you position:Home > aphria us stock > aphria us stock

Is It a Good Time to Invest in US Stocks?

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

The stock market is often unpredictable, but understanding the current market trends and economic factors can help investors make informed decisions. As of early 2023, the question on many investors' minds is: "Is it a good time to invest in US stocks?" This article delves into the factors that can influence this decision and provides insights into the potential opportunities and risks involved.

Economic Indicators

Economic indicators are critical in determining whether the current market is ripe for investment. Some key indicators to consider include:

- GDP Growth: A strong GDP growth rate suggests a healthy economy, which is often favorable for stock market performance.

- Unemployment Rate: A low unemployment rate indicates a robust labor market, which can lead to increased consumer spending and corporate profits.

- Inflation: Moderate inflation can be a sign of a healthy economy, but high inflation can erode purchasing power and negatively impact stocks.

As of early 2023, the US economy is experiencing steady GDP growth and a low unemployment rate. However, inflation remains a concern, which has been a factor for investors to consider.

Market Trends

Understanding market trends is crucial in making an investment decision. Some important trends to consider include:

- Stock Market Valuations: The P/E (Price-to-Earnings) ratio is a commonly used metric to assess stock market valuations. A high P/E ratio may indicate overvaluation, while a low P/E ratio may suggest undervaluation.

- Sector Performance: Different sectors perform differently in various economic conditions. For example, technology and healthcare sectors tend to perform well during economic downturns, while financial and real estate sectors may thrive in periods of low interest rates.

As of early 2023, the US stock market is trading at a relatively high P/E ratio, which may suggest caution in terms of overvaluation. However, some sectors, such as technology and healthcare, continue to perform well.

Risk Factors

Investing in US stocks comes with various risks, including:

- Market Volatility: Stock prices can be highly volatile, leading to significant fluctuations in investment value.

- Economic Uncertainty: Factors such as geopolitical tensions, trade disputes, and policy changes can impact the stock market.

- Company-Specific Risks: Individual companies may face risks such as poor financial performance, management issues, or product recalls.

Investors should be aware of these risks and consider their risk tolerance and investment goals before making investment decisions.

Case Studies

To illustrate the potential opportunities and risks involved in investing in US stocks, let's look at a few case studies:

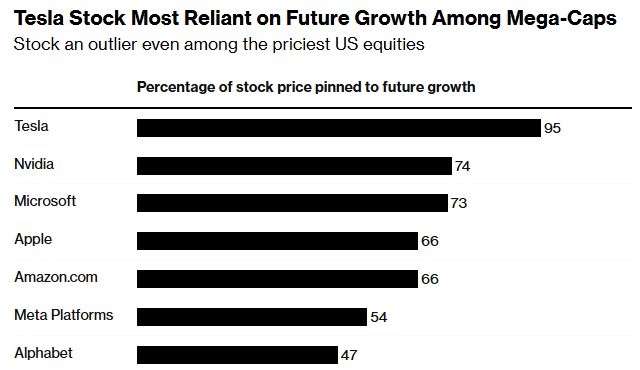

- Tesla (TSLA): As a leading electric vehicle manufacturer, Tesla has seen significant growth in its stock price over the past few years. However, the stock is also highly volatile and subject to various risks, including competition and regulatory challenges.

- Apple (AAPL): As one of the world's largest technology companies, Apple has a strong track record of consistent growth and profitability. The stock has also seen significant growth, although it may be approaching a higher valuation compared to some peers.

In conclusion, whether it is a good time to invest in US stocks depends on various factors, including economic indicators, market trends, and risk tolerance. While the current market may present some opportunities, investors should also be aware of the risks involved and conduct thorough research before making investment decisions.

so cool! ()

last:Title: Unveiling the Power of Geographical Trends in US Stocks

next:nothing

like

- Title: Unveiling the Power of Geographical Trends in US Stocks

- April 2025 US Stock Market Crash: What You Need to Know

- Market Cap US Stock Market Total: A Comprehensive Overview"

- China Stocks vs US Stocks: Performance Analysis and Key Differences

- The Number of Stock Trades in the US: A Comprehensive Overview

- US Firearms Stocks: The Comprehensive Guide to Investment Opportunities"

- Aetna US Healthcare Stock Price History: A Comprehensive Overview

- Is the US Stock Market Open on Columbus Day? A Comprehensive Guide

- Does Trump Own Stock in US Steel? A Comprehensive Analysis

- Unlocking the Potential of DB US Stock: A Comprehensive Guide

- Is the US Stock Market Open on Weekends? A Comprehensive Guide"

- Harley Benton Electric Guitar Kit Single Cut US Stock: Your Ultimate Guide

recommend

Is It a Good Time to Invest in US Stocks?

Is It a Good Time to Invest in US Stocks?

Unlocking Opportunities: Exploring Cheap, Vola

Buying US Stock by Using Credit Card: A Compre

Are U.S. Stock Markets Closed?

Is the US Stock Market Open Today July 19, 202

Cannabis Stocks Headquartered in the US: The G

Best US Penny Stocks for 2021: Your Guide to H

Title: US Overseas Stock Fund: A Strategic Inv

US Stock Market Analysis: Key Insights for Sep

All World Ex US Stock Index Fund: A Comprehens

Us Long Term Capital Gains Tax Stocks: Unlocki

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- US Stock Market Analysis: Key Insights for Sep"

- stock buyback"

- List of US Cannabis Penny Stocks: Your Ultimat"

- Is the US Stock Market Open on July 3, 2023?"

- Kinross Gold Stock US: A Comprehensive Guide t"

- US Foods Stocks: A Comprehensive Guide to Inve"

- HMMJ Stock US: The Ultimate Guide to Investing"

- Title: US Bond Market vs Stock Market Size: A "

- Momentum Stocks: Driving the US Market to New "

- US Stock Dresses: The Ultimate Guide to Stylis"