you position:Home > us energy stock > us energy stock

Innovative Strategies for Enhancing Your US Stock Index Portfolio

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In today's dynamic financial landscape, investors are constantly seeking innovative strategies to enhance their stock index portfolios. A well-diversified portfolio can offer significant returns, but it's crucial to stay ahead of the curve and implement cutting-edge strategies. This article delves into some innovative approaches to maximize the potential of your US stock index portfolio.

Understanding the US Stock Index

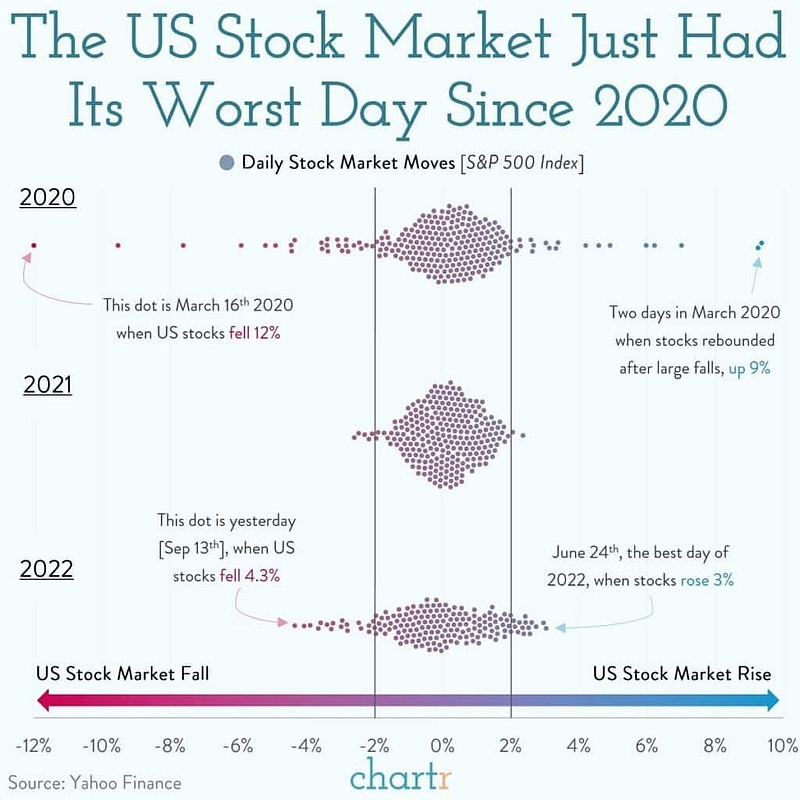

Before delving into strategies, it's essential to have a clear understanding of the US stock index. The S&P 500, for instance, is a widely followed index that tracks the performance of 500 large companies listed on U.S. exchanges. It serves as a benchmark for the broader market and is often used as a proxy for the U.S. economy.

1. Diversification through Sector Rotation

One innovative strategy is to diversify your portfolio through sector rotation. This involves identifying sectors that are poised to outperform the market and allocating your investments accordingly. By analyzing various economic indicators and market trends, you can identify sectors that are likely to benefit from changing economic conditions.

For example, during periods of economic growth, technology and consumer discretionary sectors often perform well. Conversely, during periods of economic uncertainty, defensive sectors like healthcare and consumer staples may offer more stability.

2. Utilizing Derivatives for Hedging

Another innovative strategy is to use derivatives for hedging purposes. Derivatives, such as options and futures, can be used to protect your portfolio against market downturns. By purchasing put options, you can limit your potential losses if the market takes a downturn.

For instance, if you expect the market to decline in the near future, you can purchase put options on the S&P 500 index. This will allow you to profit from the decline in the index's value, thereby protecting your portfolio.

3. Incorporating Alternative Investments

Incorporating alternative investments into your US stock index portfolio can also be an innovative approach. Alternative investments, such as real estate, commodities, and private equity, can offer diversification and potentially enhance returns.

For example, investing in real estate investment trusts (REITs) can provide exposure to the real estate market without the need for direct property ownership. Similarly, investing in commodities can offer a hedge against inflation and market volatility.

4. Leveraging Technology and Data Analytics

Leveraging technology and data analytics can also be an innovative way to enhance your US stock index portfolio. Advanced analytics and machine learning algorithms can help identify patterns and trends in market data, enabling you to make more informed investment decisions.

For instance, a machine learning model can analyze historical market data and identify sectors or individual stocks that have outperformed in similar market conditions. This can help you allocate your investments more effectively.

Case Study: Sector Rotation

Let's consider a hypothetical case where an investor decides to implement sector rotation in their US stock index portfolio. By analyzing economic indicators and market trends, the investor identifies that the technology and healthcare sectors are poised to outperform the market.

The investor allocates a significant portion of their portfolio to these sectors, resulting in substantial returns. This demonstrates the potential of sector rotation as an innovative strategy for enhancing portfolio performance.

In conclusion, enhancing your US stock index portfolio requires innovative strategies and a proactive approach. By diversifying through sector rotation, utilizing derivatives for hedging, incorporating alternative investments, and leveraging technology and data analytics, you can maximize the potential of your portfolio. Remember, staying informed and adapting to market trends is key to achieving long-term success in the stock market.

so cool! ()

last:AAPL Stock US: A Deep Dive into Apple's Financial Powerhouse

next:nothing

like

- AAPL Stock US: A Deep Dive into Apple's Financial Powerhouse

- US Congress Stock Holdings: What You Need to Know

- Kraken US Stocks: A Comprehensive Guide to Trading and Investing

- Understanding US Foods Stock Options: A Comprehensive Guide

- Southern Lithium Stock Symbol: A Comprehensive Guide

- US Fabric Stock: Your Ultimate Guide to the Best Fabric Options

- Dow Jones US Completion Total Stock Market ETF: A Comprehensive Guide

- Title: The Number of Stocks Listed on US Exchanges: A Comprehensive Overview

- Title: Time to Sell Ex-US Stocks: Understanding the Timing and Strategy

- Indian Banks Listed in US Stock Exchange: A Comprehensive Overview

- Linde US Stock Symbol: A Comprehensive Guide to Understanding the Linde Corporati

- US Large Cap Momentum Stocks: September 2025 Top Performers

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Innovative Strategies for Enhancing Your US St

Innovative Strategies for Enhancing Your US St

http stocks.us.reuters.com stocks fulldescript

GlobalWafers Stock US: A Comprehensive Analysi

Title: "http stocks.us.reuters.com st

Analyst Upgrades US Stocks: Recent News and Im

All Stock Symbols for US and Canada: A Compreh

Title: US Momentum Stocks 5-Day Performance: J

US Industrials Stocks: A Comprehensive Guide t

Nintendo Switch Back in Stock in US: The Ultim

Title: Stock X Contact Us: Your Gateway to Exc

Canadian ETFs Traded on US Stock Exchanges: A

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Bank Stocks: A Guide to Investing in the Finan"

- Semiconductor Stocks: A Comprehensive Guide to"

- Dividend History: A Comprehensive Guide to Und"

- US Pharma Stocks: A Comprehensive Guide to Inv"

- Questrade Buy US Stock: A Comprehensive Guide "

- http://stocks.us.reuters.com/stocks/fulldescri"

- Impact of Exchange Rate Fluctuations on US Sto"

- Space Stocks: The Future of Investing in Space"

- Good US Stocks to Buy Now for Long-Term Invest"

- Best Performing Stocks: How to Identify and In"