you position:Home > aphria us stock > aphria us stock

APE US Stock: A Comprehensive Guide to Understanding the APE Index

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

Are you looking to invest in the US stock market but are unsure where to start? Have you heard of the APE Index and are curious about what it represents? In this article, we will delve into the APE US Stock, providing you with a comprehensive guide to understanding this unique index and how it can help you make informed investment decisions.

What is the APE Index?

The APE Index, which stands for "Animal Pedestrian Earnings," is a unique stock market index that tracks the performance of companies with strong fundamentals and growth potential. Unlike traditional stock market indices like the S&P 500 or the NASDAQ, the APE Index focuses on companies that have a strong balance sheet, solid earnings, and a compelling growth story.

How is the APE Index Calculated?

The APE Index is calculated by taking into account several factors, including a company's earnings per share (EPS), price-to-earnings (P/E) ratio, and revenue growth rate. The index aims to identify companies that are undervalued and have the potential for significant growth in the future.

Key Components of the APE Index

Earnings Per Share (EPS): This is a measure of a company's profitability, calculated by dividing the company's net income by the number of outstanding shares. Companies with high EPS are generally considered to be more profitable.

Price-to-Earnings (P/E) Ratio: This ratio compares a company's stock price to its EPS. A low P/E ratio suggests that the stock may be undervalued, while a high P/E ratio may indicate that the stock is overvalued.

Revenue Growth Rate: This measures the rate at which a company's revenue is increasing over time. Companies with a high revenue growth rate are often considered to have strong growth potential.

Benefits of Investing in the APE US Stock

Risk Mitigation: By focusing on companies with strong fundamentals, the APE Index aims to mitigate risk and protect investors from investing in companies with poor financial health.

Growth Potential: The APE Index is designed to identify companies with strong growth potential, allowing investors to capitalize on these opportunities.

Diversification: Investing in the APE US Stock can provide investors with a diversified portfolio, as the index includes companies from various industries.

Case Study: Apple Inc.

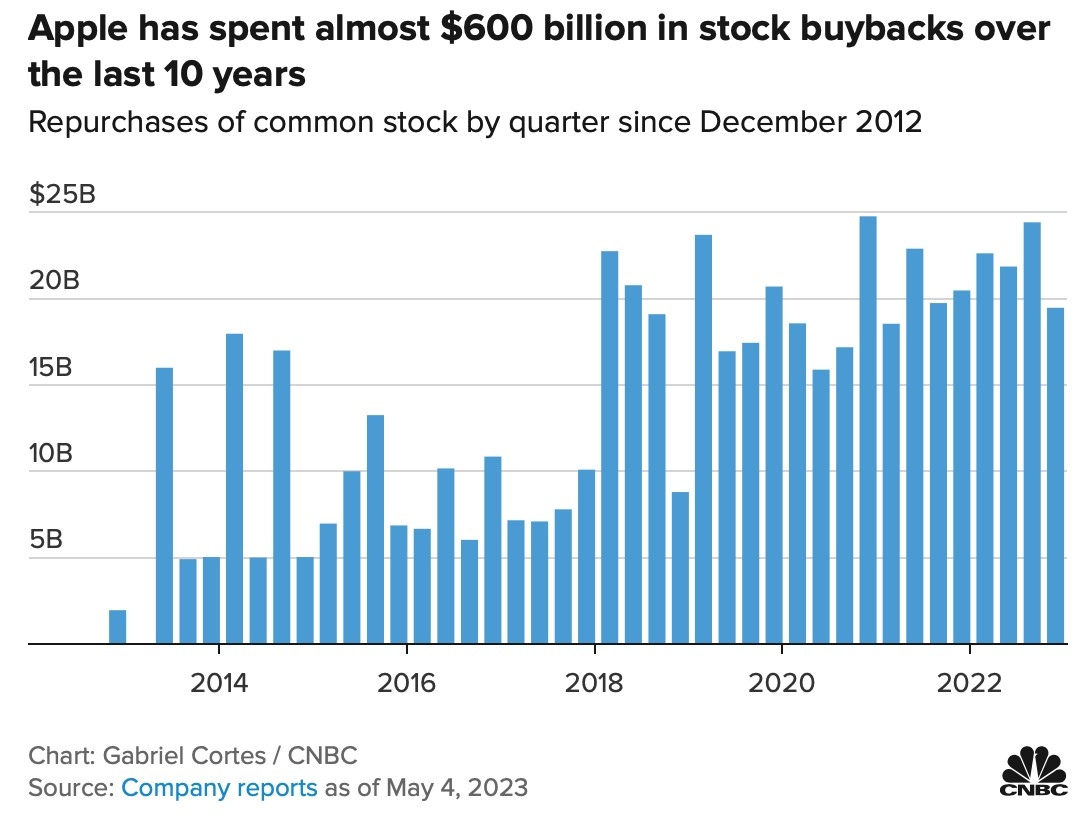

A prime example of a company that has performed well on the APE Index is Apple Inc. (AAPL). Over the years, Apple has demonstrated strong EPS growth, a relatively low P/E ratio, and a robust revenue growth rate. As a result, Apple has consistently outperformed the market and provided investors with significant returns.

How to Invest in the APE US Stock

To invest in the APE US Stock, you can consider several options:

Stock Brokers: Use a reputable stock broker to purchase shares of companies included in the APE Index.

ETFs: Exchange-traded funds (ETFs) that track the APE Index can provide you with exposure to the index without having to buy individual stocks.

Mutual Funds: Some mutual funds may include companies from the APE Index in their portfolio, allowing you to invest in a diversified manner.

Conclusion

The APE US Stock is a unique index that can help investors identify companies with strong fundamentals and growth potential. By focusing on EPS, P/E ratio, and revenue growth rate, the APE Index aims to provide investors with a risk-mitigated and potentially profitable investment opportunity. If you are considering investing in the US stock market, the APE US Stock may be worth exploring.

so cool! ()

last:Title: Best US Stock for Long-Term Investment

next:nothing

like

- Title: Best US Stock for Long-Term Investment

- DeepSeek US Stocks: Unveiling the Hidden Gems

- Average Return of the US Stock Market from 2009 to 2017: A Comprehensive Analysis

- Title: US Role on the 1989 Japanese Stock Market Crash

- American Stock Traders Outside the US: Navigating the Global Market

- US Companies Listed on Toronto Stock Exchange: A Comprehensive Guide

- Marihuana Stock Entering the US Market: A Game-Changing Opportunity

- Title: Top 3 Stock Exchanges in the US

- 2018 Top US Stock Picks: The Must-Have List for Investors

- US Stock Market Boxing Day: A Comprehensive Guide

- Trading in UK Stock Market vs US: A Comprehensive Guide

- All-Time High US Stocks: A Deep Dive into the Current Market Dynamics

recommend

APE US Stock: A Comprehensive Guide to Underst

APE US Stock: A Comprehensive Guide to Underst

Dividend Stocks Traded in the US: A Comprehens

Analyst Recommendations: US Stocks Short-Term

Highest Dividend Stocks in the US Market: Your

Top 10 US Stocks to Watch in 2023

Can I Hold Us Stocks in My TFSA? A Comprehensi

American Tower US Real Estate Stocks: A Compre

Is It Safe to Invest in US Stocks from India?

How Many Stock Markets Are There in the US?

Jamie Dimon Says Stock Prices in the US Are In

How to Buy Eutelsat Stock in the US

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- consumer staples stocks"

- US Stock Market Annual Growth Rate Calculator:"

- Is It Safe to Invest in US Stocks from India?"

- should i sell my stocks"

- cyber security stocks"

- Title: Domestic Stocks Outperform Foreign-Faci"

- veru inc share price"

- JD US Stock: A Comprehensive Guide to Investin"

- best ai companies to invest in"

- Title: Global Financial Collapse and the Impac"