you position:Home > us stock market live > us stock market live

How Evergrande Affects the U.S. Stock Market

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

The recent turmoil in the Chinese property sector, particularly the financial struggles of Evergrande Group, has sent shockwaves through global markets, including the U.S. stock market. As one of the largest property developers in China, Evergrande's fate has become a hot topic among investors and economists. This article delves into how Evergrande's situation might impact the U.S. stock market and the broader economic landscape.

Understanding the Context

Evergrande, founded in 1996, has been a key player in China's property market, developing numerous residential and commercial projects across the country. However, the company has faced significant financial challenges in recent years, leading to concerns about its ability to meet its debt obligations. With over $300 billion in liabilities, Evergrande's default could have severe consequences not only for China's economy but also for the global financial system.

Potential Impacts on the U.S. Stock Market

China's Economic Slowdown: The potential collapse of Evergrande could lead to a slowdown in China's economy, which is the world's second-largest. This slowdown could have a ripple effect on the U.S. stock market, as many American companies rely on China for a significant portion of their revenue. According to a report by CNBC, S&P 500 companies generate approximately 30% of their revenue from China.

Global Supply Chain Disruptions: Evergrande's default could disrupt the global supply chain, particularly in the construction and manufacturing sectors. This disruption could lead to higher input costs for American companies, potentially impacting their profitability and stock prices. A study by the Boston Consulting Group estimates that the global supply chain could face disruptions worth up to $1 trillion.

Credit Risk: The default of Evergrande could lead to increased credit risk in the Chinese financial system, prompting investors to reassess their exposure to Chinese assets. This reassessment could spill over into the U.S. stock market, as many American investors have a significant stake in Chinese companies. The MSCI China Index, which tracks the performance of Chinese stocks listed in the U.S., has already seen a decline of 15% in the past month.

Geopolitical Tensions: The situation in China could also exacerbate geopolitical tensions between the U.S. and China, potentially leading to trade restrictions and other economic measures. These measures could further impact the U.S. stock market and the broader global economy.

Case Studies

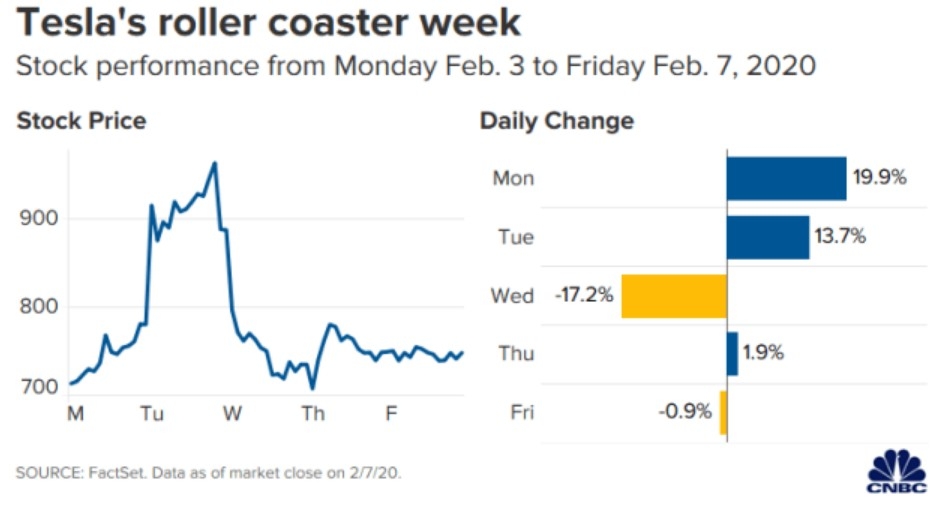

Tesla: Tesla, a U.S.-based electric vehicle manufacturer, has significant operations in China. Any disruption in the Chinese economy or supply chain could impact Tesla's operations and profitability. According to a report by Reuters, Tesla's revenue from China increased by 70% in 2020.

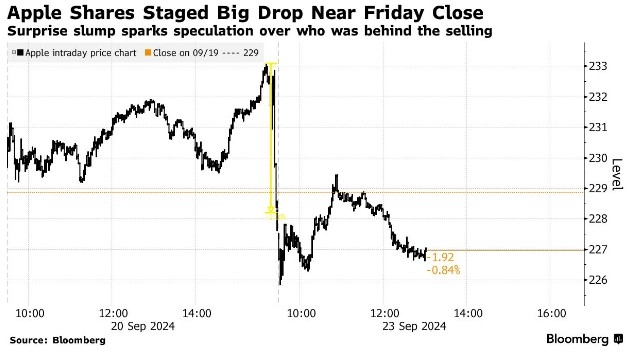

Apple: Apple, another U.S.-based company with a significant presence in China, relies heavily on Chinese manufacturers for its supply chain. Any disruption in the supply chain could impact Apple's ability to meet demand and its profitability. According to a report by CNN, Apple's revenue from China accounted for 19% of its total revenue in 2020.

In conclusion, the situation with Evergrande Group is a critical issue that could have far-reaching consequences for the U.S. stock market and the global economy. As investors, it is essential to stay informed and be prepared for potential market volatility.

so cool! ()

last:Lly Us Stock: Unlocking the Potential of Stock Market Investments

next:nothing

like

- Lly Us Stock: Unlocking the Potential of Stock Market Investments

- Title: Stock Price for US Robotics: What You Need to Know

- Title: US Citizen Investing in Stock Market in India: A Comprehensive Guide

- US Penny Stock List 2021: A Comprehensive Guide to Undervalued Opportunities

- Title: FTSE 100 vs US Growth Stocks: A Comprehensive Analysis

- How Is the US Stock Market Performing Today?

- PS4 Pro Out of Stock US: What You Need to Know

- Is the US Stock Exchange Open on Columbus Day?

- Is the US Stock Market in a Bubble October 2025?

- Tencent Has 2 Stocks in the US: A Comprehensive Guide

- Trending US Stocks Today: Top Picks for Investors

- Title: Stock Trading Apps in the US: Your Ultimate Guide to Mobile Investing

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Buy Us Stock from Malaysia: A Lucrative Invest"

- NVEI US Stock: Unveiling the Investment Potent"

- Title: T. Rowe Price US Stock Index: A Compreh"

recommend

How Evergrande Affects the U.S. Stock Market

How Evergrande Affects the U.S. Stock Market

Buy Us Stock from Malaysia: A Lucrative Invest

List of Energy US Stocks: A Comprehensive Guid

1357VOYA US Stock Index Portfolio: An In-Depth

Can a Non-US Citizen Buy US Stocks?

Samsung Stock Chart in US Dollars: A Comprehen

August 19, 2025: US Stock Market Summary

Title: State Az US Stocking Schedule: The Ulti

Bullish News for US Stocks Under $7: Pre-Marke

10 Companies Whose Stock Influences Current Ev

Small Cap US Stock Growth Potential: A Compreh

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Latest US Stock Market News September 2025"

- How Many Stock Traders Are There in the US?"

- Buy Us Stock from Malaysia: A Lucrative Invest"

- Title: Top 10 Dividend Stocks in the US"

- Stock Invest Us: Unleashing the Power of Equit"

- Join Us Stock Photo: Unleash the Power of Visu"

- US Stock Exchange Online: Your Gateway to Glob"

- Lithium Mining Stocks: A Lucrative Investment "

- Nike Stock in US Market Price: A Comprehensive"

- May 19, 2025 US Stock Market Summary"