you position:Home > aphria us stock > aphria us stock

US Energy Companies Stock: A Comprehensive Guide to Investment Opportunities

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

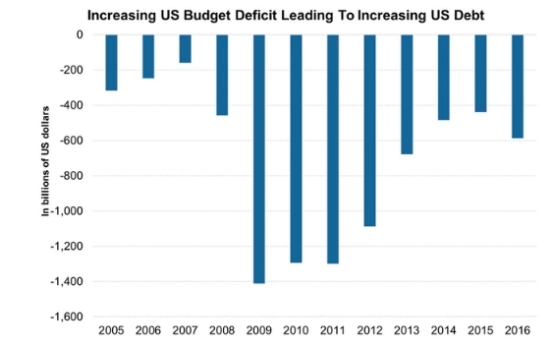

In the ever-evolving energy sector, U.S. energy companies have emerged as key players, offering a wide array of investment opportunities. Whether you're a seasoned investor or just dipping your toes into the market, understanding the stock performance of these companies is crucial. This article delves into the world of U.S. energy companies, highlighting their stock trends, potential risks, and investment strategies.

Understanding the U.S. Energy Sector

The U.S. energy sector encompasses a diverse range of companies, including oil and gas producers, renewable energy firms, and utilities. These companies are responsible for extracting, processing, and distributing energy resources across the country. The sector is influenced by various factors, such as global oil prices, regulatory changes, and technological advancements.

Top U.S. Energy Companies

Several U.S. energy companies have gained significant attention from investors due to their strong financial performance and growth potential. Here are some of the key players:

Exxon Mobil Corporation (XOM)

- Exxon Mobil is one of the largest publicly traded oil and gas companies in the world, known for its extensive exploration and production operations.

- Key Factors: The company's stock performance is heavily influenced by global oil prices and its ability to innovate in exploration and production techniques.

Chevron Corporation (CVX)

- Chevron is another major player in the oil and gas industry, with operations spanning across the globe.

- Key Factors: Similar to Exxon Mobil, Chevron's stock is sensitive to global oil prices and its success in expanding its reserves.

Royal Dutch Shell (RDS.A)

- Royal Dutch Shell is an international oil and gas company with a significant presence in the U.S. market.

- Key Factors: Shell's stock is influenced by global oil prices, as well as its investments in renewable energy and other low-carbon technologies.

BloombergNEF's Analysis: According to a recent report by BloombergNEF, Shell is leading the pack in terms of investment in renewable energy, which could positively impact its long-term growth prospects.

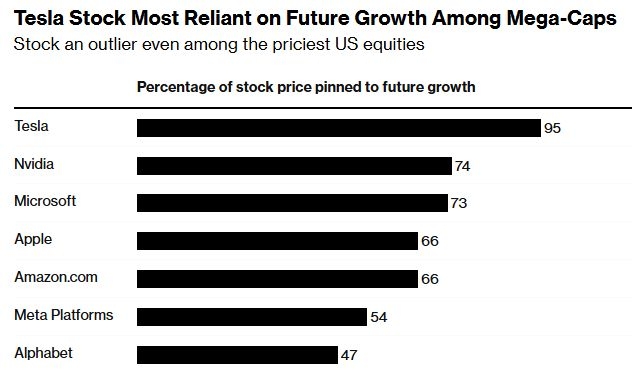

Tesla, Inc. (TSLA)

- Tesla, while primarily known for electric vehicles, has also ventured into energy storage solutions, making it a key player in the renewable energy sector.

- Key Factors: Tesla's stock is driven by its innovation in battery technology and its ability to scale up production.

Investment Strategies

When considering investments in U.S. energy companies, it's important to adopt a strategic approach:

- Diversification: Diversify your portfolio by investing in companies across different segments of the energy sector to mitigate risks.

- Long-term Perspective: Energy investments often require a long-term perspective due to the time it takes for projects to come to fruition.

- Research and Analysis: Conduct thorough research and analysis before making investment decisions, considering factors such as financial performance, market trends, and regulatory changes.

Case Study: Schlumberger Limited (SLB)

Schlumberger, a leading provider of technology and services to the oil and gas industry, has faced challenges due to the global oil price downturn. However, the company has managed to maintain its market position by focusing on cost reduction and innovation. Its strategic investments in digital solutions have positioned it well for future growth.

In conclusion, investing in U.S. energy companies can be a lucrative venture, but it requires careful consideration of various factors. By staying informed and adopting a strategic approach, investors can capitalize on the opportunities presented by this dynamic sector.

so cool! ()

last:US Stock Exchange History Chart: A Comprehensive Overview

next:nothing

like

- US Stock Exchange History Chart: A Comprehensive Overview

- Sunflower Oil Stocks: The Heart of the American Kitchen

- Top US Hydrogen Stocks to Watch in 2023

- WSJ Historical Exchange Rates: A Comprehensive Guide to Understanding Past Curren

- Mean and Deviation of US Stock Market Returns: Understanding Volatility and Stabi

- Maximize Your Investment Potential with US Exchange Stocks"

- Best US Bank Stock to Buy: Top Picks for 2023

- Yahoo Toronto Stock Exchange: A Comprehensive Guide to Trading Success

- US Stock Market 2015 Graph: A Comprehensive Look at the Year's Performance&a

- Yahho Stocks: Revolutionizing Investment Strategies

- What is the Current S&P 500: A Comprehensive Insight

- Stocks in DJIA: A Comprehensive Guide to Understanding the Dow Jones Industrial A

recommend

US Energy Companies Stock: A Comprehensive Gui

US Energy Companies Stock: A Comprehensive Gui

Maximizing Returns with Google Finance: A Deep

http stocks.us.reuters.com stocks fulldescript

Stocks in DJIA: A Comprehensive Guide to Under

Live Us Stock Market Index: Bitcoin's Ris

Top Stock Picks for August 2025 in the US Mark

Are US Bank Stocks Falling?

US Stock Exchange Symbols Ending with X: A Com

Day Trading US Stocks from Australia: A Compre

Kinross Gold Stock US: A Comprehensive Guide t

Unlocking Opportunities: Argentina Stock Perfo

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Understanding the US Dow Jones Total Stock Mar"

- Axsome Therapeutics: A Leading US Biotech Stoc"

- As an Indian, Can I Invest in US Stocks?"

- Understanding the US Residential Housing Stock"

- cyber security stocks"

- Gillette Razor Stock Price: What You Need to K"

- Investing in Canadian Stocks from the US: Navi"

- Unlocking the Potential: Understanding US Empl"

- amd price target"

- 2020 US Stock Market Schedule: A Comprehensive"