you position:Home > us energy stock > us energy stock

RSI Overbought Oversold: Analyzing US Stocks in September 2025

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the ever-evolving world of stock market analysis, understanding key indicators like the Relative Strength Index (RSI) can be a game-changer. As we approach September 2025, investors are keen on keeping a close eye on the RSI to determine whether US stocks are overbought or oversold. This article delves into the significance of RSI in predicting market trends and provides insights into how it can be used to make informed investment decisions.

Understanding RSI: A Quick Overview

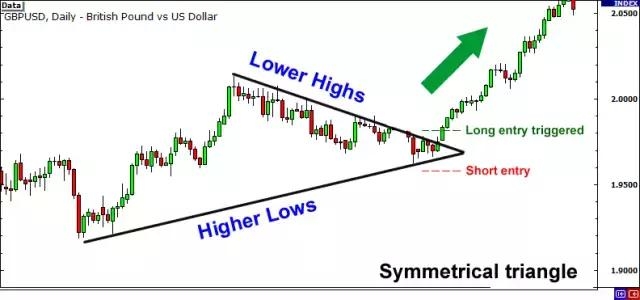

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a trading asset. An RSI above 70 is considered overbought, suggesting that the asset may be due for a pullback, while an RSI below 30 is considered oversold, indicating a potential buying opportunity.

RSI and US Stocks: A Closer Look

As we analyze US stocks in September 2025, it's crucial to consider the RSI as a valuable tool in predicting market trends. By understanding the RSI, investors can gain insights into the potential direction of the market and make informed decisions.

Overbought Conditions: What to Watch Out For

When the RSI indicates an overbought condition, it suggests that the stock has been overvalued and may be due for a pullback. This can be an excellent opportunity for investors to take profits or consider selling the stock. For example, if a popular tech stock like Apple Inc. (AAPL) has an RSI of 78, it may be overbought, indicating a potential downward trend.

Oversold Conditions: A Buying Opportunity

Conversely, when the RSI indicates an oversold condition, it suggests that the stock has been undervalued and may be due for a rebound. This can be an excellent opportunity for investors to buy the stock at a lower price. For instance, if a financial stock like JPMorgan Chase & Co. (JPM) has an RSI of 22, it may be oversold, indicating a potential upward trend.

Case Study: Amazon.com, Inc. (AMZN)

Let's take a closer look at Amazon.com, Inc. (AMZN) as an example. In September 2025, the RSI for AMZN is at 65, indicating a neutral market condition. However, if the RSI were to drop below 30, it would suggest an oversold condition, potentially signaling a buying opportunity. Conversely, if the RSI were to rise above 70, it would indicate an overbought condition, suggesting a potential pullback.

Conclusion

In conclusion, the RSI is a powerful tool for analyzing US stocks and predicting market trends. By understanding overbought and oversold conditions, investors can make informed decisions and potentially maximize their returns. As we approach September 2025, it's essential to keep a close eye on the RSI and use it as a guide in navigating the ever-changing stock market landscape.

so cool! ()

last:Hy Stock Prices Declined: A Deep Dive into US History

next:nothing

like

- Hy Stock Prices Declined: A Deep Dive into US History

- http://stocks.us.reuters.com/stocks/fulldescription.asp?rpc=66&symbol=crc

- US Stock 110V Heat Press Machine: The Ultimate Guide for Quality Printing

- US Penny Stocks to Watch in 2021: Your Guide to Investment Opportunities

- Best Performing US Large Cap Stocks: Recent Momentum and Analysis

- Stock Market in US Today: A Comprehensive Overview

- The Biggest Marijuana Stocks in the US

- US Best Performing Stocks: Top Investments to Watch in 2023

- Title: US Stock Earnings Today: Key Highlights and What They Mean

- Analysis: Hedge Fund Crowded Exit Timing for US Stocks in 2025

- The Best Online Broker for US OTC Stocks: Unveiling Your Investment Gateway

- Top US Stock Companies: A Deep Dive into the Financial Giants

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

RSI Overbought Oversold: Analyzing US Stocks i

RSI Overbought Oversold: Analyzing US Stocks i

Title: Best US Penny Stocks to Buy Right Now

Title: Levi Strauss US Stock: A Comprehensive

Live Us Stock Market Data: Your Ultimate Guide

The Best Way to Buy US Stocks in Australia

US Stocks to Buy Now: Top Picks for Investors

Impact of Exchange Rate Fluctuations on US Sto

US Medical Equipment Stocks: A Comprehensive G

5G US Army Stock: Revolutionizing Military Com

US Real Estate Stock Market: A Comprehensive G

The Costliest Stock in the US: A Deep Dive int

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Speculative Fervor in US Stocks: A Thriving Ma"

- Best Performing US Large Cap Stocks: Recent Mo"

- Penny Stocks to Buy: Your Ultimate Guide to Lo"

- Kirkland Lake Gold Stock Price: A Comprehensiv"

- LCID Stock: A Comprehensive Guide to Understan"

- Market Outlook: Navigating the Future of Busin"

- Best Growth Stocks: How to Identify and Invest"

- Best ETFs to Buy Now: Your Ultimate Guide to D"

- Indian Banks Listed in US Stock Exchange: A Co"

- Cheap AI Stocks: Smart Investments for Savvy I"