you position:Home > us energy stock > us energy stock

US Market Stock Time: Navigating the Financial Landscape

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

Introduction

The United States stock market has always been a pivotal force in the global financial landscape. Understanding the intricacies of the US market stock time is crucial for investors looking to make informed decisions. This article delves into the dynamics of the US stock market, focusing on key aspects that can help investors navigate this dynamic environment.

Understanding the US Stock Market

The US stock market is home to some of the world's most prominent and influential companies. The two major stock exchanges, the New York Stock Exchange (NYSE) and the NASDAQ, play a central role in facilitating trading.

Market Hours

The trading hours for the US stock market are generally from 9:30 AM to 4:00 PM Eastern Time. During this period, investors can buy and sell stocks, ETFs, and other securities. However, it's important to note that trading can extend beyond these hours through various platforms and markets.

Key Factors Influencing Stock Market Time

1. Economic Indicators

Economic indicators such as GDP growth, unemployment rates, and inflation can significantly impact stock prices. Understanding these indicators can help investors anticipate market movements.

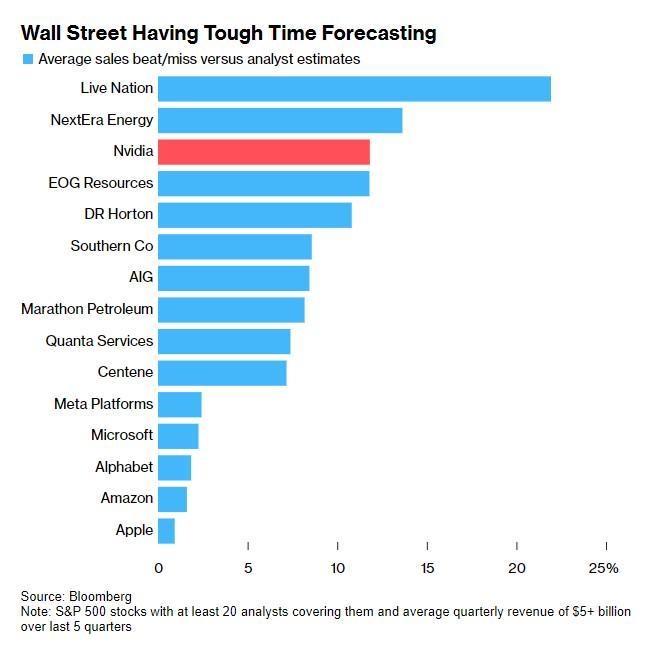

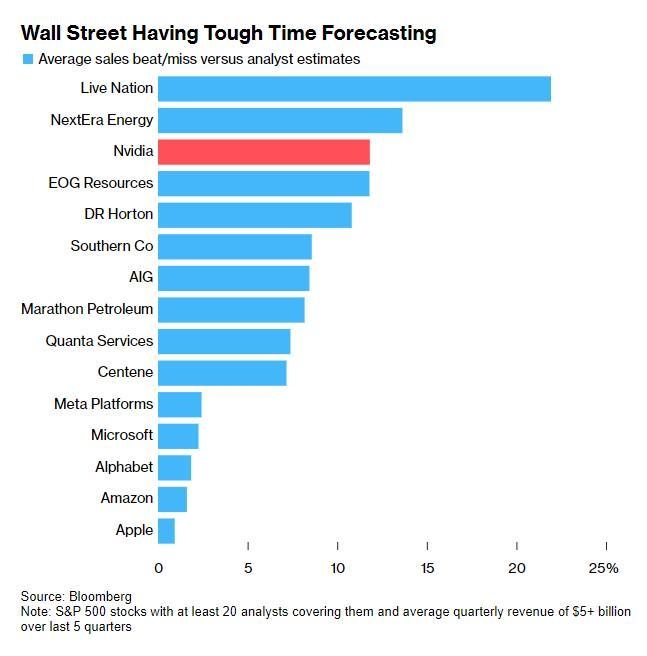

2. Corporate Earnings Reports

Corporate earnings reports are a key factor in determining stock prices. Companies that report strong earnings can see their stock prices rise, while those with disappointing results may see their shares decline.

3. Geopolitical Events

Geopolitical events, such as elections or trade wars, can create volatility in the stock market. Investors should stay informed about these events to make informed decisions.

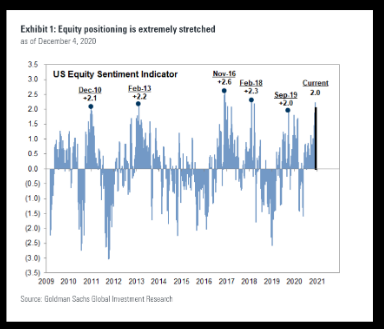

4. Market Sentiment

Market sentiment, or the overall outlook of investors, can also influence stock prices. Factors such as optimism or pessimism can lead to significant market movements.

Navigating the Market with the Right Tools

1. Financial News and Analysis

Staying informed about market trends and analysis is crucial. Websites like CNBC, Bloomberg, and Reuters provide up-to-date news and analysis that can help investors make informed decisions.

2. Technical Analysis

Technical analysis involves studying past stock price movements to predict future trends. Tools like stock charts and indicators can help investors identify potential buy and sell opportunities.

3. Fundamental Analysis

Fundamental analysis involves evaluating a company's financial health and performance. This includes analyzing financial statements, revenue growth, and market position.

Case Study: Amazon's Stock Price Movement

One notable example of how economic indicators can influence stock prices is Amazon's (AMZN) stock movement. In 2020, when the US economy was facing a recession, Amazon's stock price surged due to increased demand for online shopping. This demonstrates how economic conditions can impact stock prices.

Conclusion

Understanding the US market stock time is essential for investors looking to navigate the complex financial landscape. By staying informed about key factors, utilizing the right tools, and staying patient, investors can make informed decisions and potentially achieve their investment goals.

so cool! ()

last:Is the US Stock Market Open Easter Monday?

next:nothing

like

- Is the US Stock Market Open Easter Monday?

- US Nickel Mining Stocks: A Golden Opportunity for Investors

- Understanding the US Dollar Stock Chart: A Comprehensive Guide

- Title: Are Foreign Stock Sales Reported to Us?

- US Stock Heatpress: The Ultimate Guide to Choosing the Best Heatpress for Your Bu

- Top Consumer Discretionary Stocks in the US: A Comprehensive Guide

- The Effect of U.S. Election on the Stock Market

- US Magnet Stocks: A Lucrative Investment Opportunity

- http://stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol im

- Dash Us Stock: The Ultimate Guide to Investing in American Stocks

- Title: US Stock Market Nears $2 Trillion Milestone: What It Means for Investors

- US China Stock Market Comparison: A Comprehensive Analysis

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

US Market Stock Time: Navigating the Financial

US Market Stock Time: Navigating the Financial

Title: Best Performing US Stocks: 5 Days Momen

US Stock Market April 30, 2025 Closing: A Comp

Is the US Stock Market Trading Today?

Top Momentum Stocks: US Large Cap 5 Days Perfo

Shipping Company Stocks US: Exploring the Impa

Best Stocks to Own Outside the US

US Fabric Stock: Your Ultimate Guide to the Be

Title: Profitable US Pot Stocks: A Guide to In

Equinix US Real Estate Stocks: A Strategic Inv

Indian Banks Listed in US Stock Exchange: A Co

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- NVDA Technical Analysis: Unveiling the Power o"

- US Stock Market August 17, 2025 Summary"

- Top Performing US Stocks Q1 2025: A Deep Dive "

- Alibaba Stock Forecast: What the Analysts Are "

- How to Buy US Stocks in Jamaica"

- Biontech US Stock: A Deep Dive into the Pharma"

- Title: Understanding the Market Bubble: Causes"

- Momentum Trading: A Strategic Approach to Capi"

- Disney Earnings: A Closer Look at the Mouse�"

- Can I Trade in the US Stock Market from Canada"