you position:Home > aphria us stock > aphria us stock

US Silica Stock News: Latest Developments and Future Outlook

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

In the ever-evolving world of the stock market, staying informed about key players is crucial. One such company that has been making waves is US Silica Holdings Inc. (NYSE: SLCA). This article delves into the latest stock news surrounding US Silica, providing insights into its performance, market trends, and future outlook.

Recent Stock Performance

Over the past year, US Silica has seen a significant rise in its stock price. The company’s shares have surged by over 50%, driven by strong demand for its products and a robust market outlook. This surge can be attributed to several factors, including:

- Increased Demand for Industrial Minerals: The growing demand for industrial minerals, such as silica sand, has been a major driver for US Silica. The company’s products are used in various industries, including construction, glass manufacturing, and oil and gas extraction.

- Expansion Projects: US Silica has been actively expanding its operations, investing in new facilities and increasing production capacity. This expansion has helped the company meet the rising demand for its products and improve its market position.

- Strategic Partnerships: The company has formed strategic partnerships with key industry players, further enhancing its market reach and capabilities.

Market Trends

The industrial minerals market has been experiencing steady growth, driven by factors such as urbanization, infrastructure development, and the increasing use of alternative fuels. As a result, companies like US Silica are well-positioned to benefit from this trend. Here are some key market trends to watch:

- Rising Demand for Silica Sand: The demand for silica sand is expected to grow significantly in the coming years, driven by the growing use of hydraulic fracturing in the oil and gas industry.

- Environmental Regulations: As environmental concerns continue to rise, companies in the industrial minerals sector will need to comply with stricter regulations. This could present both challenges and opportunities for US Silica.

- Globalization: The globalization of the industrial minerals market is creating new opportunities for companies like US Silica to expand their operations and reach new markets.

Future Outlook

Looking ahead, US Silica appears to be well-positioned for continued growth. The company’s strategic investments, strong market position, and growing demand for its products bode well for its future. Here are some key factors to consider:

- Expansion Projects: US Silica has several expansion projects in the pipeline, which are expected to further increase its production capacity and market reach.

- Innovation: The company is actively investing in research and development to develop new products and improve its existing offerings.

- Strategic Partnerships: US Silica’s strategic partnerships are expected to help the company navigate the complexities of the global industrial minerals market.

Case Study: US Silica’s Partnership with Frac Sand Producers

One notable example of US Silica’s strategic partnerships is its collaboration with frac sand producers. By working closely with these companies, US Silica has been able to ensure a steady supply of high-quality silica sand, which is crucial for hydraulic fracturing operations. This partnership has not only helped US Silica meet the growing demand for its products but has also strengthened its position as a leading supplier in the industry.

In conclusion, US Silica Holdings Inc. is a company to watch in the industrial minerals sector. With strong stock performance, a robust market outlook, and a strategic approach to growth, US Silica appears poised for continued success. As the industrial minerals market continues to grow, companies like US Silica will play a crucial role in meeting the demand for these essential materials.

so cool! ()

last:Cannabis Stocks Headquartered in the US: The Growing Industry to Watch

next:nothing

like

- Cannabis Stocks Headquartered in the US: The Growing Industry to Watch

- Unveiling the Power of US Marine Corps Stock Video: A Comprehensive Guide

- Unlocking the Power of US Dow Stocks: Your Ultimate Guide

- How to Invest in the US Stock Market for Beginners: A Step-by-Step Guide

- US Bank Stock Collapse: Causes, Impacts, and Recovery Insights

- Unlocking the Potential of SBB.TO: A Deep Dive into Swisscom's Stock

- Is Today a Holiday in the US Stock Market? What You Need to Know

- F1 Visa Students: Is Investing in the US Stock Market Legal?

- Best Stocks to Buy Now in the US: Top 5 Picks for 2023"

- Can I Buy Huawei Stock in the US? A Comprehensive Guide

- Teva Stock US: A Comprehensive Analysis of the Pharma Giant's Market Perform

- Toys "R" Us Historical Stock Prices: A Look Back at the Iconic

recommend

US Silica Stock News: Latest Developments and

US Silica Stock News: Latest Developments and

Top Gaining US Stocks This Week: Momentum Anal

Top Momentum Stocks: 5-Day Performance in the

Title: US Stock Average: Understanding the Mar

US Shorted Stocks: Understanding the Risks and

Stock Analysis in the U.S.: A Comprehensive Gu

The Worst Day in US Stock Market History

http stocks.us.reuters.com stocks fulldescript

2019 International Stock vs. US Stock: A Compr

Title: TS1935B Stock in the US: A Comprehensiv

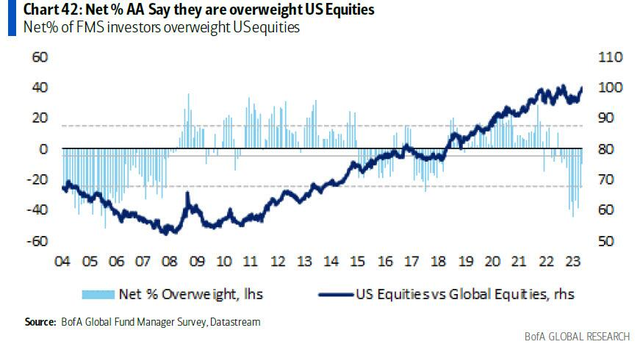

Are U.S. Stocks in a Bubble Analysis 2025?

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- disney stock forecast"

- Title: US Overseas Stock Fund: A Strategic Inv"

- Title: Inflation Adjusted Long-Term Return of "

- data center stocks"

- silver etf"

- market manipulation"

- HMMJ Stock US: The Ultimate Guide to Investing"

- DeepSeek US Stocks: Unveiling the Hidden Gems"

- stocks to buy now"

- How Much Did the US Stock Market Lose Today?"