you position:Home > aphria us stock > aphria us stock

IBKR Commission: Understanding the Fee Structure for US Stocks

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

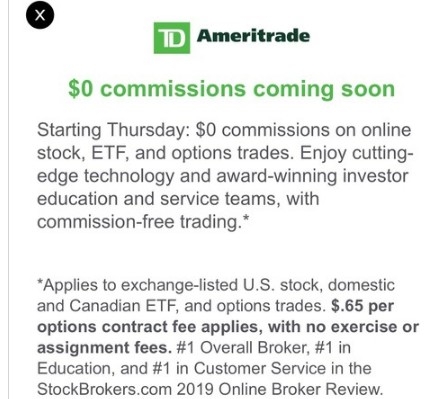

In the world of online stock trading, the fee structure can be a significant factor in determining the profitability of your investments. One of the leading platforms, Interactive Brokers (IBKR), offers a wide range of services, including trading in US stocks. Understanding the commission structure for US stocks is crucial for making informed decisions. In this article, we will delve into the details of IBKR’s commission fees, providing you with the information you need to navigate the trading landscape effectively.

IBKR Commission Structure: A Closer Look

1. Commission Rates for US Stocks

IBKR offers competitive commission rates for trading US stocks. The standard commission rate for US equity trades is

2. Options Trading Fees

For options trading, IBKR charges a commission of

3. Market Data and Research

IBKR provides a range of market data and research tools at no additional cost to its clients. This includes real-time quotes, historical data, and a variety of analytical tools. Access to these resources can be a significant advantage, especially for investors who rely on detailed market analysis to inform their trading decisions.

4. Execution Quality

One of the key strengths of IBKR is its execution quality. The platform boasts low latency and direct access to global liquidity, ensuring that orders are executed quickly and efficiently. This is particularly important for high-frequency traders who need to execute trades at the best possible price.

Case Study: Active Trader Benefits

Let’s consider a hypothetical scenario involving an active trader who executes 1000 US stock trades per month. With the standard commission rate of

- 1000 trades x

1.00 (minimum commission) = 1000

This demonstrates the cost-effectiveness of IBKR’s commission structure, especially for active traders who benefit from the platform’s low fees and efficient execution.

Conclusion

Understanding the fee structure of a trading platform is crucial for making informed decisions. IBKR’s commission structure for US stocks offers competitive rates and a range of additional benefits, making it an attractive option for both individual investors and institutional traders. By considering the specifics of the commission structure and leveraging the platform’s features, traders can maximize their returns and navigate the stock market with confidence.

so cool! ()

last:Penny Stocks to Buy in the US Market: Top Picks for Investors

next:nothing

like

- Penny Stocks to Buy in the US Market: Top Picks for Investors

- Unlocking the Potential of Juju Stock: A Comprehensive Guide for US Investors

- Is the US Stock Market Open on December 31, 2018?

- Acadia Pharmaceuticals: A Rising Star in US Pharma Stocks

- Unlocking the Potential of US Marawana Stocks: A Comprehensive Guide

- US Automakers Stock: A Comprehensive Look at the Industry's Performance

- Car Stocks: The Ultimate Guide to Investing in the US Auto Industry

- Growth Stocks on the US Market: Unveiling the Potential Powerhouse

- Coronavirus US Stock Market: Impact, Recovery, and Future Outlook

- How to Buy Gold Stocks in the US: A Comprehensive Guide"

- US Antimony Stock Forecast 2025: A Comprehensive Outlook

- Best US Pot Stocks to Invest In: A Guide for 2023

recommend

IBKR Commission: Understanding the Fee Structu

IBKR Commission: Understanding the Fee Structu

How to Trade in the US Stock Market from Dubai

Title: Stock Markets Predicting the US Electio

US PS5 Stock Tracker: Your Ultimate Guide to F

Best US Electric Utility Stocks to Buy in 2025

Title: 2020 Philine Isabelle Barolo Preda In S

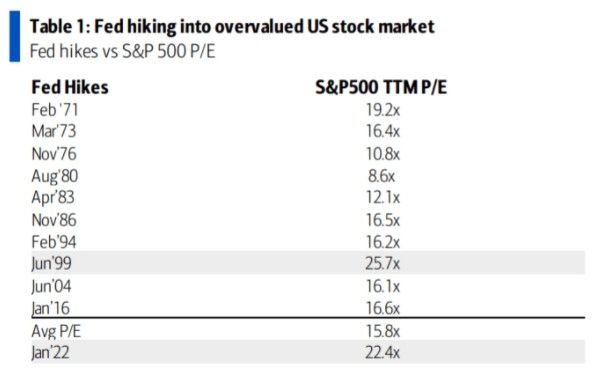

Barclays Strategists Believe US Stocks Are Ove

Top Momentum Stocks: Large Cap US September 20

Stock Market in US Now: Current Trends and Pre

DBV Technologies Stock: The Ultimate Investmen

Understanding the "TH" Stock

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- News from the US Stock Market: Key Development"

- Rubber Stocks: A Game-Changing Investment in t"

- Toy R Us Stocks: A Comprehensive Analysis of t"

- Understanding the US Bank Sector Stocks: A Com"

- Best Performing US Stocks Q2 2025: Unveiling t"

- Tax on Stock Exchange Transactions in the US: "

- investor day"

- cyclical stocks"

- upcoming stock splits"

- Tesla US Stocks: A Comprehensive Guide to Inve"