy US stocks is one that often plagues both seasoned investors and newcomers alike. With the stock market's notorious volatility, making an informed decision can be challenging. In this article, we'll delve into the current market conditions, key factors to consider, and provide insights to help you make an informed decision about buying US stocks.

Understanding the Current Market Conditions

The stock market is influenced by a multitude of factors, including economic indicators, geopolitical events, and corporate earnings reports. As of now, the US stock market is experiencing a period of uncertainty. The Federal Reserve's monetary policy, inflation concerns, and the ongoing COVID-19 pandemic are among the factors contributing to this uncertainty.

Key Factors to Consider

Economic Indicators: It's crucial to keep an eye on economic indicators such as GDP growth, unemployment rates, and inflation. These indicators can provide valuable insights into the overall health of the economy and, by extension, the stock market.

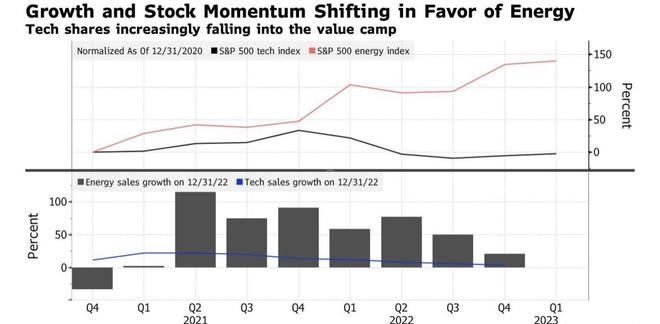

Sector Performance: Different sectors perform differently in various market conditions. For instance, technology stocks may outperform during periods of economic growth, while defensive sectors like healthcare and consumer staples may fare better during downturns.

Valuation Metrics: Valuation metrics such as the price-to-earnings (P/E) ratio and price-to-book (P/B) ratio can help determine whether stocks are overvalued or undervalued. A lower P/E or P/B ratio may indicate a good buying opportunity.

Dividend Yields: Dividend yields can be an attractive factor for investors seeking income. Companies with high dividend yields may be a good option for those looking to generate consistent returns.

Market Sentiment: The overall sentiment of the market can also impact stock prices. Positive sentiment can drive prices higher, while negative sentiment can lead to sell-offs.

Historical Performance

To gain a better understanding of the current market conditions, it's helpful to look at historical performance. Over the long term, the US stock market has generally delivered positive returns. However, it's important to note that past performance is not indicative of future results.

Case Studies

Let's take a look at a couple of case studies to illustrate the potential of investing in US stocks:

Apple Inc. (AAPL): Over the past decade, Apple has consistently delivered strong returns, with its stock price increasing significantly. Despite facing challenges such as supply chain disruptions and increased competition, Apple has managed to maintain its position as a market leader.

Tesla Inc. (TSLA): Tesla has experienced rapid growth over the past few years, driven by its innovative electric vehicle technology and aggressive expansion plans. While the stock has experienced significant volatility, it has also delivered impressive returns for investors who were willing to take on the risk.

Conclusion

Whether it's a good time to buy US stocks now depends on your investment strategy, risk tolerance, and market outlook. By considering the factors mentioned above and conducting thorough research, you can make an informed decision about whether investing in US stocks is right for you. Remember, investing always involves risks, and it's crucial to diversify your portfolio to mitigate potential losses.

so cool! ()

last:Is LG Chem on the US Stock Market?

next:nothing

like

- Is LG Chem on the US Stock Market?

- Title: ELGX Stock: A Deep Dive into US News Coverage

- AAPL US Stock: The Ultimate Guide to Investing in Apple's Stock

- Nonresident Alien Capital Gains Tax on US Stocks: What You Need to Know

- US Stock Market Apps: Your Ultimate Investment Toolkit

- Did the US Govt Give GM Stock to the UAW?

- Best Broker for US Stocks in Malaysia: Your Ultimate Guide

- MCD US Stock: A Comprehensive Analysis

- Title: US Stock Exchange Volume Decline: What It Means for Investors

- Today's WSJ US Stock Market Summary: Key Insights and Trends

- Stocks by Market Cap US: A Comprehensive Guide to Understanding the Largest Compa

- Top 10 in US Stocks Market: The Elite List of Investment Powerhouses

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- US Stock Exchange Holiday List 2018: A Compreh"

recommend

Is It Good to Buy US Stocks Now?

Is It Good to Buy US Stocks Now?

Foxconn Stock US Ticker: A Comprehensive Guide

Chances of a U.S. Stock Market Crash: Understa

US Corn Ending Stocks 2025 Statistics: A Compr

Can I Buy Baidu Stock in the US? A Comprehensi

Title: Top 10 Dividend Stocks in the US

Understanding the Difference Between REITs and

Nintendo Stock US Price: What You Need to Know

Buy Us Stock from Malaysia: A Lucrative Invest

Small Cap Biotech Upcoming Catalysts: US Stock

Title: Stock Price for US Robotics: What You N

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Tech Stock US: The Future of Innovation and In"

- Is It Good to Buy US Stocks Now?"

- Momentum Stocks: US Large Cap August 2025 Outl"

- US Penny Stock to Buy: How to Identify and Inv"

- Live Us Stock Market TV: Your Ultimate Guide t"

- Konica Minolta Stock US: A Comprehensive Analy"

- Goldman Sachs US Stock Market Outlook 2025: A "

- Title: Does the U.S. Military Protect Us Stock"

- US Hotel Stock: A Comprehensive Guide to the C"

- US Steel Stock Trend: What You Need to Know"