you position:Home > aphria us stock > aphria us stock

Buying U.S. Stocks in Canadian Dollars: A Strategic Guide

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

In today's interconnected financial world, investors from Canada are increasingly looking beyond their borders to diversify their portfolios. One popular investment avenue is buying U.S. stocks in Canadian dollars. This guide will explore the benefits, considerations, and strategies for Canadians looking to invest in U.S. stocks while keeping their currency exposure in Canadian dollars.

Understanding the U.S. Stock Market

The U.S. stock market is one of the most robust and diverse in the world, offering a wide range of investment opportunities. From tech giants like Apple and Microsoft to energy companies like ExxonMobil, the U.S. market has something for every investor. However, investing in U.S. stocks requires a solid understanding of the market, including its valuation methods, industry sectors, and individual stock performance.

Why Invest in U.S. Stocks in Canadian Dollars?

There are several reasons why Canadian investors might choose to buy U.S. stocks in Canadian dollars:

- Currency Diversification: Investing in U.S. stocks can help diversify a Canadian investor's portfolio away from the Canadian dollar, which can fluctuate against other currencies.

- Access to a Larger Market: The U.S. stock market offers a broader range of investment opportunities than the Canadian market, including access to many of the world's largest and most innovative companies.

- Potential for Higher Returns: Historically, the U.S. stock market has offered higher returns than the Canadian market, making it an attractive option for long-term investors.

Considerations When Buying U.S. Stocks in Canadian Dollars

While investing in U.S. stocks can be beneficial, there are several considerations to keep in mind:

- Currency Risk: Fluctuations in the exchange rate can impact the value of your investment in Canadian dollars. It's important to stay informed about exchange rate movements and consider how they may affect your investment returns.

- Transaction Costs: Buying and selling U.S. stocks may involve additional transaction costs, including brokerage fees and currency conversion fees. It's important to understand these costs and factor them into your investment strategy.

- Tax Implications: Investing in U.S. stocks may have tax implications, including capital gains tax and withholding tax on dividends. It's important to consult with a tax professional to understand your specific tax obligations.

Strategies for Buying U.S. Stocks in Canadian Dollars

Here are some strategies to consider when buying U.S. stocks in Canadian dollars:

- Dividend Stocks: Investing in U.S. dividend-paying stocks can provide a steady stream of income in Canadian dollars, as dividends are typically paid in the currency of the company's country of incorporation.

- Index Funds: Index funds provide exposure to a basket of U.S. stocks, offering diversification and lower transaction costs compared to individual stocks.

- ETFs: Exchange-traded funds (ETFs) are a popular way to invest in U.S. stocks, as they offer liquidity, low fees, and diversification.

Case Study: Investing in Apple (AAPL) in Canadian Dollars

Let's say you're interested in investing in Apple (AAPL), one of the most successful and valuable companies in the world. By purchasing Apple stocks in Canadian dollars, you can benefit from potential growth in the company's share price while keeping your exposure to the Canadian dollar.

Assuming you invest

Conclusion

Investing in U.S. stocks in Canadian dollars can be a strategic move for Canadian investors looking to diversify their portfolios and potentially achieve higher returns. By understanding the U.S. stock market, considering the associated risks and costs, and implementing a well-defined investment strategy, Canadians can successfully invest in U.S. stocks while keeping their currency exposure in Canadian dollars.

so cool! ()

last:What Did Dow Close At Yesterday? A Deep Dive into the Market's Movement

next:nothing

like

- What Did Dow Close At Yesterday? A Deep Dive into the Market's Movement

- What's the Highest Stock: Unveiling the Peak Performers in the Market

- Top 30 US Stocks to Watch in 2023: A Comprehensive Guide

- How Brexit Impacts the US Stock Market: A Comprehensive Analysis"

- Does MGM Macau Impact MGM Stocks in the US?

- Avo Stock US: Unveiling the Potential of Avocado Stocks in the American Market

- Understanding US Stock Exchange Trading Days: A Comprehensive Guide

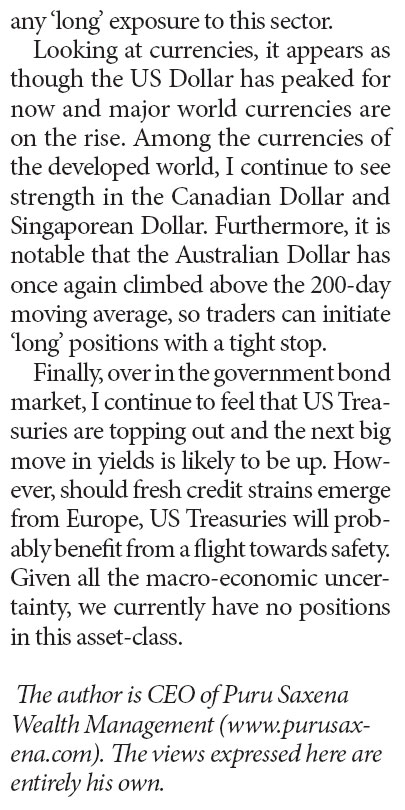

- The Intricate Linkage Between U.S. and EM Stock Markets: Understanding the Dynami

- Inside the Three Major US Stock Exchange Servers: How They Power the Financial Wo

- Best Oil Stocks in the US: Top Picks for 2023

- Toys "R" Us Overnight Stocker Review: A Glimpse into the World

- Title: FCX US Stock Quote: Comprehensive Guide and Analysis

recommend

Buying U.S. Stocks in Canadian Dollars: A Stra

Buying U.S. Stocks in Canadian Dollars: A Stra

Top Trending Stocks: Unveiling the US Market&#

Understanding the US Stock Market by Sector: A

Understanding the US Housing Stock: Key Insigh

Is the Stock Market Open Today? Your Comprehen

M7 US Stock: Unveiling the Potential of Emergi

Screener Equivalent for US Stocks: How to Find

Best Momentum Stocks in the US Market: Top 5 P

Market Outlook Next Week: US Stocks Commentary

Can I Still Buy Stocks When the US Market Clos

Title: In-Depth Analysis of KEM Stock: Everyth

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Multibagger Stocks US 2021: Top Performers and"

- China Stocks vs US Stocks: Performance Analysi"

- CSL Behring Stock US: A Comprehensive Analysis"

- Title: The Three Major Stock Markets in the US"

- Title: In-Depth Analysis of CLF Stock: The Fut"

- US Stock Market 1 Year: A Comprehensive Overvi"

- Understanding Canadian Capital Gains Tax on US"

- Title: US Dollar to Yen Stock Symbol: Understa"

- Major Shareholders: Understanding the Power Be"

- Understanding the Stock Symbol of Tod's S"