you position:Home > us energy stock > us energy stock

AWS Stock Price: A Comprehensive Analysis

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

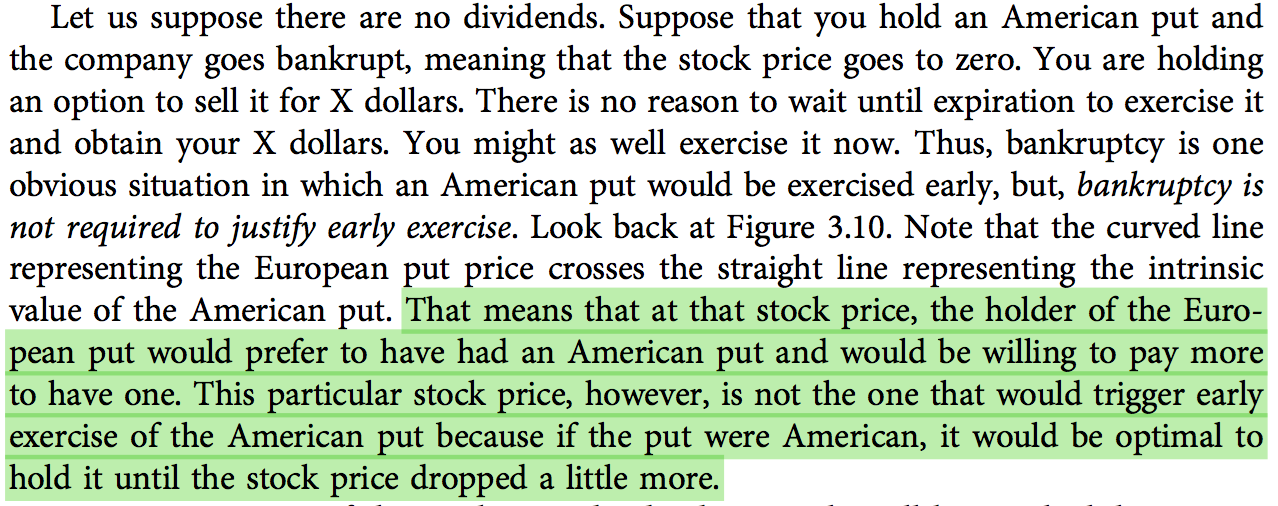

In the rapidly evolving tech industry, Amazon Web Services (AWS) has emerged as a dominant player, and investors have taken notice. The stock price of AWS, a subsidiary of Amazon.com, Inc., has been a subject of keen interest for market analysts and investors alike. This article delves into the factors influencing the AWS stock price, its historical performance, and what it could mean for the future.

Historical Performance

The AWS stock price has shown significant growth over the years. Since its inception, AWS has been a key driver of Amazon's revenue, contributing to a substantial portion of the company's overall earnings. As a result, the stock has appreciated accordingly.

In 2015, AWS reported a revenue of

Factors Influencing the AWS Stock Price

Several factors have contributed to the AWS stock price's upward trajectory:

Rapid Growth in Cloud Computing: The adoption of cloud computing has been on the rise, with businesses increasingly shifting their operations to the cloud. AWS, being a leader in the cloud computing industry, has benefited from this trend.

Innovation and Expansion: AWS has been continuously innovating and expanding its services. From adding new features to acquiring other companies, AWS has shown its commitment to staying ahead of the competition.

Strong Financial Performance: AWS has consistently reported strong financial results, with revenue growth and profitability contributing to the stock's appeal.

Market Leader Position: AWS's market leader position in the cloud computing industry has given it a competitive edge, making it a preferred choice for businesses looking to migrate to the cloud.

Case Studies

Several case studies highlight the impact of AWS on businesses:

Netflix: Netflix, a leading streaming service, has leveraged AWS to scale its operations globally. AWS has enabled Netflix to handle massive amounts of data and deliver content to millions of users worldwide.

Spotify: Spotify, the popular music streaming platform, has also used AWS to power its operations. AWS has helped Spotify scale its infrastructure and improve the user experience.

Adobe: Adobe has shifted its Creative Cloud services to AWS, enabling the company to offer its products as a subscription-based service. AWS has played a crucial role in Adobe's transition to the cloud.

Conclusion

The AWS stock price has been a testament to the company's success and its leadership in the cloud computing industry. As cloud computing continues to grow, the AWS stock price is expected to remain strong. Investors looking to capitalize on this trend should keep a close eye on AWS's performance and the broader cloud computing industry.

Key Takeaways

- AWS has been a key driver of Amazon's revenue and has contributed to the company's stock price growth.

- Factors such as rapid growth in cloud computing, innovation, and strong financial performance have influenced the AWS stock price.

- AWS's market leader position and case studies like Netflix, Spotify, and Adobe showcase its impact on businesses.

- The AWS stock price is expected to remain strong as cloud computing continues to grow.

so cool! ()

last:Understanding the US Bevkre Stock Market: A Comprehensive Overview

next:nothing

like

- Understanding the US Bevkre Stock Market: A Comprehensive Overview

- Understanding Non-US Resident Stock Tax: Everything You Need to Know

- Understanding Capital Stock in the US: A Comprehensive Guide

- Thndr Us Stocks Reddit: The Ultimate Guide to Stock Trading on the Platform

- Maximizing Returns: A Deep Dive into the Potential of McCollum Corporation Stocks

- Intercept Pharmaceuticals: A Rising Star in US Pharma Stocks

- Understanding the Stock of Portfolio Investments in the US Owned by Foreigners

- List of US Solar Stocks: Top Picks for Renewable Energy Investors"

- Trading US Penny Stocks from UK: A Comprehensive Guide

- US A2 MP5 Stock: The Ultimate Guide to Choosing the Best"

- How Did the US Stock Market Perform in May 2019?

- Us Bancorp Del Stock: A Comprehensive Guide to Understanding the Investment

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

AWS Stock Price: A Comprehensive Analysis

AWS Stock Price: A Comprehensive Analysis

Stock Market News October 19, 2025: US Markets

Emerging Markets and Global Growth vs. US Stoc

The Costliest Stock in the US: A Deep Dive int

Can Vietnamese Investors Dive into US Stock Ma

Is the Stock Market Open Tomorrow in the US? K

Canadian Day Trading US Stocks: A Comprehensiv

Title: "Good US Stocks to Buy in 2019

Swedish Companies on the US Stock Exchange: Op

Indivior Stock in US Dollars: A Comprehensive

US Growth Stocks to Watch in 2021: A Guide to

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- 3 Major US Stock Indexes Record Highs: What It"

- Title: "Socially Responsible Investin"

- US Banks Stock List: A Comprehensive Guide to "

- 3 Categories of Companies in the US Stock Mark"

- Options Strategies: Mastering the Art of Tradi"

- Operational Non-US Stock Index Fund: A Strateg"

- US Copper Stocks List: A Comprehensive Guide t"

- Best US Stock Broker in Australia: Your Ultima"

- US Momentum Stocks 5-Day Performance Analysis:"

- Title: Natural Gas Companies Stock Us: The Gro"