you position:Home > aphria us stock > aphria us stock

Stocks After US Election: A Comprehensive Analysis

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

The Impact of the US Election on Stock Markets

The recent US election has sparked a whirlwind of discussions and speculations across various sectors, including the stock market. As investors and market analysts dissect the potential implications of the election results, it is crucial to understand the potential shifts in the stock market landscape. This article delves into the potential effects of the US election on stocks, analyzing various sectors and offering insights into the expected market trends.

Stock Market Performance Pre-Election

Leading up to the election, the stock market exhibited mixed performance. While certain sectors, such as technology and healthcare, experienced robust growth, others, like energy and finance, faced challenges. The uncertainty surrounding the election outcome added a layer of volatility to the market, with investors hedging their bets on potential policy changes and market shifts.

Potential Implications of the Election Results

The election results have brought about a mix of optimism and skepticism among investors. Let's analyze the potential implications of the election on different sectors:

1. Technology Sector

The technology sector has been a significant driver of stock market growth over the past few years. The election results have further bolstered investor confidence in this sector. With the Democratic Party retaining control of the Senate, it is expected that policies favoring technology innovation and growth will continue. Companies like Apple, Google, and Microsoft are likely to benefit from increased government support and investments in research and development.

2. Healthcare Sector

The healthcare sector has also seen substantial growth in the wake of the election. The Democratic Party's focus on expanding healthcare coverage and investing in medical research could lead to increased demand for healthcare services and pharmaceutical products. Companies like Johnson & Johnson and Pfizer are poised to benefit from these policies.

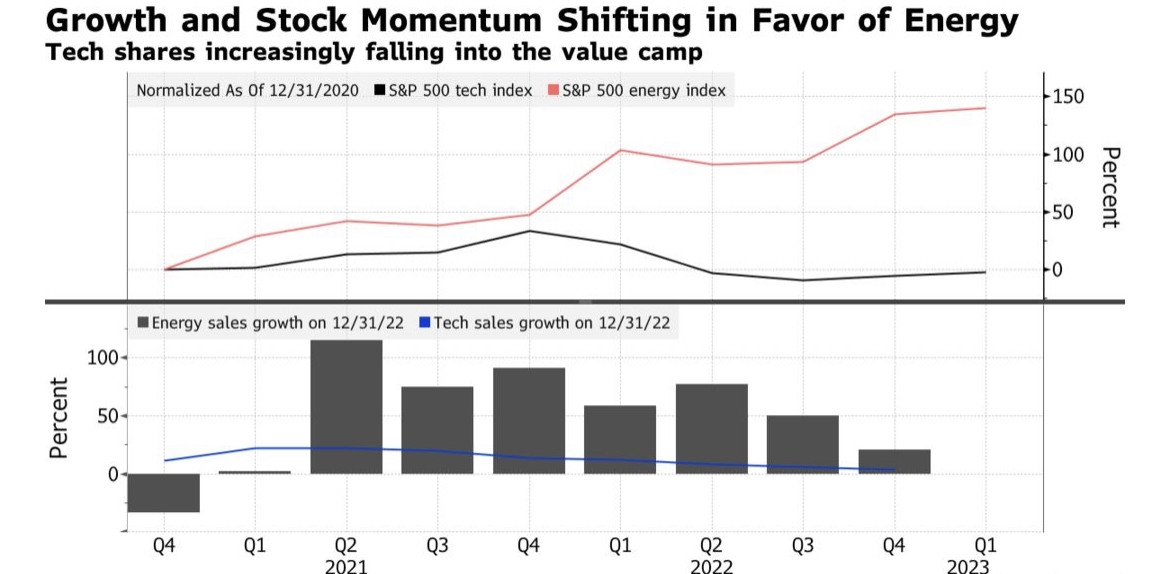

3. Energy Sector

The energy sector, particularly oil and gas, may face challenges post-election. The Democratic Party's push for renewable energy and environmental regulations could lead to decreased investments in fossil fuels. However, the market may see a short-term boost due to the anticipation of increased oil prices as global demand recovers.

4. Finance Sector

The finance sector is likely to experience minimal changes post-election. However, increased regulatory oversight and a focus on consumer protection could lead to some adjustments in the banking industry. Companies like JPMorgan Chase and Bank of America may need to adapt to these changes.

Case Study: Tech Giant Apple

To illustrate the potential impact of the election on the stock market, let's consider the case of Apple Inc. The tech giant has seen significant growth in the past few years, driven by its innovative products and services. With the Democratic Party retaining control of the Senate, Apple is expected to benefit from increased government support for technology and innovation. This could lead to further growth in the company's stock price in the long term.

Conclusion

The US election has undoubtedly had a significant impact on the stock market. As investors navigate the changing landscape, it is crucial to stay informed about potential market trends and sector-specific developments. While the election results have brought about a mix of optimism and skepticism, the long-term outlook remains positive for certain sectors, including technology and healthcare. By staying informed and adapting to market shifts, investors can capitalize on these opportunities.

so cool! ()

last:Top Momentum Stocks: Large Cap US September 2025

next:nothing

like

- Top Momentum Stocks: Large Cap US September 2025

- US Steel Stock Charts: A Comprehensive Guide to Understanding Market Trends

- Baillie Gifford US Growth Stock: A Comprehensive Guide to Investment Opportunitie

- Apple Stock Price in the US Market on April 18, 2025: A Comprehensive Analysis

- Stock Associate Toys "R" Us: A Comprehensive Guide to the Role

- Understanding "US Stock Before Hours": A Comprehensive Guide

- US Stock Market Bubble 2024: Is It Time to Worry?

- Best US Electric Utility Stocks to Buy in 2025

- Understanding the US Single Family Housing Stock: Trends, Challenges, and Opportu

- Mexican Stocks Trading in the US: A Comprehensive Guide

- Positive Growth Rate Stock for a US-Based Company: How to Identify and Invest Wis

- Title: "US Marijuana Stock Exchange: The Future of Legal Cannabis Invest

recommend

Stocks After US Election: A Comprehensive Anal

Stocks After US Election: A Comprehensive Anal

Title: US Olive Oil Stocks: A Deep Dive into t

Title: Factors Influencing US Stock Market Per

Title: Best Stock to Buy in US Market

Open Time of the Australian Stock Exchange to

How to Buy US Stock from Hang Seng Bank

US Stock Market Boxing Day: A Comprehensive Gu

High Dividend Yield US Stocks: A Guide to Top

Phillip Securities US Stock: Your Ultimate Gui

Best Dividend US Stock: How to Identify the Be

Title: Schedule of 2018 Reports That Affect Us

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- swing trading strategies"

- US 10Y Stock: A Comprehensive Guide to Underst"

- convertible bond"

- How to Invest in the US Stock Market from Indi"

- Title: US Stock Future Index: A Comprehensive "

- How to Buy Taiwan Stock in the US"

- ev stocks"

- coffee stocks"

- Spirit Airlines: A Rising Star in the US Airli"

- when to sell stocks"