you position:Home > us energy stock > us energy stock

Unlocking the Potential of OTC US Stocks: A Comprehensive Guide

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

Are you looking to diversify your investment portfolio but unsure where to start? Consider exploring the world of OTC US stocks. Over-the-counter (OTC) trading offers a unique opportunity for investors to gain access to a wide range of stocks that are not listed on major exchanges. In this comprehensive guide, we will delve into the intricacies of OTC US stocks, highlighting their benefits, risks, and key considerations for investors.

Understanding OTC US Stocks

OTC US stocks refer to shares of companies that are not listed on major stock exchanges like the New York Stock Exchange (NYSE) or NASDAQ. Instead, these stocks are traded over-the-counter, which means they are bought and sold directly between investors and brokers. This decentralized trading system allows for a broader range of companies to be accessible to investors.

Benefits of Investing in OTC US Stocks

Access to a Broader Range of Companies: OTC US stocks provide access to a diverse range of companies, including small-cap and micro-cap businesses that may not be listed on major exchanges. This allows investors to explore emerging industries and potentially high-growth companies.

Potential for Higher Returns: Investing in OTC US stocks can offer higher returns compared to stocks listed on major exchanges. However, it's important to conduct thorough research and due diligence before investing.

Low Entry Barrier: OTC US stocks often have lower share prices compared to stocks listed on major exchanges, making them more accessible to retail investors.

Risks of Investing in OTC US Stocks

Lack of Regulation: OTC US stocks are not subject to the same level of regulation as stocks listed on major exchanges. This can lead to higher risks, including potential manipulation and less transparency.

Market Volatility: OTC US stocks can be highly volatile, experiencing significant price fluctuations due to lower liquidity and fewer investors.

Liquidity Concerns: OTC US stocks may have lower liquidity, meaning it may be challenging to buy or sell shares without significantly impacting the stock price.

Key Considerations for Investing in OTC US Stocks

Conduct Thorough Research: Before investing in OTC US stocks, it's crucial to conduct thorough research, including analyzing financial statements, understanding the company's business model, and assessing its competitive position.

Consider the Company's Reputation: Look for companies with a strong reputation and a history of transparency and ethical practices.

Diversify Your Portfolio: To mitigate risks, consider diversifying your investment portfolio by allocating a small portion to OTC US stocks.

Stay Informed: Keep up-to-date with market news and developments related to the companies you are considering investing in.

Case Study: XYZ Corporation

Let's consider XYZ Corporation, a small-cap company trading on the OTC US market. After conducting thorough research, you discover that XYZ Corporation has a strong management team, a promising product pipeline, and a solid financial position. By diversifying your portfolio with a small investment in XYZ Corporation, you may benefit from potential growth in the company's stock price.

In conclusion, OTC US stocks offer a unique opportunity for investors to explore a broader range of companies and potentially achieve higher returns. However, it's crucial to conduct thorough research, understand the risks, and stay informed to make informed investment decisions.

so cool! ()

last:In-Depth Analysis of COP Stock: A Must-Read for Investors"

next:nothing

like

- In-Depth Analysis of COP Stock: A Must-Read for Investors"

- Emblem Corp Stock US: The Ultimate Guide to Investing in This Emerging Market Gia

- Best Momentum Stocks US Large Cap October 2024: Top Picks for Investors

- Robert Shiller's Insights on the US Stock Market: A Comprehensive Analysis

- Nasdaq Futures Lead US Stocks Higher on Monday

- Reason for Us Stock Market Drop Today: Key Factors and Implications

- How to Buy Japan Stock in the US: A Step-by-Step Guide"

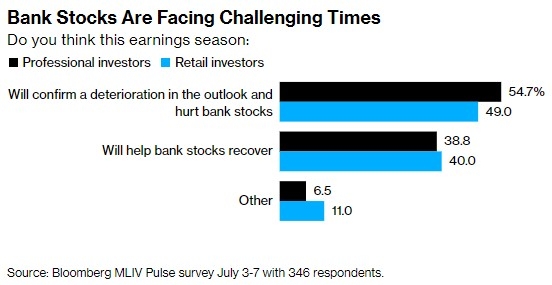

- US Bank Stocks Fall Baffling Some Investors

- Hot Momentum Stocks to Watch in the US Market

- Unlocking the Potential of KKR & Co. Inc. (KEF): A Deep Dive into the Sto

- Trade Hong Kong Stocks in the US: Your Ultimate Guide to Investing Success

- Top US Penny Stocks of 2020: A Breakdown of the Most Exciting Investments

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Unlocking the Potential of OTC US Stocks: A Co

Unlocking the Potential of OTC US Stocks: A Co

Tots R Us Spokabe Cribs in Stock: The Ultimate

Did Us Tax Stocks? Understanding the Impact of

The Impact of US Elections on the Indian Stock

Title: RSX US Stock Price: Understanding the M

Can You Buy Samsung Stock in the US?

Understanding the Stock of Portfolio Investmen

NVIDIA's Q3 Earnings in Focus Amid Mixed

Barclays Strategists Believe US Stocks Are Ove

April 21, 2025: A Deep Dive into the US Stock

TFSA Holding US Stocks: A Comprehensive Guide

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Best AI Stocks to Watch in 2025"

- Chevron Stock: A Comprehensive Guide to Invest"

- Current Outlook: US Stock Market in September "

- US Polls Stock Market: What You Need to Know"

- US Penny Stocks to Watch in 2021: Your Guide t"

- Momentum Trading: A Strategic Approach to Capi"

- Understanding the US Stock Close Time: Key Fac"

- Toys "R" Us Stock Crew Job R"

- September 1, 2025: A Look into the US Stock Ma"

- US Binocular M16 Stock No 7578343: A Comprehen"