you position:Home > us energy stock > us energy stock

Disney Stock Price in US Dollars: A Comprehensive Analysis

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

In the dynamic world of investing, keeping a close eye on stock prices is crucial for informed decision-making. For investors who are keen on entertainment and media, Disney stock price in US dollars is a significant metric to monitor. This article delves into the current status, historical trends, and future prospects of Disney's stock price, offering valuable insights for potential investors.

Current Status of Disney Stock Price

As of the latest available data, the Disney stock price in US dollars stands at approximately $104.56. This figure reflects the stock's performance over the past few months and provides a snapshot of its current value in the market.

Historical Trends of Disney Stock Price

Looking back at the historical data, the Disney stock price in US dollars has seen both ups and downs over the years. The stock experienced a surge in the early 2000s, reaching a high of around $75.00 in 2004. However, it faced several challenges, including the economic downturn and the company's restructuring efforts, which led to a decline in stock price.

In recent years, Disney has managed to recover and stabilize its stock price, with a steady increase in its value. The company's strong financial performance, including revenue growth and expansion into new markets, has contributed to the positive trend.

Factors Influencing Disney Stock Price

Several factors influence the Disney stock price in US dollars, and it's important for investors to understand these factors to make informed decisions. Some of the key factors include:

- Economic Conditions: The overall economic climate, including GDP growth, inflation rates, and interest rates, can significantly impact the stock price of Disney and other entertainment companies.

- Revenue Growth: Disney's revenue growth is a crucial indicator of its financial health. Increased revenue from its parks, movies, streaming services, and merchandise can drive the stock price higher.

- Market Trends: The broader market trends, such as market sentiment and investor expectations, can also affect the stock price.

Future Prospects of Disney Stock Price

Looking ahead, the future prospects of the Disney stock price in US dollars appear promising. Disney continues to invest in its streaming services, expanding its content library and subscriber base. The company's strong brand recognition and diverse portfolio of products and services position it well for continued growth.

In addition, Disney's acquisition of 20th Century Fox has provided it with access to a wealth of content, further enhancing its competitive advantage. With the ongoing growth of the entertainment industry and the increasing popularity of streaming services, Disney is well-positioned to capitalize on these trends and potentially increase its stock price.

Case Studies: Disney Stock Price Performance

To illustrate the impact of various factors on Disney's stock price, let's consider a few case studies:

- Economic Downturn: During the 2008 financial crisis, Disney's stock price experienced a significant decline. This decline can be attributed to the broader economic conditions and the subsequent decrease in consumer spending.

- Successful Acquisition: The acquisition of Marvel Entertainment in 2009 significantly boosted Disney's stock price, reflecting the company's commitment to diversifying its content and expanding its market presence.

- Streaming Service Growth: The launch of Disney+ in 2020 led to a surge in subscriber numbers and a corresponding increase in Disney's stock price.

Conclusion

Understanding the Disney stock price in US dollars is essential for investors interested in the entertainment and media sector. By analyzing historical trends, current market conditions, and future prospects, investors can make informed decisions and potentially capitalize on the company's growth potential. As always, it's crucial to conduct thorough research and consider individual risk tolerance before making any investment decisions.

so cool! ()

like

- Babies R Us Stock Crew Salary: Understanding the Wages at the Retail Giant

- Understanding the Fluctuations of US Ecology Stock Price

- US High Yield Bond Fund Stocks 2019: Top Performers and Investment Insights

- Stock Broker US Trust: Your Ultimate Guide to Financial Confidence

- Best Drone Stocks in the US: Your Ultimate Guide to Investing in the Sky

- Superior 100 US Plastic Card Stock: The Ultimate Guide

- Argosy Minerals Ltd: Your Ultimate Guide to US Stock Symbol

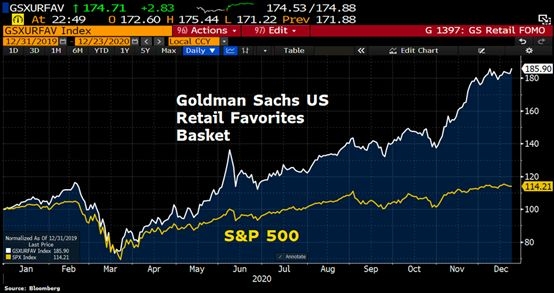

- "Retail Investors US Stocks Influx: The Latest Trend in the Market&q

- Maximizing Returns with US Glass Company Stocks

- US Car Companies Stock: A Comprehensive Analysis

- Best US Stock to Buy in 2020: A Smart Investment Strategy

- Muscle-depot.ws - Unveiling the US Stock Market's Hidden Gem

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Disney Stock Price in US Dollars: A Comprehens

Disney Stock Price in US Dollars: A Comprehens

Will the S Stay Strong? A Comprehensive Look a

List of Marijuana Stock in US: Your Ultimate G

High Momentum US Stocks: A Short-Term Investme

Dow, S&P, and Nasdaq Futures: A Compre

Top Sexy Stockings Available in the US Market&

Is It a Qualified Dividend If It's a US S

March 2020 IPO US Stock Market List: Top Compa

Bytedance Stock US: A Comprehensive Analysis

US Banc Stock Historical P/E: A Comprehensive

Stock Price for US Robotics: Insights and Anal

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Can US Military Personnel Invest in Chinese St"

- US Steel Marathon Stock Split: What It Means f"

- Is Apple a US Stock? A Comprehensive Guide to "

- How to Buy Novonix Stock in the US: A Step-by-"

- US Stock Heatpress: The Ultimate Guide to Choo"

- Stock Market Time: Understanding the U.S. Fina"

- Blue Chip Stocks: A Solid Investment in the US"

- TLS Stock US: The Ultimate Guide to Investing "

- Title: US All Stock: Unveiling the Ultimate In"

- Title: "US Stock Correction: Understa"