you position:Home > us energy stock > us energy stock

2018 US Stock Market Predictions: A Comprehensive Outlook

![]() myandytime2026-01-27【us stock market today live cha】view

myandytime2026-01-27【us stock market today live cha】view

info:

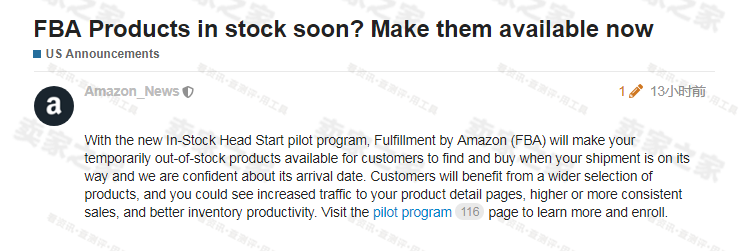

The 2018 US stock market predictions have been a hot topic among investors and financial analysts. With the end of 2017 in sight, many are eager to know what the upcoming year has in store for the market. This article delves into the various predictions made by experts, analyzing the potential trends and risks that could shape the US stock market in 2018.

Economic Growth and Corporate Earnings

One of the key factors influencing the US stock market in 2018 is the expected economic growth. The US economy has been showing signs of improvement, with low unemployment rates and strong consumer spending. This positive economic backdrop is expected to boost corporate earnings, leading to higher stock prices.

Interest Rates and Inflation

The Federal Reserve has been gradually raising interest rates in recent years, and this trend is likely to continue in 2018. While higher interest rates can have a negative impact on stock prices in the short term, they also indicate a strong economy. Additionally, the possibility of higher inflation could lead to increased corporate costs, which might be reflected in lower earnings.

Sector Outlook

Several sectors are expected to perform well in 2018, driven by factors such as technological advancements, regulatory changes, and economic growth. Here are some key sectors to watch:

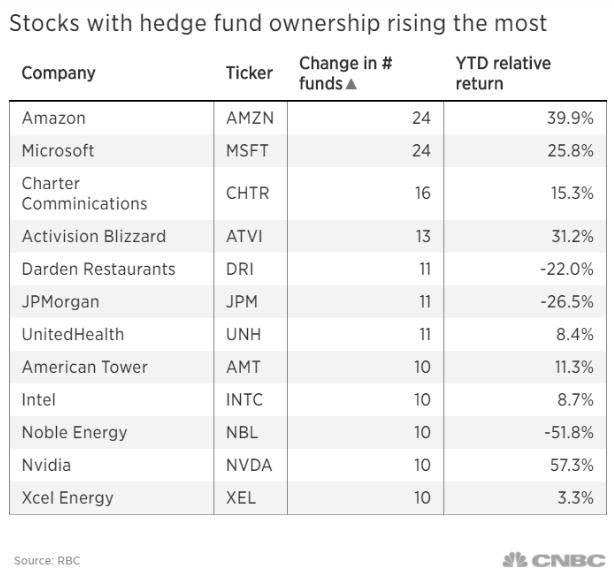

- Technology: The technology sector remains one of the most powerful drivers of the US stock market. With companies like Apple, Google, and Microsoft leading the charge, this sector is likely to continue its upward trend in 2018.

- Healthcare: The healthcare sector is expected to benefit from the aging population and advancements in medical technology. Companies involved in biotechnology, pharmaceuticals, and medical devices are likely to see strong growth.

- Financials: The financial sector is expected to benefit from the ongoing recovery in the real estate market and higher interest rates. Banks and insurance companies could see improved earnings and stock prices.

Market Risks

Despite the positive outlook, there are several risks that could impact the US stock market in 2018. These include:

- Political Uncertainty: The upcoming midterm elections in the US could lead to increased political uncertainty, which might impact investor sentiment.

- Global Economic Risks: Economic downturns in other countries, such as China and Europe, could have a negative impact on the US stock market.

- Market Volatility: The stock market has experienced periods of volatility in recent years, and this could continue in 2018.

Conclusion

The 2018 US stock market predictions offer a mixed outlook, with opportunities and risks present. While economic growth and sector-specific trends could drive stock prices higher, market volatility and political uncertainty remain potential obstacles. Investors should stay informed and consider their risk tolerance when making investment decisions in the coming year.

so cool! ()

last:Navigating the Stock Market: Online Stock Brokers for Non-US Citizens

next:nothing

like

- Navigating the Stock Market: Online Stock Brokers for Non-US Citizens

- Us Stock Market After Hours Time: A Comprehensive Guide

- Maximizing Returns with Para Us Stock: A Comprehensive Guide

- Average US Stock Market Return: Long-Term Trends and Insights

- How to Buy Aurora Stock in the US: A Step-by-Step Guide

- Stock Market US Hours: What You Need to Know for Trading Success

- Stock Market Capitalization in the US: Size, Growth, and Trends

- How to Buy US Stocks from Singapore: A Comprehensive Guide

- How to Buy Reliance Industries Stock in the US: A Step-by-Step Guide

- Tencent Stock US Listing: A Comprehensive Guide to Investing in Tencent's Am

- Top US Phone Maker Stock Companies to Watch in 2023

- Best US Stock Market Index Fund: Your Ultimate Guide to Investment Success

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

2018 US Stock Market Predictions: A Comprehens

2018 US Stock Market Predictions: A Comprehens

Dogecoin US Stock: The Emerging Crypto Investm

Best Performing US Stocks Past Week: Momentum

Equinix US Real Estate Stocks: A Strategic Inv

How Much Money Has the US Stock Market Lost? A

Thndr Us Stocks Reddit: The Ultimate Guide to

US Steel Stock Quote RSS: Real-Time Updates fo

US Steel Stock News Today: Key Updates and Ana

Unlocking the Potential of TDW US Stock: A Com

Galaxy S3 Stock ROM for US Cellular: A Compreh

Countable.US Bump Stocks: The Ultimate Guide t

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Aphria Stock: What You Need to Know About the "

- Unlocking the Potential of ALM Stock: A Compre"

- US Solar Stock Performance in May 2025: A Comp"

- Can Chinese Invest in US Stocks? A Comprehensi"

- Bull Market: Understanding the Thriving Econom"

- The Most Expensive Stock in the US Market: A D"

- Title: US Middle Market Stocks: A Golden Oppor"

- Pharmaceutical US Stocks to Buy: Top Picks for"

- Emblem Corp Stock US: The Ultimate Guide to In"

- Pork Stocks US: The Power of Pork in the Stock"