you position:Home > us energy stock > us energy stock

Should I Sell US Stocks Now? A Comprehensive Guide

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

Are you contemplating selling your US stocks? The decision to sell can be daunting, especially in today's volatile market. In this article, we'll explore the factors you should consider before making this important financial move.

Market Conditions

The first thing to consider is the current market conditions. The stock market is influenced by various factors, including economic indicators, geopolitical events, and corporate earnings reports. Here are a few key indicators to keep an eye on:

- Interest Rates: Higher interest rates can negatively impact stocks, as they tend to increase borrowing costs for companies and reduce consumer spending.

- Inflation: High inflation can erode purchasing power and lead to lower stock prices.

- GDP Growth: Strong economic growth can boost stock prices, while slow or negative growth can have the opposite effect.

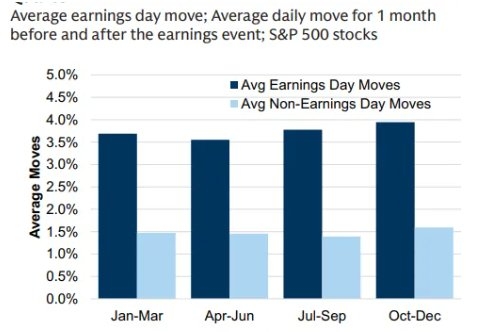

- Corporate Earnings: Positive earnings reports can drive stock prices higher, while negative reports can have the opposite effect.

Your Financial Goals

Your individual financial goals are crucial in determining whether it's the right time to sell your stocks. Ask yourself the following questions:

- Am I nearing retirement?: If you're planning to retire soon, you may want to consider selling some of your stocks to reduce your risk exposure.

- Do I need the money for a specific purpose?: If you have a specific financial goal, such as purchasing a home or paying for a child's education, selling stocks may be a good idea.

- What is my risk tolerance?: If you're risk-averse, you may want to consider selling some of your stocks to protect your portfolio.

Dividend Yields

Dividend yields can be a valuable indicator of whether it's a good time to sell your stocks. A higher dividend yield can suggest that a stock is undervalued, while a lower yield may indicate that it's overvalued.

Sector Performance

Different sectors of the economy perform differently at various times. Consider the following:

- Tech Stocks: The technology sector has been a strong performer in recent years, but it may be due for a correction.

- Energy Stocks: The energy sector can be sensitive to oil prices and geopolitical events.

- Healthcare Stocks: The healthcare sector has been a reliable performer, but it's important to stay informed about regulatory changes.

Case Study: Amazon (AMZN)

Let's look at a case study to illustrate how market conditions and individual goals can influence the decision to sell stocks. Amazon (AMZN) has been a strong performer over the years, but it's important to stay informed about its fundamentals.

In early 2020, as the COVID-19 pandemic began to spread, Amazon's stock price surged due to increased demand for online shopping. However, as the market stabilized and economic uncertainty persisted, some investors decided to sell their shares to reduce their risk exposure.

Conclusion

In conclusion, the decision to sell your US stocks should be based on a combination of market conditions, your financial goals, and your risk tolerance. By staying informed and considering these factors, you can make a more informed decision about whether it's the right time to sell your stocks.

so cool! ()

like

- Boy Scout Rifle Stock US: The Ultimate Guide to Quality and Customization&quo

- Maximizing Profits with US Seafood Stocks: A Comprehensive Guide

- Unlocking the Potential of Cooking Oil Stocks in the US"

- NVIDIA's Q3 Earnings in Focus Amid Mixed US Stocks

- Stocks to Benefit from India-US Trade Deal: Opportunities and Insights

- Target Corporation Stock on February 7, 2019: A Comprehensive Analysis

- How to Open a Stock Market Account in the US: A Step-by-Step Guide

- Mak 90 US Made Stock: The Ultimate Guide to High-Quality American Firearms

- Exploring the Canadian Stock Market: A Guide for US Investors

- Unlocking Global Investment Opportunities: A Deep Dive into the Non-US World Stoc

- Understanding the Average P/E Ratio in the US Stock Market

- Cobalt Mining Stocks: The Key to a Sustainable Future"

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Should I Sell US Stocks Now? A Comprehensive G

Should I Sell US Stocks Now? A Comprehensive G

Latitude 64 Opto Air Bolt in Stock at US Retai

US Grid Stocks: Powering the Future of Energy

PFE US Stock: A Comprehensive Guide to Underst

Title: List of Stocks in the US: Your Ultimate

US Large Cap Momentum Stocks: September 2025 T

After Market Stock US M1917: Enhancing the Cla

Penny Stocks in the Oil Sector: US-Based Oppor

Market Sentiment: US Stocks in October 2025

US Copper Stocks List: A Comprehensive Guide t

2021 US Stock Market Predictions: What to Expe

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Top ETFs: Your Guide to Diversifying Your Port"

- Historical Impact of U.S. Government Shutdowns"

- AMZN Stock Split: What It Means for Investors"

- Disney Stock Forecast: What's the Future "

- Latitude 64 Opto Air Bolt in Stock at US Retai"

- Buy Us Stock from Australia: A Smart Investmen"

- Top Steel Stocks in the US: A Comprehensive Gu"

- Top Performing US Stocks Last Week: Momentum T"

- Cobalt Mining Stocks: The Key to a Sustainable"

- US Stock Futures: Hot Stocks to Watch"