you position:Home > us energy stock > us energy stock

US Dividend Stock Recommendation: Top 5 Stocks for Consistent Income

![]() myandytime2026-01-27【us stock market today live cha】view

myandytime2026-01-27【us stock market today live cha】view

info:

Are you looking to boost your investment portfolio with stable, high-dividend-paying stocks? If so, you're in the right place. In this article, we'll explore the top 5 US dividend stocks that offer consistent income and growth potential. Whether you're a seasoned investor or just starting out, these recommendations could be the key to a more profitable portfolio.

1. Johnson & Johnson (JNJ)

Johnson & Johnson, often referred to as J&J, is a household name in the healthcare industry. This company offers a diverse range of products, including consumer healthcare, pharmaceuticals, and medical devices. With a dividend yield of around 3.5%, J&J is a reliable choice for investors seeking consistent income.

Why invest in JNJ?

- Stable Dividend: J&J has a long history of increasing its dividend, making it a strong choice for income investors.

- Strong Brand: The company's strong brand recognition and diversified product portfolio provide a solid foundation for growth.

- Dividend Yield: The current dividend yield is around 3.5%, offering investors a good return on their investment.

2. Procter & Gamble (PG)

Procter & Gamble is another leading company in the consumer goods industry. With brands like Gillette, Pampers, and Tide, P&G has a strong presence in various markets around the world. The company offers a dividend yield of approximately 3.1%, making it an attractive option for income seekers.

Why invest in PG?

- Stable Dividend: P&G has a long history of increasing its dividend, providing investors with a reliable income stream.

- Strong Brand Portfolio: The company's strong brand portfolio ensures steady revenue and growth potential.

- Dividend Yield: The current dividend yield of around 3.1% offers investors a good return on their investment.

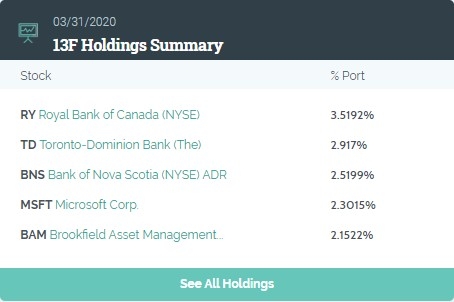

3. Microsoft (MSFT)

Microsoft, the world's largest software company, has become a staple in the tech industry. With a dividend yield of around 1.8%, Microsoft offers investors a stable and growing income stream. The company's diversification into cloud computing and other tech sectors has helped it maintain a strong position in the market.

Why invest in MSFT?

- Stable Dividend: Microsoft has increased its dividend for the past 19 years, making it a reliable income source.

- Diversification: The company's diversification into cloud computing and other tech sectors provides growth potential.

- Dividend Yield: The current dividend yield of around 1.8% offers investors a good return on their investment.

4. Visa (V)

Visa is a global leader in digital payments, processing over 60 billion transactions annually. The company offers a dividend yield of approximately 1.3%, making it an attractive option for income investors. Visa's strong position in the payments industry ensures steady revenue and growth potential.

Why invest in V?

- Stable Dividend: Visa has increased its dividend for the past 14 years, providing investors with a reliable income stream.

- Strong Position in Payments Industry: Visa's dominant position in the payments industry ensures steady revenue and growth potential.

- Dividend Yield: The current dividend yield of around 1.3% offers investors a good return on their investment.

5. AT&T (T)

AT&T is a leading telecommunications company with a long history of dividend payments. The company offers a dividend yield of around 6.4%, making it one of the highest-yielding dividend stocks on this list. However, investors should note that AT&T's dividend has been subject to cuts in the past, so it's important to conduct thorough research before investing.

Why invest in T?

- High Dividend Yield: AT&T offers one of the highest dividend yields on this list, providing investors with a significant income stream.

- Stable Revenue: The telecommunications industry is a stable sector, ensuring steady revenue for AT&T.

- Potential for Dividend Growth: While AT&T's dividend has been cut in the past, the company has the potential to increase its dividend in the future.

In conclusion, these top 5 US dividend stocks offer investors a mix of stability, growth potential, and consistent income. Whether you're looking to supplement your retirement income or grow your investment portfolio, these recommendations could be a great starting point. As always, it's important to conduct thorough research and consult with a financial advisor before making any investment decisions.

so cool! ()

like

- Nissan Stock US: A Comprehensive Guide to Investing in Nissan's US Market

- Toys "R" Us Stock Price Today: Current Status and Future Prospe

- Net Worth of the US Stock Market: A Comprehensive Analysis

- The Rising Percentage of US Households Owning Stock: A Comprehensive Look

- Us Large Cap Momentum Stocks August 2025: Top Picks for Investors

- Buying US Stocks When Canadian Dollar Is Low: A Strategic Move

- US All Stocks Reports: The Ultimate Guide to Stock Market Insights

- US Stock Closed: Key Takeaways and Analysis

- Teva Pharma Stock: A Comprehensive Analysis of US Market Performance

- Unlocking the Potential of US Rentals Stock: A Comprehensive Guide

- Tencent Stock Price: A Comprehensive Analysis in US Dollars

- US Reopening Stocks: A Comprehensive Guide to Investing in Post-Pandemic Recovery

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

US Dividend Stock Recommendation: Top 5 Stocks

US Dividend Stock Recommendation: Top 5 Stocks

Us Silver Corporation Stock Quote: A Comprehen

"Shop Us Stock": Your Ultima

How Can a Foreigner Buy US Stocks? A Comprehen

How Did the US Stock Market Perform in May 201

US Pork Companies Stock: Trends, Insights, and

Mak 90 US Made Stock: The Ultimate Guide to Hi

US Lithium Battery Stocks: A Comprehensive Gui

How to Buy Japan Stock in the US: A Step-by-St

How to Invest in US Stocks from Nigeria: A Ste

Tesla Stock: A NASDAQ US Investment Highlight

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- US Standard Atmosphere 1976 Stock No 003 017 0"

- Title: Swiss Central Bank's Influence on "

- Daily US Stock Closing Prices: Unveiling the D"

- Which Stock to Invest: Top 5 Picks for 2023"

- Linde US Stock: A Comprehensive Analysis and I"

- How to Make Money in Stocks: A Comprehensive G"

- Mckesson US Pharma Stocks: A Comprehensive Gui"

- June 26, 2025: US Stock Market News Roundup"

- Title: In-Depth Analysis of 3087.t: The Future"

- Maximize Your Returns: Ultimate Guide to Stock"