you position:Home > us energy stock > us energy stock

11 US Stock Market Sectors: A Comprehensive Guide

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

In the vast landscape of the US stock market, understanding the different sectors is crucial for investors looking to diversify their portfolios. Each sector represents a distinct area of the economy, offering unique opportunities and risks. Let's delve into the 11 primary sectors that dominate the US stock market.

1. Communication Services

The Communication Services sector encompasses companies involved in the transmission of information, including telecommunications, internet services, and entertainment. Key players like AT&T, Verizon, and Netflix are part of this sector. It's a sector that's often driven by technological advancements and consumer demand for digital content.

2. Consumer Discretionary

This sector includes companies that produce goods and services that are not considered necessities. It includes industries like retail, automotive, and leisure. Companies like Amazon, Disney, and Ford are prominent in this sector. The Consumer Discretionary sector can be volatile, as it's sensitive to economic cycles and consumer spending habits.

3. Consumer Staples

Consumer Staples companies produce goods and services that are considered essential for daily living, such as food, beverages, and household products. Companies like Procter & Gamble, Coca-Cola, and Walmart are key players. This sector is known for its stability and defensive nature, often performing well during economic downturns.

4. Energy

The Energy sector includes companies involved in the exploration, production, and distribution of oil, natural gas, and coal. It's a sector that can be highly volatile due to geopolitical events and changes in energy prices. Companies like ExxonMobil, Chevron, and BP are major players in this sector.

5. Financials

The Financials sector includes banks, insurance companies, and real estate investment trusts (REITs). This sector is sensitive to interest rate changes and economic conditions. Key players include JPMorgan Chase, Wells Fargo, and Bank of America.

6. Health Care

The Health Care sector includes pharmaceutical companies, biotech firms, and medical device manufacturers. It's a sector that's growing rapidly due to advancements in medical technology and an aging population. Companies like Johnson & Johnson, Pfizer, and Merck are prominent in this sector.

7. Information Technology

The Information Technology sector covers a wide range of businesses, from software and hardware companies to internet services. Key players include Apple, Microsoft, and IBM. This sector is known for its innovation and rapid growth, often leading the market in terms of performance.

8. Industrials

The Industrials sector includes companies involved in the manufacturing and construction industries. This sector is sensitive to economic cycles and can be affected by changes in interest rates and commodity prices. Companies like General Electric, 3M, and Caterpillar are part of this sector.

9. Materials

The Materials sector includes companies involved in the production of raw materials, such as metals, mining, and chemicals. This sector is often cyclical and can be affected by global economic conditions. Key players include Aluminum Corporation of China, Rio Tinto, and BASF.

10. Real Estate

The Real Estate sector includes REITs and companies involved in property management and development. This sector can be sensitive to interest rate changes and economic conditions. Companies like Public Storage, AvalonBay Communities, and Vornado Realty Trust are part of this sector.

11. Utilities

The Utilities sector includes companies involved in the generation, transmission, and distribution of electricity and natural gas. This sector is known for its stability and steady dividends. Key players include Duke Energy, Southern Company, and Exelon.

Understanding these 11 sectors can help investors make informed decisions about where to allocate their investments. By diversifying across sectors, investors can mitigate risks and capitalize on different market conditions. Whether you're a seasoned investor or just starting out, knowledge of these sectors is essential for navigating the complex world of the US stock market.

so cool! ()

last:Exploring Canadian Marijuana Stocks on the US Stock Market

next:nothing

like

- Exploring Canadian Marijuana Stocks on the US Stock Market

- How to Buy Pot Stocks in the US: A Step-by-Step Guide

- US Steel Stock Live: Real-Time Analysis and Insights

- How to Buy Dogecoin Stock in the US: A Comprehensive Guide

- Unveiling the Potential of US Oil Producer Stocks: A Comprehensive Guide

- Highest Dividend Paying Stocks in the US 2021: Top Performers to Watch

- Best App for Investing in the US Stock Market: Unveiling the Ultimate Platform

- Stock Ranking US: Mastering the Art of Stock Analysis

- Unveiling the US Premarket Stock Scene: Your Ultimate Guide"

- US Government Shutdown and Its Impact on the Stock Market"

- Beretta US Stock Prices: A Comprehensive Guide

- Roku US Stocks: A Comprehensive Guide to Investing in Streaming Devices

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

11 US Stock Market Sectors: A Comprehensive Gu

11 US Stock Market Sectors: A Comprehensive Gu

Are Bump Stocks Illegal in the US?

AXP Stock Price: Understanding the Trends and

How Did US Stocks Perform Today? A Comprehensi

US Stock Future Live: The Ultimate Guide to Un

Is the US Stock Market in Trouble?

Geely Stock in US Dollars: An In-Depth Analysi

Is the US Stock Market Trading Today?

The Costliest Stock in the US: A Deep Dive int

Buying US Stocks on Wealthsimple Trade: A Comp

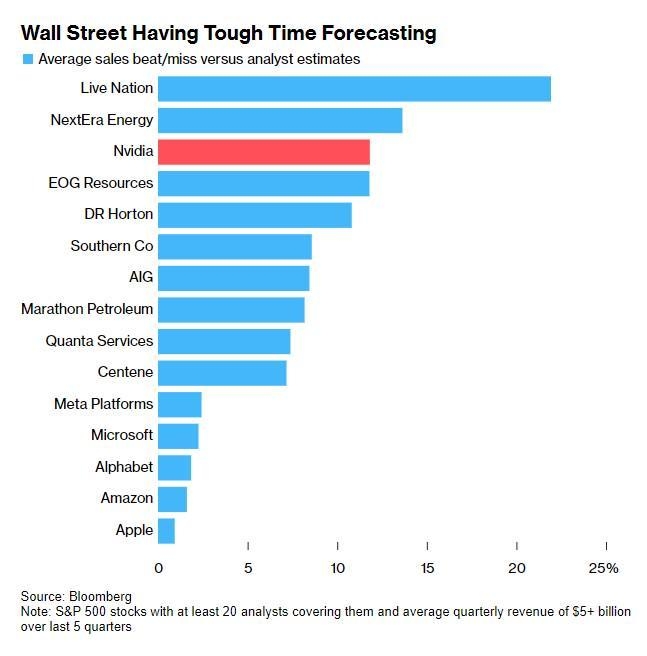

NVIDIA's Q3 Earnings in Focus Amid Mixed

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- CS Stock Price: What You Need to Know"

- Foreigners That Buy the Most US Stocks: An Ins"

- Bump Stock Ban: The US Federal Decision That S"

- The 25 Biggest Pharmaceutical Stocks Trading i"

- Major US Stock Indexes Rise After a Three-Day "

- Agrimonia Pilosa Powder Extract US Stock Avail"

- Title: Profitable US Pot Stocks: A Guide to In"

- Best Chinese Stocks on US Exchanges: A Compreh"

- Understanding the Importance of US Liquified N"

- Best US Stock Broker in Australia: Your Ultima"