you position:Home > us energy stock > us energy stock

Spot Us Stock: Unveiling the Best Investment Opportunities

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

In the vast and dynamic world of investing, identifying the best stock opportunities can be a daunting task. However, with the right strategies and knowledge, you can spot the next big winner in the stock market. This article aims to guide you through the process of spotting promising stocks, focusing on the "Spot Us Stock" method. By the end, you'll be equipped with the insights to make informed investment decisions.

Understanding Spot Us Stock

Firstly, let's clarify what "Spot Us Stock" means. It's a method that involves identifying stocks with strong potential for growth and profitability. These stocks are often overlooked or undervalued by the market, making them excellent investment opportunities. The key to spotting these stocks lies in analyzing various factors, including financial health, market trends, and industry dynamics.

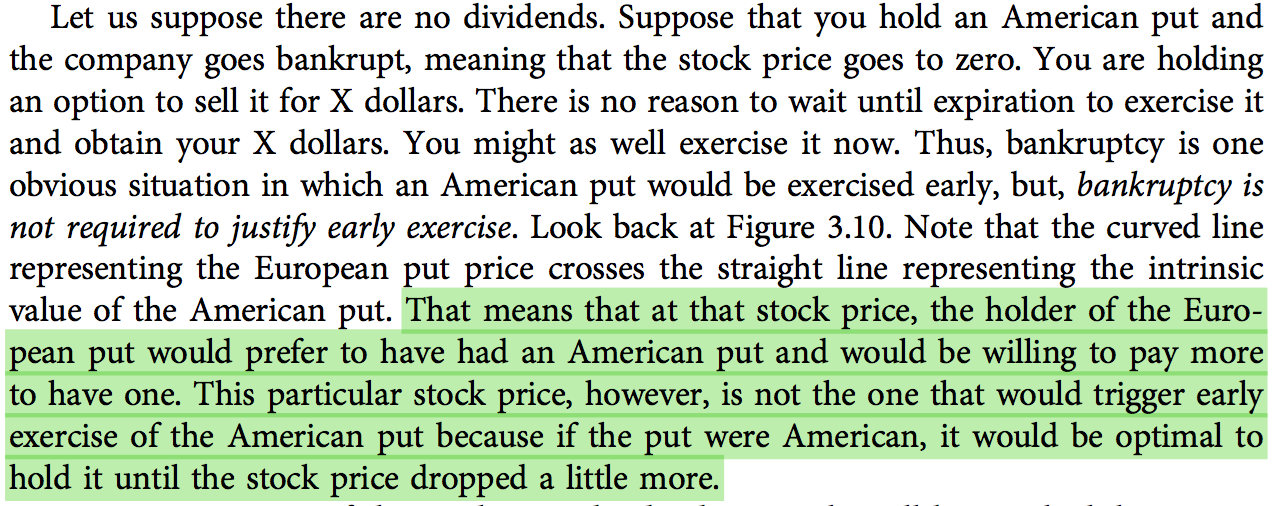

Financial Health: The Foundation of Spot Us Stock

The first step in spotting promising stocks is to assess their financial health. This involves analyzing key financial ratios and metrics, such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, debt-to-equity ratio, and return on equity (ROE). These ratios provide valuable insights into a company's profitability, financial stability, and growth potential.

Market Trends: Keeping an Eye on the Big Picture

While financial health is crucial, it's also essential to stay updated on market trends. By understanding the broader market context, you can identify sectors or industries that are poised for growth. For instance, emerging technologies, renewable energy, and healthcare are currently hot sectors with promising long-term prospects.

Industry Dynamics: The Key to Uncovering Hidden Gems

Industry dynamics play a vital role in spotting undervalued stocks. By analyzing industry trends, such as technological advancements, regulatory changes, and consumer behavior, you can identify companies that are well-positioned to capitalize on these trends. This approach helps you uncover hidden gems that may be overlooked by the market.

Case Study: Tesla Inc.

A prime example of a stock that was once undervalued but later became a market leader is Tesla Inc. In the early 2010s, Tesla was facing significant challenges, including high production costs and a limited market presence. However, the company's innovative electric vehicle technology and long-term vision for sustainability caught the attention of investors. As Tesla's market share grew and the industry recognized its potential, the stock price skyrocketed, making it one of the most valuable companies in the world.

Spot Us Stock: A Winning Strategy

By combining financial analysis, market trends, and industry dynamics, the "Spot Us Stock" method can help you identify promising investment opportunities. Here are some key takeaways:

- Analyze financial health: Assess key financial ratios and metrics to gauge a company's profitability and stability.

- Stay updated on market trends: Keep an eye on emerging sectors and industries with strong growth potential.

- Understand industry dynamics: Identify companies that are well-positioned to capitalize on industry trends.

- Be patient and disciplined: Investing requires patience and discipline, as it can take time for a stock to appreciate in value.

In conclusion, spotting promising stocks requires a combination of financial analysis, market trends, and industry insights. By applying the "Spot Us Stock" method, you can identify undervalued stocks with strong potential for growth and profitability. With the right approach, you can make informed investment decisions and achieve your financial goals.

so cool! ()

last:Netflix Earnings Beat Boosts US Stock Futures

next:nothing

like

- Netflix Earnings Beat Boosts US Stock Futures

- US Listed Stock AI Accelerator Unveils Revolutionary Platform

- OnePlus 3 Out of Stock in US: What You Need to Know

- OpenDoor US Stock: The Comprehensive Guide to Investing in This Rising Star

- MFI Stock US: A Comprehensive Guide to Understanding Microfinance Investment Oppo

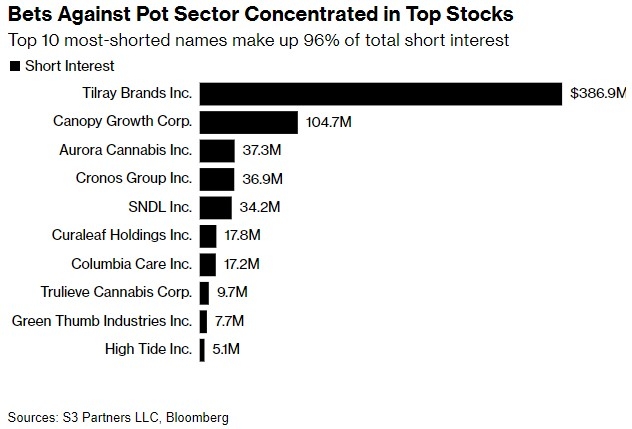

- Top US Cannabis Stocks to Watch in 2020: A Comprehensive Guide

- Airbus Stock in US Dollars: A Comprehensive Guide to Airbus's Financial Perf

- US Biotech Stocks with Upcoming Catalysts: The Next Big Moves

- Short US Stock: A Comprehensive Guide to Investing in American Equities

- Title: In-Depth Analysis of 3087.t: The Future of Stock Market Investment

- Best Chinese Stocks on US Exchanges: A Comprehensive Guide

- Stock Invest US: A Guide to the AGLI Index

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Spot Us Stock: Unveiling the Best Investment O

Spot Us Stock: Unveiling the Best Investment O

Boy Scout Rifle Stock US: The Ultimate Guide t

US Housing Stock Index: A Comprehensive Guide

Unlocking the Potential of US Financial Stocks

Stocks with Momentum This Week: US Market Insi

Best US Stock Picks: How to Identify the Next

June 26, 2025: US Stock Market News Roundup

Delek US Stock Forecast: What to Expect in the

PFE US Stock: A Comprehensive Guide to Underst

Fanuc US Stock Location: Optimizing Your Manuf

US Stock Market Apps: The Ultimate Guide to Tr

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- S&P 500: The Percent of the US Stock M"

- Best ETFs to Buy: Top Picks for Investors"

- Understanding the US Oil Prices Stock: What Yo"

- US Steel Stock Drop in 1929: The Significance "

- US Stock Forecast 2025: What to Expect and How"

- The Best Online Broker for US OTC Stocks: Unve"

- Ovv Stock Price US: Comprehensive Insights and"

- Title: "US Stock Correction: Understa"

- 2x4 With Us Flag Blowing Stock Video Loop: Cap"

- Dividend History: A Comprehensive Guide to Und"