you position:Home > us energy stock > us energy stock

Unleashing the Growth Potential of U.S. Small Cap Stocks

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

In the vast ocean of the U.S. stock market, small cap stocks often fly under the radar. Yet, these companies, with a market capitalization of less than $2 billion, hold immense growth potential. This article delves into the factors that make U.S. small cap stocks a promising investment opportunity.

Understanding Small Cap Stocks

Small cap stocks are companies that have a relatively small market capitalization. Unlike large cap stocks, which are often well-established and have a market cap of over $10 billion, small caps are usually younger and have the potential for rapid growth.

Market Capitalization: A Key Factor

Market capitalization is the total value of a company's outstanding shares of stock. For small cap stocks, this figure is typically below $2 billion. This distinction is crucial because it determines the potential growth opportunities and risk associated with these investments.

Rapid Growth Potential

Small cap stocks often have greater growth potential compared to their larger counterparts. This is primarily due to their limited market share and less competition. As these companies scale up, they can capture a larger market share, leading to significant growth in their stock prices.

Diversification Benefits

Investing in small cap stocks can offer diversification benefits. By including small cap stocks in your investment portfolio, you can reduce the overall risk and exposure to market fluctuations. This is because small cap stocks often perform differently from large cap stocks, providing a balanced portfolio.

Factors to Consider

When evaluating the growth potential of small cap stocks, several factors should be considered:

- Industry: The industry in which the company operates plays a crucial role in its growth potential. Companies in growing industries often have a higher likelihood of achieving significant growth.

- Management: The quality of the company's management team is crucial. Effective leadership can drive innovation, increase efficiency, and lead to long-term growth.

- Financial Health: Analyzing the company's financial statements, including its revenue, profit margins, and debt levels, can provide insights into its financial health and growth potential.

- Market Conditions: The overall market conditions can impact the performance of small cap stocks. During periods of economic growth, these stocks often outperform their larger counterparts.

Case Study: Amazon

To illustrate the potential of small cap stocks, let's consider Amazon. When it first went public in 1997, Amazon was a small cap stock with a market capitalization of less than

Conclusion

U.S. small cap stocks offer immense growth potential for investors. By understanding the factors that contribute to their success and carefully selecting promising companies, investors can achieve significant returns. While these investments come with higher risk, the potential rewards make them a compelling option for those willing to take on the challenge.

so cool! ()

like

- Average Dividend Yield in the US Stock Market 2025: What Investors Need to Know

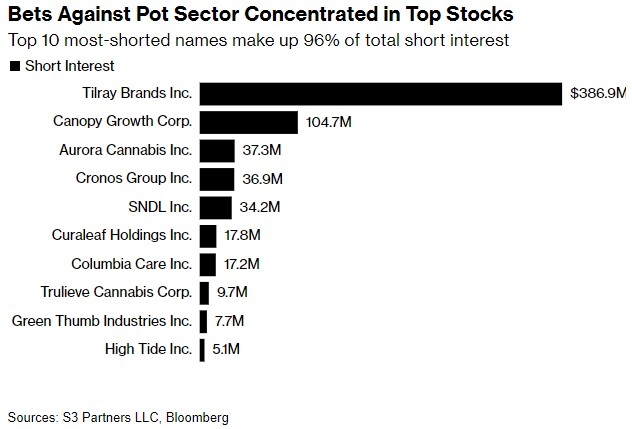

- Canadian Marijuana Stocks on US Stock Exchange: A Comprehensive Guide

- Does Stock Market Affect USD Exchange Rates?

- US Corporate Stock Buybacks 2025: Trends, Impact, and Opportunities

- Safe Stocks to Invest In: A Guide to Secure Investments in the US Market

- US Steel Stock Drop in 1929: The Significance and Impact

- April 21, 2025: A Deep Dive into the US Stock Market News

- Can Foreigners Trade Stocks on the U.S. Stock Market? A Comprehensive Guide

- Unlocking the Potential of US Financial Stocks: A Comprehensive Guide

- In Stock Hatchimals US: The Ultimate Guide to the Hottest New Toy

- Pre Market US Stocks Today: A Comprehensive Guide

- How to Buy Cannabis Stocks in the U.S.

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Unleashing the Growth Potential of U.S. Small

Unleashing the Growth Potential of U.S. Small

Understanding the US Stock Close Time: Key Fac

Title: "http stocks.us.reuters.com st

US Steel Stock News Today: Key Updates and Ana

PS5 US Stock Update: The Latest on Availabilit

US High Growth Tech Stocks: The Future is Here

Title: US Stock Market Nears $2 Trillion Miles

New US Company Stocks: Unveiling the Potential

US Stock Futures: A Comprehensive Guide to Und

How Many US Stocks: A Comprehensive Guide to t

Unlocking the Potential of NTDoy.pk: A Deep Di

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- ADRs: Unlocking the Potential of U.S. Stocks f"

- http stocks.us.reuters.com stocks fulldescript"

- Title: "http stocks.us.reuters.com st"

- Fly Us Stock Isn't Crashing: Why You Shou"

- Understanding Vesting Schedules: A Comprehensi"

- US Steel Stock News Today: Key Updates and Ana"

- http stocks.us.reuters.com stocks fulldescript"

- Understanding the US Oil Prices Stock: What Yo"

- Title: Stock X Contact Us: Your Gateway to Exc"

- Title: US Government Stocks to Buy: Top Invest"