you position:Home > aphria us stock > aphria us stock

How to Hedge Your US Stocks: Strategies for Risk Management

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

Investing in the stock market can be a lucrative endeavor, but it also comes with its fair share of risks. As a prudent investor, you might be wondering how to hedge your US stocks to protect your portfolio. This article delves into various strategies for risk management, helping you navigate the volatile markets with confidence.

Understanding Stock Hedging

What is Hedging?

Hedging is an investment strategy designed to offset potential losses. It involves taking positions that will benefit if the price of an asset falls. For stock investors, hedging can help mitigate the impact of market downturns and protect their investments.

Why Hedge US Stocks?

The US stock market, while known for its resilience, can still be unpredictable. Factors like economic downturns, political instability, or sector-specific challenges can lead to market volatility. By hedging your US stocks, you can safeguard your portfolio against these unforeseen events.

Strategies for Hedging US Stocks

Stock Index Futures

What They Are: Stock index futures are financial contracts that represent an agreement to buy or sell a basket of stocks at a predetermined price and date.

How to Use Them: To hedge your US stocks, you can sell futures contracts on a relevant index. If the market falls, the gain from the futures will help offset the losses in your stock portfolio.

Options Trading

What They Are: Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an asset at a specified price within a certain time frame.

How to Use Them: You can use call options to protect your portfolio from market downturns. By purchasing call options on your stocks, you gain the right to sell them at a higher price, which can mitigate losses if the stock price falls.

Dividend Stocks

What They Are: Dividend stocks are shares of companies that pay out a portion of their earnings to shareholders.

How to Use Them: Investing in dividend stocks can provide a steady income stream and act as a hedge against market volatility. Companies with strong financials and stable dividend payments are often better positioned to withstand market downturns.

Short Selling

What It Is: Short selling is the practice of selling borrowed securities in the expectation that their price will fall, allowing the seller to buy back the shares at a lower price and return them to the lender.

How to Use It: Short selling can be a powerful tool for hedging, but it involves higher risk and requires a margin account. By selling short on stocks that you believe will decline in value, you can offset losses in your long positions.

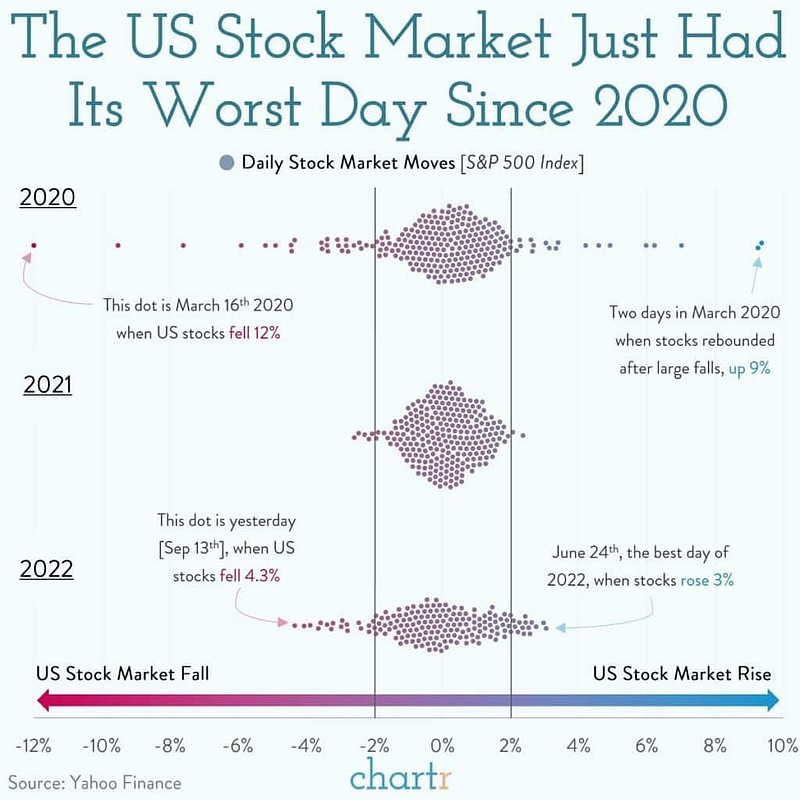

Case Study: hedging during the 2020 market crash

During the 2020 market crash triggered by the COVID-19 pandemic, many investors turned to hedging strategies to protect their portfolios. Those who employed options trading or sold index futures saw their investments weather the storm more effectively than those who did not hedge.

Conclusion

Hedging your US stocks is a crucial strategy for managing risk and protecting your investments. By understanding the various hedging methods and incorporating them into your investment strategy, you can navigate the market with greater confidence. Remember, the key to successful hedging is to do thorough research and consider your own risk tolerance before implementing any strategy.

so cool! ()

last:Stock Ww2 Equipment: A Comprehensive Guide to US Navy WWII Supplies

next:nothing

like

- Stock Ww2 Equipment: A Comprehensive Guide to US Navy WWII Supplies

- Title: In-Depth Analysis of CLF Stock: The Future of http Stocks

- PlayStation 5 US Stock: The Ultimate Guide to Availability and Pre-Orders

- Can I Buy US Stocks with My TFSA? A Comprehensive Guide

- US Rare Mineral Stocks: The Next Gold Rush?

- Best Stocks to Invest in the US Market: Top Picks for 2023

- Stocks to Buy After US-China Trade Deal: A Strategic Investment Guide

- Title: Discover the Least Correlated Foreign Stock to US for Diversification

- Best US Stocks to Buy from India: A Strategic Investment Guide

- ARM Stock Price US: The Ultimate Guide to Understanding Current Trends

- Stock Market Crashes in the US: Understanding the Impacts and Recovery

- Buy Us Stocks from Kenya: A Lucrative Investment Opportunity

recommend

How to Hedge Your US Stocks: Strategies for Ri

How to Hedge Your US Stocks: Strategies for Ri

US Stock Low PE Rankings: Identifying Value St

Penny Stocks to Watch in the US: 2023's M

Key Market Trends and Risks in the US Stock Ma

"Toys R Us Store Stock: A Comprehensi

US Bank Stock Collapse: Causes, Impacts, and R

Is the US Stock Market Open on Good Friday 201

Edward Jones US Stock Focus List: Top Picks fo

Buying US Stock by Using Credit Card: A Compre

FDL Stock: What You Need to Know from US News

Earnings Calendar Week of October 6, 2025: A D

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- Unlocking the Potential of 601398.ss: A Deep D"

- Title: How Many Publicly Traded US Stocks?"

- Can I Buy US Stocks in a TFSA? A Comprehensive"

- Kato Rabe N Scale US Shop in Stock: Your Ultim"

- Momentum Stocks High Volume US Large Cap: A Gu"

- How Many Stock Markets Are There in the US?"

- PJ Japan Stock Market Discount to US: A Compre"

- KFC Stock Price US: What You Need to Know"

- How to Invest in UK Stocks from the US: A Step"

- Benefits of Buying US Stock: Why It’s a Smar"