you position:Home > us energy stock > us energy stock

Understanding the Risks of Stocks in the US Economy

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

In the ever-evolving landscape of the US economy, investing in stocks can be a lucrative endeavor, but it comes with its own set of risks. Understanding these risks is crucial for investors looking to navigate the stock market successfully. This article delves into the potential pitfalls of investing in stocks, offering insights and practical advice for those considering this investment path.

Market Volatility

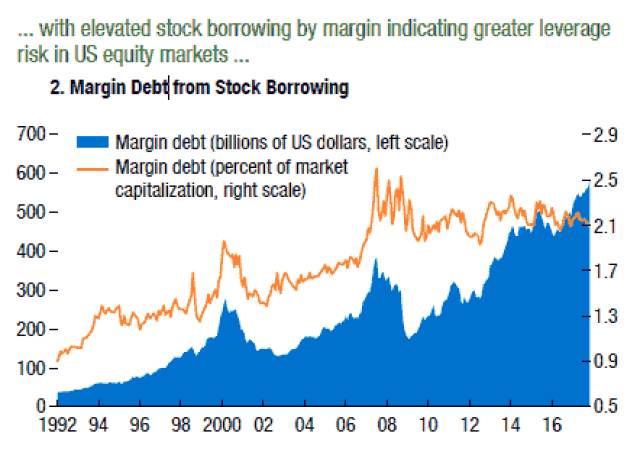

One of the most significant risks associated with stocks in the US economy is market volatility. Stock prices can fluctuate wildly, often influenced by economic indicators, political events, and company performance. This volatility can lead to significant gains or losses in a short period, making it essential for investors to stay informed and have a well-thought-out investment strategy.

Economic Factors

The state of the US economy plays a crucial role in the performance of stocks. Economic indicators such as GDP growth, unemployment rates, and inflation can all impact stock prices. For instance, during a recession, many companies may experience decreased revenue and profitability, leading to a decline in stock prices. Conversely, during periods of economic growth, stocks may perform well as companies expand and thrive.

Company Performance

The performance of individual companies is another critical factor in stock investment risks. Issues such as poor financial management, product failures, or legal problems can all negatively impact a company's stock price. It is essential for investors to conduct thorough research on the companies they are considering investing in, including their financial statements, management team, and market position.

Market Manipulation

Unfortunately, the stock market is not immune to manipulation. Insider trading, false information, and other fraudulent activities can all distort stock prices and pose significant risks for investors. It is crucial to stay vigilant and only invest in companies with a strong track record of transparency and ethical business practices.

Diversification

One way to mitigate the risks associated with stocks is through diversification. By spreading investments across various sectors and asset classes, investors can reduce their exposure to the risks of any single stock or sector. This approach can help protect against losses in the event of a downturn in any particular market.

Case Study: Enron Scandal

A notable example of the risks associated with stocks in the US economy is the Enron scandal. In the early 2000s, Enron, once a highly regarded energy company, collapsed due to massive accounting fraud. The scandal resulted in the loss of billions of dollars for investors and led to significant changes in corporate governance and financial reporting standards.

Conclusion

Investing in stocks in the US economy can be a rewarding endeavor, but it is crucial to understand the associated risks. By staying informed, conducting thorough research, and employing strategies such as diversification, investors can navigate the stock market more effectively and reduce their exposure to potential pitfalls.

so cool! ()

last:Is US Stock Trade Open Today? Your Ultimate Guide to Market Hours

next:nothing

like

- Is US Stock Trade Open Today? Your Ultimate Guide to Market Hours

- Unlock the Power of US Steel Stock Certificates

- Linde US Stock: A Comprehensive Analysis and Investment Guide

- NVIDIA US Stock: A Comprehensive Guide to Investing in the Tech Giant

- Bialetti Industrie S.p.A. US Stock Symbol: Your Guide to Investing in the Italian

- Best Stocks to Buy in the US Market: Top 5 Picks for 2023

- Toys "R" Us and Babies "R" Us Daytime Stock A

- Best Twitter Accounts for US Stock Market Recommendations

- Us Dollar Stock to Flow: A Comprehensive Guide to Understanding This Valuation Me

- Best US Stock ETFs: Your Ultimate Guide to Top Performing Funds

- Top Dividend-Yielding U.S. Stocks: Unlocking High-Paying Investments

- Can US Military Personnel Invest in Chinese Stocks?

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Understanding the Risks of Stocks in the US Ec

Understanding the Risks of Stocks in the US Ec

Stock Price for US Robotics: Insights and Anal

US Stock Today: Key Insights and Trends to Wat

Global Share Market News: Latest Developments

US Steel Industry Stocks: A Comprehensive Guid

http://stocks.us.reuters.com/stocks/fulldescri

Honour Us Latex Stocking Size: Finding the Per

US Momentum Stocks: Best Performers Last 5 Day

How Much Money Has the US Stock Market Lost? A

Can I Still Buy Stocks When the US Market Clos

Confidence Flight Indicators: A Deep Dive into

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Early Movers: Top US Stocks to Watch in 2023"

- Us Dollar Stock to Flow: A Comprehensive Guide"

- Title: List of US Marijuana Stocks: Your Ultim"

- Best US Rare Earth Stocks: A Guide to Investme"

- How the Stock Market Influences the US Economy"

- US Foods Stock: Buy or Sell? A Comprehensive A"

- Stocks Slip as US Tariff Concerns and Walmart "

- Us Presidents Stocked in Bathroom: The Surpris"

- Unlocking Potential: The Rise of American Towe"

- Utility Stocks: A Solid Investment for Long-Te"