you position:Home > us energy stock > us energy stock

2020 US Stock Market Outlook: Navigating the Unpredictable

![]() myandytime2026-01-26【us stock market today live cha】view

myandytime2026-01-26【us stock market today live cha】view

info:

As we step into the new year, investors are eager to understand the 2020 US stock market outlook. The year 2020 is poised to bring both opportunities and challenges, and it's crucial to have a clear understanding of the market trends and potential risks. In this article, we'll delve into the key factors that could influence the US stock market in 2020, including economic indicators, geopolitical events, and technological advancements.

Economic Indicators to Watch

One of the primary factors that will shape the 2020 US stock market outlook is the state of the economy. The Federal Reserve's monetary policy, unemployment rates, and inflation are all critical indicators to monitor.

The Federal Reserve's monetary policy: The Fed's decision to lower interest rates in 2019 has been a significant factor in boosting investor confidence. However, the possibility of further rate cuts or hikes in 2020 remains uncertain. A rate cut could stimulate economic growth and boost stock prices, while a hike could have the opposite effect.

Unemployment rates: Low unemployment rates are generally a positive sign for the stock market, as they indicate a strong labor market. If unemployment rates continue to decline in 2020, it could suggest a robust economic environment and potentially higher stock prices.

Inflation: Moderate inflation is typically seen as a sign of a healthy economy. However, if inflation starts to rise too quickly, it could lead to higher interest rates and potentially hurt stock market performance.

Geopolitical Events

Geopolitical events can have a significant impact on the US stock market. In 2020, several key events could influence market sentiment.

Trade tensions: The ongoing trade tensions between the US and China could escalate or de-escalate in 2020. A resolution to these tensions could boost investor confidence and lead to higher stock prices, while further escalation could have the opposite effect.

Political events: The 2020 US presidential election could also play a role in the stock market. While it's difficult to predict the outcome, political uncertainty can lead to market volatility.

Technological Advancements

Technological advancements continue to drive innovation and growth in the stock market. In 2020, several key trends to watch include:

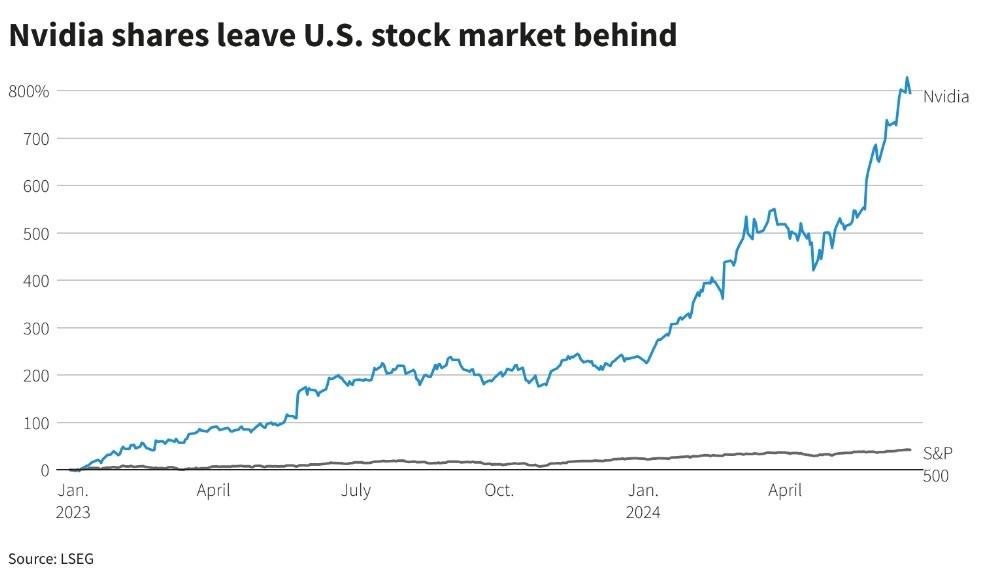

Artificial intelligence (AI): AI is expected to play a significant role in various industries, from healthcare to finance. Companies at the forefront of AI development could see significant growth in 2020.

Blockchain technology: Blockchain technology is gaining traction in various sectors, including finance, healthcare, and logistics. Companies investing in blockchain could see a boost in their stock prices.

Sector Outlook

Several sectors are expected to perform well in 2020, while others may face challenges.

Technology and healthcare: These sectors are often seen as defensive plays, as they tend to perform well during economic downturns. Companies in these sectors could see increased investor interest in 2020.

Energy: The energy sector has faced challenges in recent years, but with the rise of renewable energy sources, there may be opportunities for growth in 2020.

Conclusion

The 2020 US stock market outlook is uncertain, with a mix of economic, geopolitical, and technological factors at play. By keeping a close eye on these key indicators and sectors, investors can navigate the unpredictable market and potentially find opportunities for growth. As always, it's important to do thorough research and consider your own risk tolerance before making investment decisions.

so cool! ()

last:DGazf: Unveiling the Potential of US Stocks

next:nothing

like

- DGazf: Unveiling the Potential of US Stocks

- AK-74 US Stock Set: The Ultimate Guide to Customizing Your Rifle

- 2015 US Stock Market Holiday Calendar: A Comprehensive Guide

- How Many People in the US Invest in the Stock Market?

- US Minerals Stock: The Ultimate Guide to Investing in America's Precious Res

- Buy Airbus Stock in the US: A Smart Investment for Your Portfolio

- Israel War: How It Impacts the US Stock Market

- Top Performing US Large Cap Stocks Last Week: Momentum that Shines Bright

- "Paw Patrol Stocking Toys R Us: The Ultimate Christmas Gift Guide for Ki

- Is There a New Stock Market Opening in the US?

- US Smokeless Tobacco Company Stock: A Comprehensive Analysis

- Top Cybersecurity Stocks as Recommended by US News: Your Ultimate Investment Guid

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

2020 US Stock Market Outlook: Navigating the U

2020 US Stock Market Outlook: Navigating the U

Did Us Tax Stocks? Understanding the Impact of

Unlocking the Potential of US Financial Stocks

Investing in US Stocks from Australia: A Compr

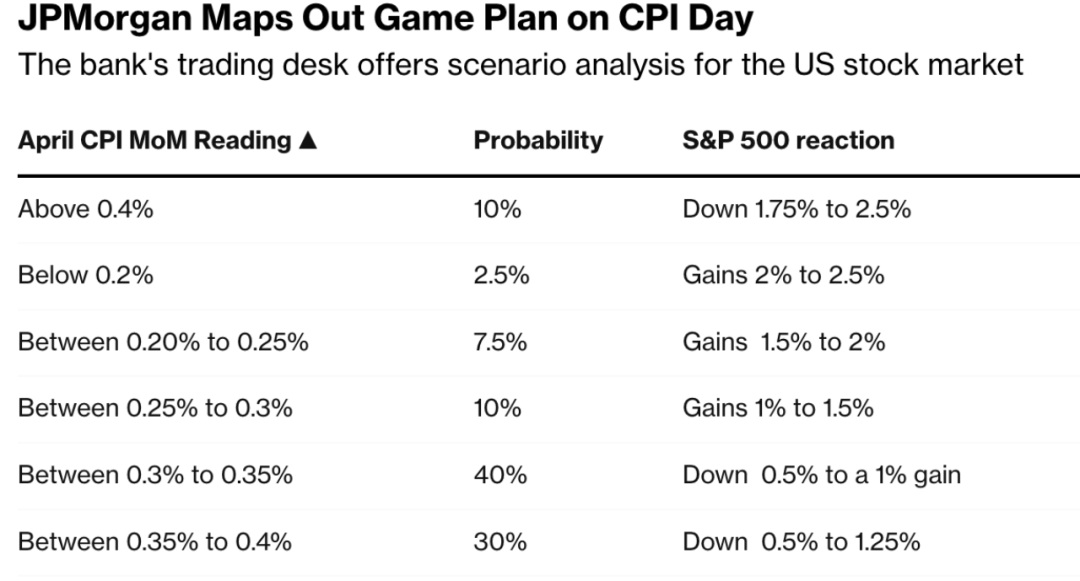

US Stock Futures Mixed Ahead of Inflation Data

Symbols for Major Stock Market Index in the US

AXA Stock Price US: A Comprehensive Analysis

5130 US Highway 1: A Gateway to the Enchanting

Total US Stock Market Capitalization in 2025:

Unveiling the Potential of US Rare Earth Miner

Stock Significance in U.S. History: A Deep Div

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stock us stocks games silver etf

like

- Indivior Stock in US Dollars: A Comprehensive "

- US Penny Stocks to Watch in 2021: Your Guide t"

- S&P 500 Index History: Decades of Mark"

- Us Most Expensive Stock Top 10: A Look at the "

- US Listed Rare Earth Stocks: A Comprehensive G"

- Understanding Put Options: A Comprehensive Gui"

- Stock Crash in the US: What You Need to Know&a"

- Reclaimed Wood Bulk Purchase: Northeastern US "

- Ticker NASDAQ: A Comprehensive Guide to Unders"

- Title: "Clinton Campaign's Misst"