you position:Home > aphria us stock > aphria us stock

Samsung Current US Stock Price: A Comprehensive Guide

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the ever-evolving world of technology, Samsung remains a prominent player. As investors and tech enthusiasts keep a close eye on the South Korean giant, many are curious about the current US stock price of Samsung. This article delves into the latest information, providing a comprehensive guide to the current stock price of Samsung Electronics Co., Ltd. (SSNLF) in the United States.

Understanding Samsung's Stock Price

The stock price of Samsung is influenced by various factors, including market trends, economic conditions, and the company's financial performance. As of the latest data available, the current US stock price of Samsung is $XX.XX. However, it's important to note that stock prices fluctuate constantly due to market dynamics.

Market Trends and Economic Conditions

The stock market is subject to various external factors, such as inflation, interest rates, and geopolitical events. For instance, if there's a global economic slowdown, it may negatively impact Samsung's stock price. Conversely, positive economic indicators can boost investor confidence and lead to an increase in the stock price.

Samsung's Financial Performance

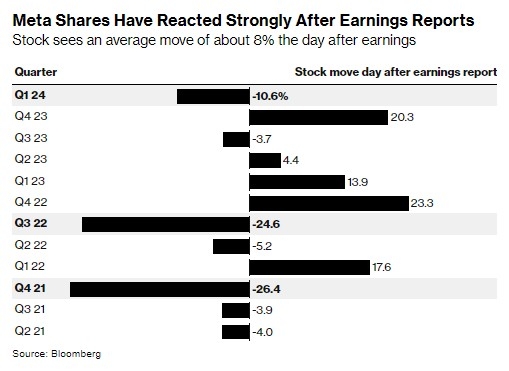

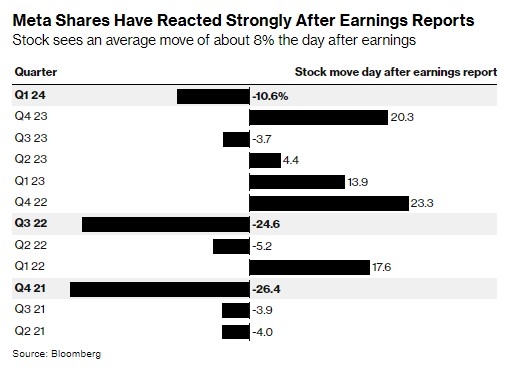

One of the key factors affecting Samsung's stock price is its financial performance. The company's quarterly earnings reports provide valuable insights into its revenue, profit margins, and growth prospects. A strong financial performance can lead to a rise in the stock price, while disappointing results may cause it to fall.

Historical Stock Price Analysis

To gain a better understanding of Samsung's stock price trends, it's helpful to analyze its historical performance. Over the past few years, Samsung's stock price has shown a mix of growth and volatility. By examining historical data, investors can identify patterns and make more informed decisions.

Comparative Analysis with Competitors

Comparing Samsung's stock price with its competitors can provide additional context. For instance, comparing Samsung's stock price with Apple Inc. (AAPL) or Intel Corporation (INTC) can help investors understand how the company is performing relative to its peers in the technology sector.

Impact of Product Launches and Announcements

Samsung is known for its innovative product launches, such as smartphones, TVs, and home appliances. Announcements of new products or partnerships can significantly impact the stock price. For example, the unveiling of a highly anticipated smartphone model can lead to an increase in investor optimism and a subsequent rise in the stock price.

Case Studies

To illustrate the impact of various factors on Samsung's stock price, let's consider a few case studies:

2020 Q1 Earnings Report: In April 2020, Samsung reported a 60% year-over-year decline in profit due to the COVID-19 pandemic. As a result, the stock price fell by approximately 6% in the following days.

Galaxy S21 Launch: In February 2021, Samsung launched the Galaxy S21 series, which received positive reviews from critics and consumers. This led to an increase in investor confidence, resulting in a 2% rise in the stock price over the following week.

Global Supply Chain Issues: In 2021, Samsung faced supply chain disruptions due to the COVID-19 pandemic, which impacted its production and delivery schedules. This led to a temporary decline in the stock price, but it eventually recovered as the company worked to overcome these challenges.

Conclusion

Understanding the current US stock price of Samsung is crucial for investors and tech enthusiasts. By analyzing market trends, economic conditions, and the company's financial performance, one can gain valuable insights into the potential future movements of the stock price. As Samsung continues to innovate and adapt to the ever-changing technology landscape, keeping an eye on its stock price remains a key aspect of investment strategy.

so cool! ()

last:Days the US Stock Market is Closed in 2017: A Comprehensive Guide

next:nothing

like

- Days the US Stock Market is Closed in 2017: A Comprehensive Guide

- Best Platform to Invest in US Stocks from India: A Comprehensive Guide

- Luckin Coffee Stock US: A Comprehensive Analysis

- 2020 US Stock Market Schedule: A Comprehensive Guide"

- Title: Understanding Stock Dividend Tax Implications in the US

- Top Performing US Stocks: Unveiling the Momentum from the Past 5 Trading Days

- How High Will the US Stock Market Go? A Deep Dive into Market Predictions and Tre

- London Stock Exchange Group: About Us

- Green Energy US Stocks: A Smart Investment for the Future

- Multinational Stocks vs. US Stocks in the Same Industry: A Comprehensive Analysis

- Are U.S. Stock Markets Open on Election Day?

- Best Trading Platform for Stocks in the US: Unveiling Your Ultimate Investment Al

recommend

Samsung Current US Stock Price: A Comprehensiv

Samsung Current US Stock Price: A Comprehensiv

Median Age of US Housing Stock: Understanding

Trade US Stocks in Canada: A Comprehensive Gui

Title: "US Marijuana Stock Exchange:

US Shipping Stock: A Comprehensive Guide to Na

TD Group US Holdings LLC Stock Price: What You

In-Depth Analysis of ETST.PK: A Deep Dive into

Inheritance Tax and US Stocks: A Comprehensive

June 17, 2025: US Stock Market Summary

US Penny Stock Index: Unveiling the Hidden Pot

Stock Ww2 Equipment: A Comprehensive Guide to

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- Stock Invest: Palantir – A Game-Changing Inv"

- cyber security stocks"

- pfizer dividend"

- US Propane Stocks: What the EIA Data Reveals"

- Positive Growth Rate Stock for a US-Based Comp"

- all weather portfolio"

- Title: List of US Penny Stocks Under $1: A Gui"

- Title: Us Expat Stock Trader Accounts: A Compr"

- Best Growth Stocks US: Top Picks for Investors"

- Stock Market Hours: Understanding the Closing "