you position:Home > us stock market live > us stock market live

Company Giving Us Stock: What You Need to Know

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

Are you excited about your company giving you stock? This is a significant opportunity that can have a profound impact on your financial future. In this article, we'll delve into what it means when a company gives you stock, the potential benefits, and what you should consider before accepting.

Understanding Stock Grants

When a company gives you stock, it's typically in the form of a stock grant. This is an award of shares in the company to employees or executives. The value of these shares can vary based on the company's stock price at the time of the grant and the number of shares you receive.

Benefits of Stock Grants

There are several benefits to receiving stock from your company:

- Potential for High Returns: If the company's stock price increases, the value of your stock will too. This can lead to significant wealth accumulation over time.

- Tax Advantages: Stock grants often come with favorable tax treatment. In some cases, you may not have to pay taxes on the stock until you sell it.

- Ownership Stake: By receiving stock, you become a partial owner of the company. This can provide a sense of loyalty and commitment to the company's success.

Considerations Before Accepting Stock

Before you jump at the opportunity to receive stock, there are a few things you should consider:

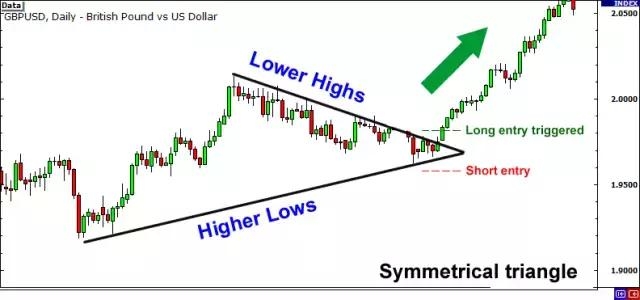

- Stock Price Volatility: The value of your stock can fluctuate significantly, so it's important to understand the risks involved.

- Lock-Up Period: Many stock grants come with a lock-up period, which means you cannot sell the stock for a certain period of time. This can impact your liquidity.

- Company Performance: The value of your stock is directly tied to the company's performance. If the company struggles, the value of your stock could decline.

Case Studies

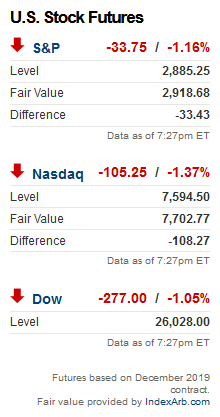

Let's take a look at a couple of case studies to illustrate the potential benefits and risks of receiving stock from your company:

- Case Study 1: An employee at a tech company received a stock grant worth

10,000. Over the next five years, the company's stock price increased significantly, and the employee sold their shares for a profit of 50,000. - Case Study 2: An employee at a struggling company received a stock grant worth $10,000. The company's stock price plummeted, and the employee's shares became essentially worthless.

Conclusion

Receiving stock from your company can be a valuable opportunity, but it's important to understand the potential benefits and risks. By doing your research and considering the factors mentioned in this article, you can make an informed decision about whether to accept a stock grant.

Key Takeaways:

- Stock grants can offer significant potential returns.

- Tax advantages and ownership stake are additional benefits.

- Consider stock price volatility, lock-up periods, and company performance before accepting stock.

- Research and understand the potential risks and rewards.

so cool! ()

like

- P65910B_05 Stock Firmware for LG Optimus F3 P659 US T-Mobile: A Comprehensive Gui

- Singapore Brokerage for US Stocks: Your Ultimate Guide

- Nintendo Stock Symbol: Understanding the Symbol and Its Implications

- OGRMF Stock: The Ultimate Guide to Understanding OGRMF Corporation's US Mark

- Top US Penny Cannabis Stocks to Watch in 2023

- Top Marijuana Stocks in the US: Your Guide to Investment Opportunities

- How Many People Invest in the US Stock Market?

- US Stock Market Analysis: A Deep Dive into April 2021 Performance

- Toys 'R' Us Stock Market Check: A Comprehensive Overview"

- US Silica Stock Symbol: A Comprehensive Guide to Investing in the Industry Leader

- US-China Trade War: A Deep Dive into Its Impact on the Stock Market

- Maximizing Your TFSA: Investing in US Stocks

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- US Stock Exchange Holiday List 2018: A Compreh"

recommend

Company Giving Us Stock: What You Need to Know

Company Giving Us Stock: What You Need to Know

List of US Energy Stocks: A Comprehensive Guid

Enterprise Stocks in the US: A Comprehensive G

How Many Active Stocks in the US?

Daimler Stock Price: A Comprehensive Guide to

Stock Market Performance After the 2024 U.S. P

Title: Understanding US Stock and Bonds: A Com

US Large Cap Momentum Stocks This Week

Title: Understanding Incentive Stock Options a

US Steel Stock Charts: A Comprehensive Guide t

Mint Mobile Stock US: The Ultimate Guide to In

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- 20 Inch Herschel Squishmallow in Stock: Top US"

- Chances of a U.S. Stock Market Crash: Understa"

- Live Us Stock Market TV: Your Ultimate Guide t"

- Title: Best Momentum Stocks to Watch in Octobe"

- Tencent Has 2 Stocks in the US: A Comprehensiv"

- Investing in US Stocks from UAE: A Guide to Na"

- Lithium Mining Stocks: A Lucrative Investment "

- Recent Drops in the Stock Market in the US: Wh"

- Us Mail Stock Price: A Comprehensive Analysis "

- Luxury Brands Stocks US: A Thriving Market for"