you position:Home > us energy stock > us energy stock

Growth Rate of US Stocks: A Comprehensive Analysis

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the ever-evolving landscape of the financial world, the growth rate of US stocks has been a topic of significant interest for investors and market analysts alike. This article delves into the factors influencing the growth rate of US stocks, providing insights into the current trends and future projections. By understanding these dynamics, investors can make informed decisions to maximize their returns.

Historical Performance

The historical performance of US stocks has been nothing short of impressive. Over the past few decades, the S&P 500, a widely followed index of large-cap stocks, has delivered an average annual return of around 10%. This growth has been driven by various factors, including economic growth, technological advancements, and favorable regulatory environments.

Factors Influencing Growth Rate

Economic Growth: A robust economy is often a precursor to strong stock market performance. When the economy is growing, companies tend to generate higher revenues and profits, leading to increased stock prices. Factors such as GDP growth, low unemployment rates, and strong consumer spending can contribute to economic growth and, subsequently, to the growth rate of US stocks.

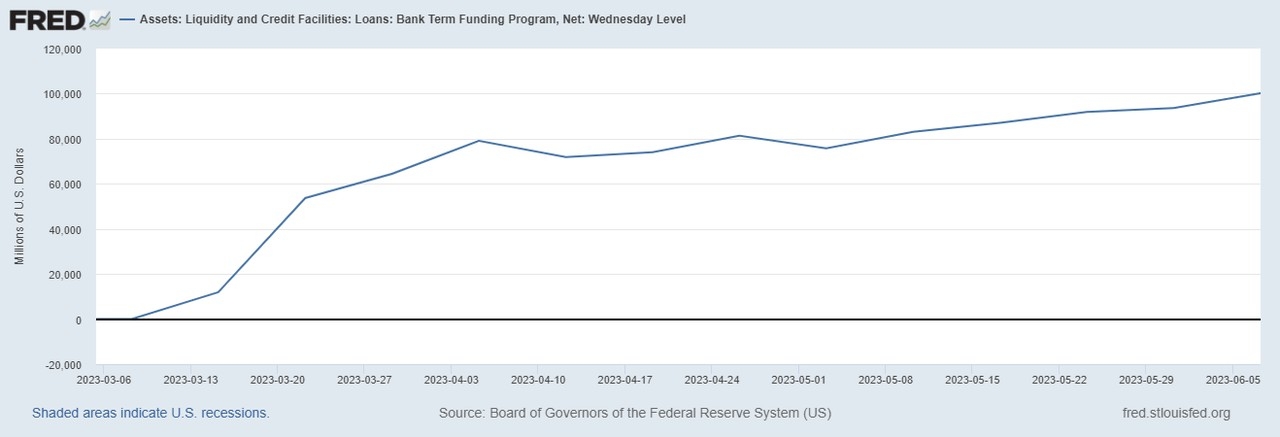

Interest Rates: The Federal Reserve's monetary policy, particularly the manipulation of interest rates, has a significant impact on the stock market. Lower interest rates tend to stimulate economic activity and encourage investors to seek higher returns in the stock market, leading to increased stock prices.

Inflation: Inflation can erode purchasing power and negatively impact stock prices. However, moderate inflation can be beneficial for stocks, as it can lead to higher corporate profits. Conversely, high inflation can be detrimental to the stock market, as it can lead to increased borrowing costs and reduced consumer spending.

Technological Advancements: The rapid pace of technological advancements has been a major driver of stock market growth. Companies that are at the forefront of innovation tend to outperform their peers, leading to increased stock prices.

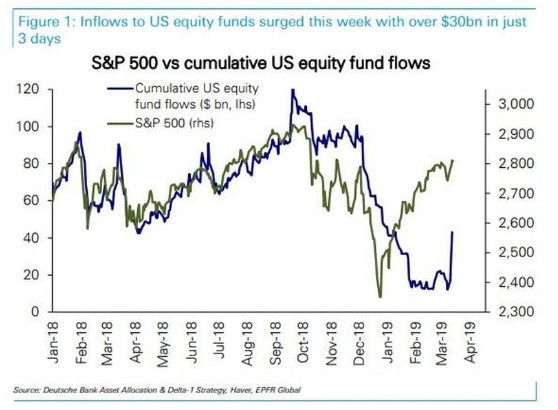

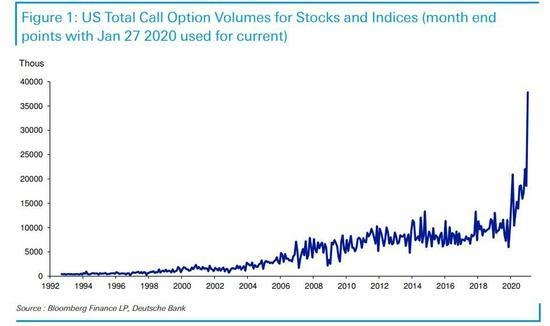

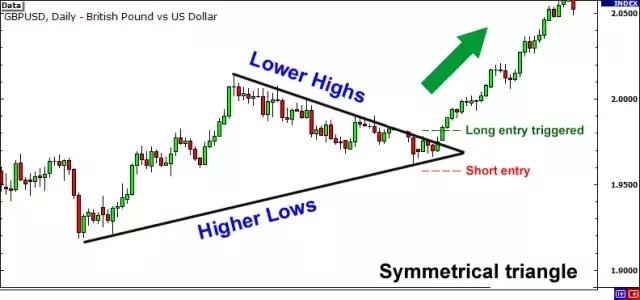

Market Sentiment: Investor sentiment can play a crucial role in the growth rate of US stocks. During periods of optimism, investors are more willing to take on risk, leading to increased stock prices. Conversely, during periods of pessimism, investors may be more cautious, leading to decreased stock prices.

Current Trends

As of 2023, the US stock market has been experiencing a period of strong growth. Factors such as robust economic growth, low unemployment rates, and favorable monetary policy have contributed to this growth. Additionally, the rise of technology stocks, particularly in the tech sector, has played a significant role in driving the growth rate of US stocks.

Future Projections

While the future is always uncertain, several factors suggest that the growth rate of US stocks is likely to remain strong in the coming years. Economic growth, technological advancements, and favorable market conditions are expected to continue driving stock market performance.

Case Studies

To illustrate the impact of various factors on the growth rate of US stocks, let's consider a few case studies:

Apple Inc.: Over the past decade, Apple Inc. has been a prime example of how technological advancements can drive stock market growth. The company's continuous innovation and expansion into new markets have led to significant revenue growth and, subsequently, increased stock prices.

Amazon.com Inc.: Amazon's growth has been fueled by its ability to adapt to changing consumer preferences and technological advancements. The company's expansion into various sectors, such as cloud computing and streaming services, has contributed to its impressive stock market performance.

In conclusion, the growth rate of US stocks is influenced by a variety of factors, including economic growth, interest rates, inflation, technological advancements, and market sentiment. By understanding these dynamics, investors can make informed decisions to maximize their returns. As the US economy continues to grow and technological advancements accelerate, the future of US stocks looks promising.

so cool! ()

last:Stock Speculation Definition and Its Impact on US History

next:nothing

like

- Stock Speculation Definition and Its Impact on US History

- Highest Price Stocks in US: Unveiling the Market's Titans

- Unlocking Potential: The Rise of Oil Refinery Stocks in the US"

- Maximize Your Retirement Savings with Canadian RRSPs and US Stocks"

- History of the US Stock Market Chart: A Comprehensive Look

- Title: "Tough Stance Heightens Us Stocks: How Resolute Actions Boost the

- Lyg Stock US Price vs UK Price: A Comprehensive Comparison"

- Momentum Stocks: Best Performers Past Week in the US Market

- Unlocking the Potential of US Housing Sector Stocks

- The Evolution of Japanese Stock Companies in U.S. History: A Journey of Integrati

- Cheap Stocks in the US: Top Picks for Investors on a Budget

- HSBC Stock US: A Comprehensive Guide to Understanding the HSBC Share Price in the

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Growth Rate of US Stocks: A Comprehensive Anal

Growth Rate of US Stocks: A Comprehensive Anal

Glaxosmithkline Stock Price US: A Comprehensiv

US Solar Stock Index: A Comprehensive Guide to

Should I Sell US Stocks Now? A Comprehensive G

Us Silver Corporation Stock Quote: A Comprehen

Current Market Capitalization of the US Stock

How to Buy US Stocks from Singapore: A Step-by

Impact of US Tariffs on Global Stock Markets

June 25, 2025 US Stock Market Summary: Key Dev

50/50 Allocation: The Smart Strategy for Diver

Soros Continues Betting Against US Stock: What

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- Momentum Stocks: Top Performers in the US Larg"

- Investors are Shifting Money from US Stocks to"

- Unlocking the Potential of Quantitative Tradin"

- NVDA Price Target: What You Need to Know"

- Adaro Energy US Stock Price: A Comprehensive A"

- How to Buy Australian Stocks from the US"

- US Graphene Companies Stock: A Comprehensive O"

- Total US Stocks Surpass 20,000: A Deep Dive in"

- Title: Levi Strauss US Stock: A Comprehensive "

- US Stock Futures: Hot Stocks to Watch"