you position:Home > aphria us stock > aphria us stock

US Large Cap Stocks Momentum Winners: July 2025 Outlook

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In the ever-evolving landscape of the stock market, large cap stocks have long been considered the cornerstone of a well-diversified portfolio. As we approach July 2025, investors are on the lookout for the momentum winners among these giants. This article delves into the top-performing large cap stocks that are expected to lead the pack in the coming months.

Understanding Large Cap Stocks

Large cap stocks refer to companies with a market capitalization of over $10 billion. These companies are typically well-established and have a strong track record of profitability and stability. They often dominate their respective industries and are seen as a safer investment compared to smaller cap stocks.

Momentum as a Key Indicator

Momentum, in the context of stock investing, refers to the rate of change in a stock's price. When a stock is said to have momentum, it means that it has been consistently increasing in value over a certain period. Investors often look for stocks with strong momentum as they believe these trends are likely to continue.

Top Large Cap Stocks to Watch in July 2025

Technology Giants

- Apple Inc. (AAPL): As the world's largest technology company by market capitalization, Apple has consistently shown strong momentum. With its diverse product line and global presence, Apple is poised to continue its upward trajectory.

- Microsoft Corporation (MSFT): Microsoft has been a leader in the technology sector for decades. Its cloud computing and enterprise solutions have been driving its growth, making it a strong momentum candidate.

Healthcare Leaders

- Johnson & Johnson (JNJ): A household name in healthcare, Johnson & Johnson has a diverse portfolio of pharmaceuticals, medical devices, and consumer healthcare products. Its strong brand recognition and innovation capabilities make it a solid momentum play.

- Merck & Co., Inc. (MRK): Known for its pharmaceuticals and biotechnology products, Merck has been a consistent performer. With a pipeline of new drugs and a strong R&D focus, it remains a top pick for momentum investors.

Consumer Goods Powerhouses

- Procter & Gamble (PG): As one of the world's largest consumer goods companies, Procter & Gamble has a vast product portfolio that includes brands like Gillette, Tide, and Pampers. Its stable revenue streams and strong market position make it a compelling momentum candidate.

- Coca-Cola Company (KO): Coca-Cola, a global leader in beverage production, has been a staple in investors' portfolios for decades. With a robust brand and a diversified product line, it continues to be a top performer.

Case Study: Amazon.com, Inc. (AMZN)

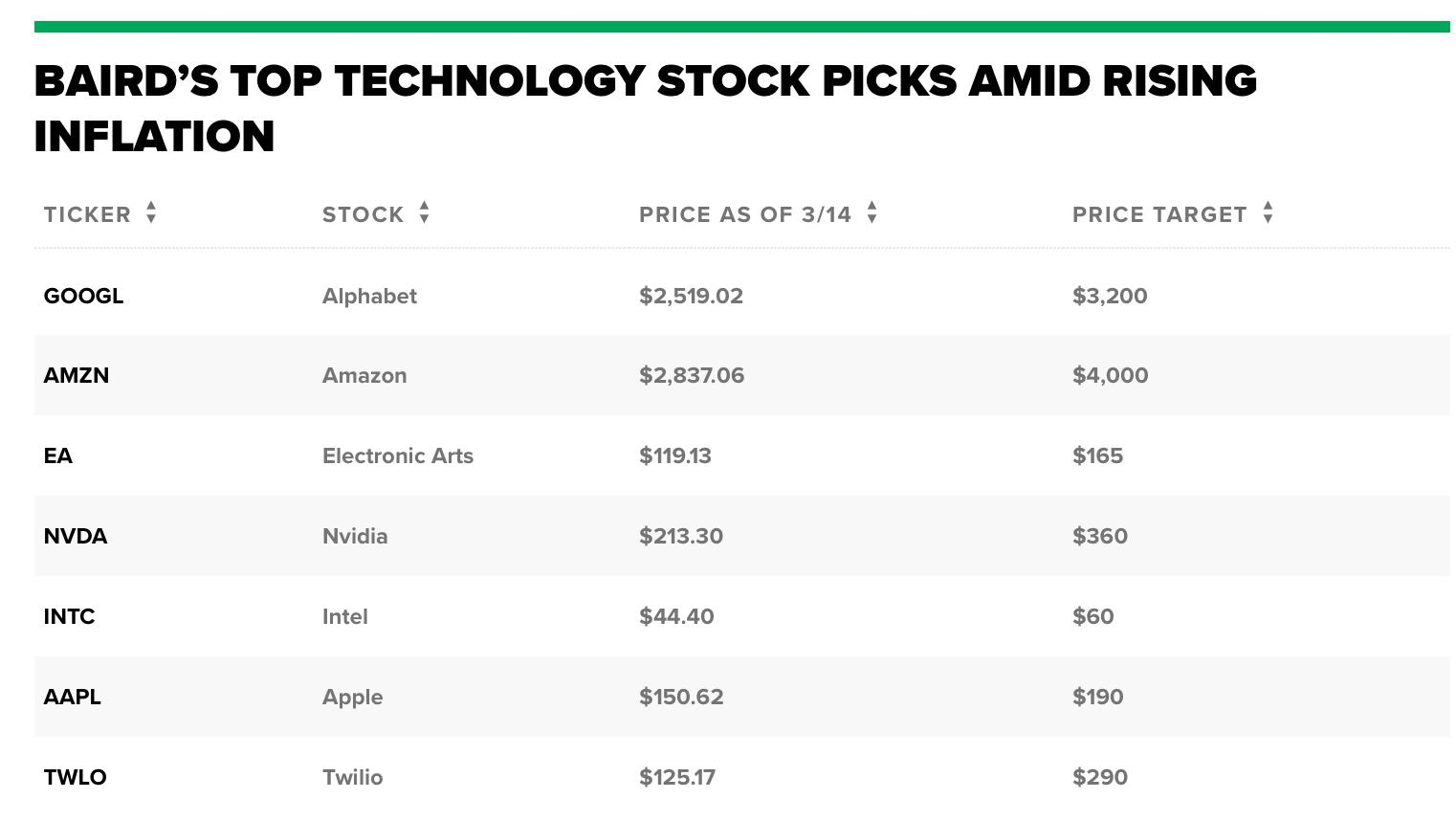

One company that has demonstrated exceptional momentum is Amazon.com, Inc. (AMZN). As an e-commerce and cloud computing giant, Amazon has revolutionized the way we shop and do business. Its strong growth in cloud services, particularly through Amazon Web Services (AWS), has been a significant driver of its momentum. Investors who recognized this trend early on have seen substantial returns.

Conclusion

As we move into July 2025, investors should focus on large cap stocks with strong momentum. By analyzing industry leaders and their performance trends, investors can identify the top-performing large cap stocks that are likely to continue their upward momentum. Whether it's technology, healthcare, or consumer goods, these sectors offer promising opportunities for investors looking to capitalize on market trends.

so cool! ()

last:Dow Jones Industrial Average Chart: A 10-Year Analysis

next:nothing

like

- Dow Jones Industrial Average Chart: A 10-Year Analysis

- Yahoo Headlines News US: Stay Updated with the Latest Stories

- Nasdaq Tech Stocks: The Future of Innovation and Investment

- Dimension for Laminator Machine 63 US Stock: Find the Perfect Fit

- TG Therapeutics: A Promising Player in the US Biotech Stocks Landscape"

- Trade Republic: Your Gateway to a World of US Stocks

- Streamlining Your Financial Management: A Guide to Google Financial Login

- Unlocking the Future: A Deep Dive into Market Projections

- Stocks and Opportunities: Navigating the Financial Landscape for Success

- Buy Us Stocks from Canada: A Strategic Investment Opportunity

- Can U.S. Military Get Foreign Stocks? A Comprehensive Guide

- Market Watch: Pre-Market Movers – Your Guide to Early Market Insights

recommend

US Large Cap Stocks Momentum Winners: July 202

US Large Cap Stocks Momentum Winners: July 202

Moving Stocks from Canada to the US: A Compreh

2025 US Stock Recommendations: A Comprehensive

US Stock Earnings: A Comprehensive Overview

US Stock Bubble 2020: What Caused It and What

Top Momentum Stocks: Large Cap US September 20

Understanding US Banks Stock Symbols: A Compre

Kar Us Stock: A Comprehensive Guide to Investi

Oil Refinery Stocks: A Lucrative Investment Op

US Information Technology Stocks: A Comprehens

Unlocking Potential: The World of US Small Gro

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Understanding the Chinese Companies Listed in "

- Nasdaq Tech Stocks: The Future of Innovation a"

- Top Performing Stocks in the US Market July 20"

- Understanding the US Stock Cross Sector Correl"

- Tencent Stock Price in US Dollars: A Comprehen"

- US Stock Leather Machines: The Ultimate Guide "

- Top Momentum Stocks: 5-Day Performance in the "

- should i buy stocks now"

- sustainable investing"

- Beigene US Biotech Stocks: A Lucrative Investm"