you position:Home > aphria us stock > aphria us stock

Tax on US Stock: Understanding the Implications and Strategies

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the ever-evolving landscape of financial markets, understanding the tax implications of owning US stocks is crucial for investors. This article delves into the various taxes associated with US stocks, including capital gains tax, dividend tax, and the impact of the Tax Cuts and Jobs Act of 2017. We will also explore effective strategies to minimize your tax burden and maximize returns.

Capital Gains Tax on US Stocks

When you sell a stock for a profit, you are subject to capital gains tax. The rate at which you are taxed depends on how long you held the stock. Short-term capital gains, which are stocks held for less than a year, are taxed as ordinary income, while long-term capital gains, which are stocks held for more than a year, are taxed at a lower rate.

Dividend Tax on US Stocks

Dividends are payments made by companies to their shareholders. The tax rate on dividends depends on your overall income level. Qualified dividends, which are dividends paid by U.S. corporations, are taxed at the lower long-term capital gains rate. Non-qualified dividends, which are dividends paid by foreign corporations or certain U.S. corporations, are taxed as ordinary income.

Impact of the Tax Cuts and Jobs Act of 2017

The Tax Cuts and Jobs Act of 2017 made significant changes to the tax code, including reducing the corporate tax rate and adjusting the tax rates for individuals. This act also impacted the tax treatment of dividends and capital gains. For example, the qualified dividend rate was reduced from 23.8% to 20% for most taxpayers, and the top rate on long-term capital gains was reduced from 39.6% to 37%.

Strategies to Minimize Tax Burden

Holding Stocks for the Long Term: As mentioned earlier, long-term capital gains are taxed at a lower rate than short-term gains. By holding stocks for more than a year, you can benefit from this lower tax rate.

Understanding Qualified Dividends: If you receive dividends from U.S. corporations, ensure that they are qualified dividends to take advantage of the lower tax rate.

Tax-Loss Harvesting: This strategy involves selling stocks that have lost value to offset capital gains taxes. By doing so, you can reduce your overall tax burden.

Investing in Tax-Advantaged Accounts: Consider investing in tax-advantaged accounts such as IRAs or 401(k)s, which offer tax-deferred or tax-free growth on investments.

Seek Professional Advice: Consulting with a tax professional can help you navigate the complex tax code and develop a personalized strategy to minimize your tax burden.

Case Study: Tax-Loss Harvesting

Let's consider a hypothetical scenario. John purchased 100 shares of Company A at

In conclusion, understanding the tax implications of owning US stocks is essential for investors. By implementing effective strategies and seeking professional advice, you can minimize your tax burden and maximize your returns. Remember, the key is to stay informed and proactive in managing your investments.

so cool! ()

last:Oversold Us Stocks: Understanding the Implications and Strategies

next:nothing

like

- Oversold Us Stocks: Understanding the Implications and Strategies

- Dash Stock US: A Comprehensive Guide to Investing in Dash Cryptocurrency

- US Stock Market Bottom: A Comprehensive Guide to Identifying and Capitalizing on

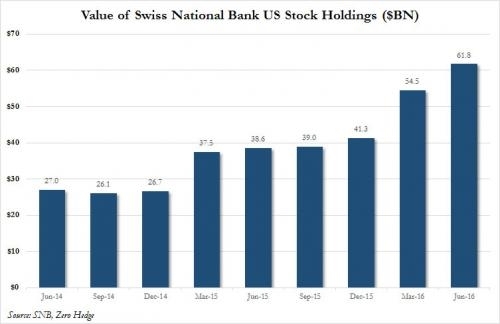

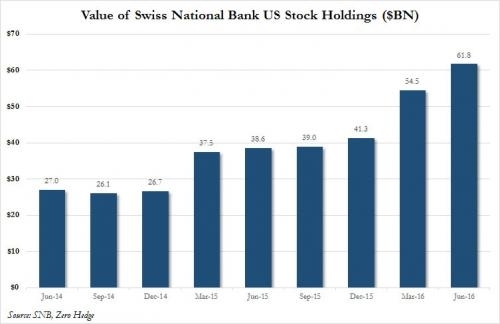

- How Much Foreign Investment in the US Stock Market: An Insightful Analysis

- LDS Stock US: A Comprehensive Guide to LDS Corporation’s Stock Performance

- Hot Momentum Stocks US: The Top Picks for 2023

- Oil and Gas Stocks: A Deep Dive into the US Market

- Is the US Stock Market Open on July 3, 2023?

- Multibagger Stocks US Paid: How to Identify and Invest in High-Growth Stocks

- August 4, 2025 US Stock Market Closing Summary

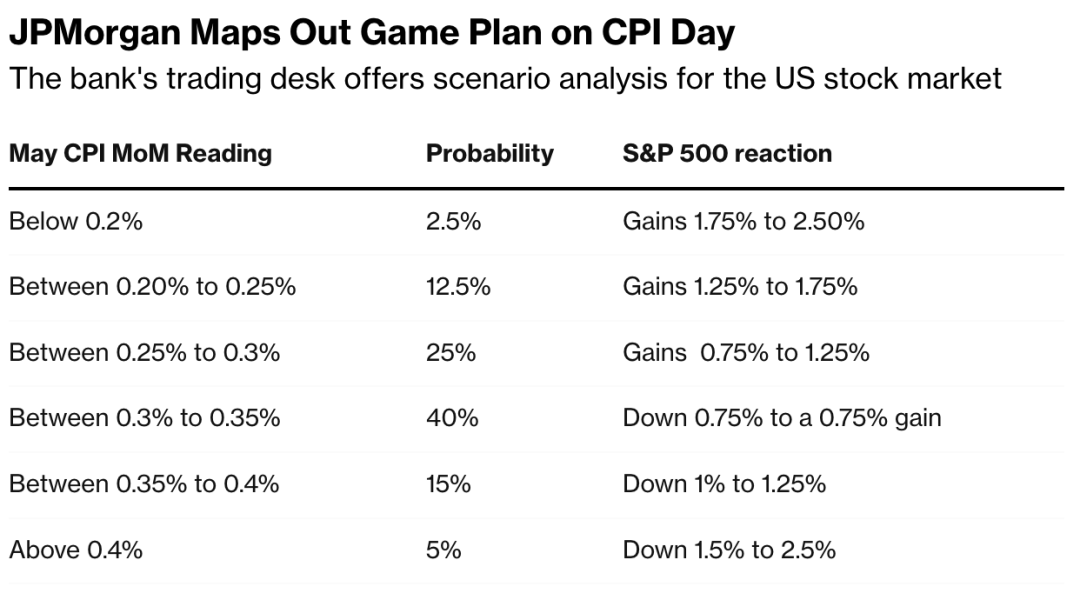

- Analyst Recommendations: US Stocks Short-Term Outlook

- Title: "Li Us Stock: A Comprehensive Guide to Investing in Chinese Compa

recommend

Tax on US Stock: Understanding the Implication

Tax on US Stock: Understanding the Implication

Is the US Stock Market Open on December 31?

DeepSeek US Stock: Unveiling the Potential of

LDS Stock US: A Comprehensive Guide to LDS Cor

Is the US Stock Market Open on July 3, 2023?

Oil and Gas Stocks: A Deep Dive into the US Ma

How to Buy Shares in the US Stock Market

Oversold Us Stocks: Understanding the Implicat

Momentum Stocks High Volume US Large Cap: A Gu

How to Buy Taiwan Stock in the US

Tax on US Stock: Understanding the Implication

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock