you position:Home > us energy stock > us energy stock

Unlocking Opportunities with Penny Stocks Under $0.10 US

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Investing in the stock market can be an exciting and potentially lucrative endeavor. However, it can also be daunting for beginners. One group of stocks that has gained popularity among investors looking for high-risk, high-reward opportunities are penny stocks, particularly those priced under

Understanding Penny Stocks Under $0.10 US

Penny stocks are shares of publicly traded companies that trade at very low prices. Generally, they are priced under

The Appeal of Penny Stocks Under $0.10 US

There are several reasons why investors are attracted to penny stocks under $0.10 US:

- Low Entry Barrier: The low price point means that investors can start with a relatively small amount of money.

- High Potential for Growth: Many penny stocks have seen significant growth over the years, offering the potential for substantial returns.

- Active Trading: The low price and high volatility make penny stocks attractive to traders looking for quick profits.

Risks Associated with Penny Stocks Under $0.10 US

Despite their potential, investing in penny stocks under $0.10 US also comes with significant risks:

- High Volatility: Prices can fluctuate wildly, making it difficult to predict future performance.

- Lack of Transparency: Smaller companies may not have the same level of transparency as larger, more established companies.

- Fraud Risk: Some penny stocks are subject to fraudulent activities, including market manipulation and false reporting.

Navigating the Penny Stock Market

To succeed in the penny stock market, it is essential to:

- Do Your Research: Thoroughly research the company and its industry before investing. Look for factors such as management quality, financial health, and growth prospects.

- Understand the Risks: Be aware of the risks involved and only invest money you can afford to lose.

- Stay Informed: Keep up with the latest news and developments related to the company and its industry.

Case Studies

One notable example of a company that started as a penny stock under

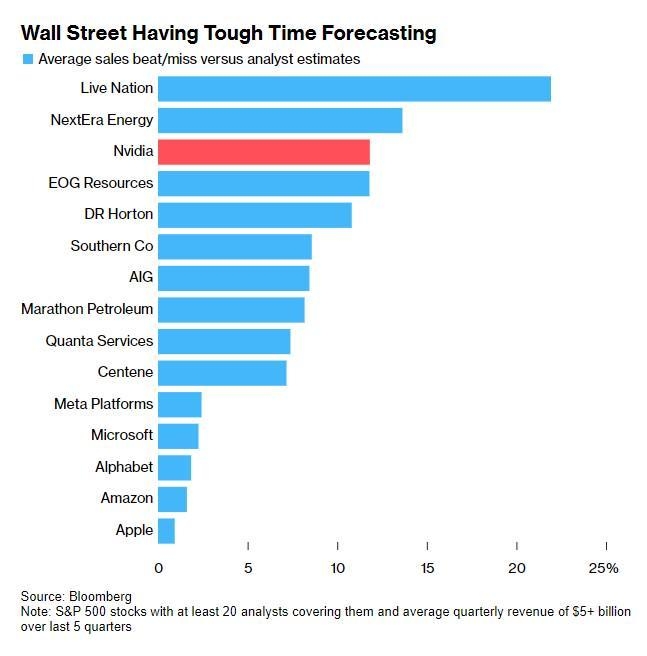

Another example is NVIDIA Corporation, which started as a penny stock in the late 1990s and later became a leading player in the semiconductor industry.

Conclusion

Investing in penny stocks under $0.10 US can be an exciting and potentially lucrative endeavor. However, it is crucial to approach this market with caution and conduct thorough research. By understanding the risks and rewards, investors can make informed decisions and potentially capitalize on the high-growth potential of these companies.

so cool! ()

last:SGEN US Stock Price: What You Need to Know

next:nothing

like

- SGEN US Stock Price: What You Need to Know

- The Stock Exchange: Your Ultimate Guide to the Financial Market

- Jamison Whiskey: A Thriving Investment on the US Stock Exchange

- What Will the Markets Do on Monday? A Comprehensive Outlook

- Unlocking the Power of Stock Codes: Your Ultimate Guide"

- The Worst Stock Market Crash in US History: A Comprehensive Analysis

- Share Bazar Today: The Ultimate Shopping Experience

- US Stock Futures Rise Amidst Government Shutdown

- S&P After Hours Live: Your Ultimate Guide to After-Hours Trading

- Best US Stock Broker in India: Your Ultimate Guide to Investment Success"

- Unlocking the Potential of Tencent Holdings Stock US: A Comprehensive Analysis

- Unlock the Power of Comina: A Comprehensive Guide

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Unlocking Opportunities with Penny Stocks Unde

Unlocking Opportunities with Penny Stocks Unde

Short Sell US Stock: A Comprehensive Guide

Understanding US Stock Exchange Market Hours i

How the Stock Market Influences the US Economy

Unlocking the Potential of US Bancorp Stock: A

Kver Stock: Contact Us for Exceptional Investm

How to Buy Stocks in the US Market: A Comprehe

Title: How Did US Stock Markets Close on May 5

Biggest Stock Broker in the US: A Comprehensiv

Top 5 US Healthcare Stocks to Watch in 2023

June 25, 2025 US Stock Market Summary: Key Dev

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Pelosi Stocks: A Deep Dive into the Investment"

- Unlocking the Potential of US Gas and Oil Stoc"

- Stock Rise Today: What's Behind the Bulli"

- US Stock Close Today: A Comprehensive Look at "

- Micron US Stock: A Comprehensive Guide to Inve"

- Title: Does Ubq Israeli Company Trade on US St"

- Best Performing US Stocks Past Week: Momentum "

- Stock WhatsApp Group US: The Ultimate Platform"

- By or Sell Airbus US Stock: Your Ultimate Guid"

- Options Trading for Beginners: A Comprehensive"