you position:Home > us stock market live > us stock market live

Understanding the Factors Influencing Our Stock Price

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info: Infl(2)Factors(4)The(1453)

In today's volatile financial markets, understanding the factors that influence stock prices is crucial for both investors and businesses. "ing us stock price" refers to the dynamics that determine the value of a company's shares on the market. This article delves into the key factors that can affect a company's stock price, offering insights and practical tips for stakeholders.

Market Demand and Supply Dynamics

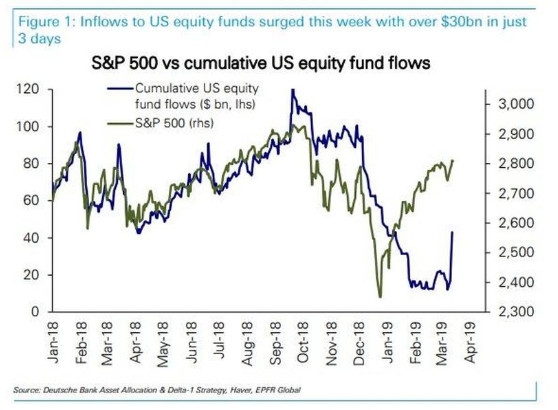

One of the most fundamental factors affecting stock prices is the interaction between market demand and supply. When a company performs well, investors tend to increase their demand for its shares, pushing up the price. Conversely, if the company faces challenges or a negative outlook, the supply of shares might exceed demand, causing the stock price to fall.

For instance, consider the tech giant Apple (AAPL). When Apple launches a new product, there's usually a surge in demand, boosting the company's stock price. However, if the company faces issues like a product recall or negative reviews, the stock price may take a hit.

Economic Indicators

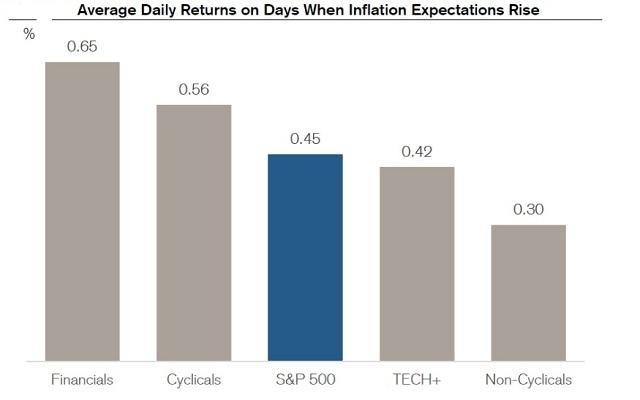

Economic indicators, such as GDP growth, unemployment rates, and inflation, also play a significant role in determining stock prices. When the economy is performing well, companies are likely to see improved sales and profits, leading to higher stock prices. Conversely, economic downturns can lead to lower stock prices.

For example, during the 2008 financial crisis, the stock prices of many companies plummeted due to rising unemployment and declining consumer spending. Conversely, when the economy is thriving, companies may see an increase in demand for their products or services, resulting in higher stock prices.

Company Financial Performance

The financial performance of a company is another critical factor that influences stock prices. Investors closely monitor metrics like revenue, earnings per share (EPS), and return on equity (ROE). Companies that consistently demonstrate strong financial performance tend to attract more investors, driving up their stock prices.

Let's take Microsoft (MSFT) as an example. The company's consistent revenue growth and strong EPS have helped maintain its status as a leading tech stock. However, during periods of economic uncertainty, Microsoft's stock price might experience volatility, reflecting the broader market sentiment.

Sector and Industry Factors

Sector and industry factors also play a role in determining stock prices. Certain industries may be more sensitive to economic cycles or regulatory changes than others. For instance, the healthcare industry might experience increased demand during a pandemic, while the energy sector might be affected by changes in oil prices.

Additionally, companies within a particular sector may influence each other's stock prices. For instance, if a major pharmaceutical company announces a breakthrough drug, it may positively impact the stock prices of other companies in the healthcare sector.

Analyst Ratings and Expectations

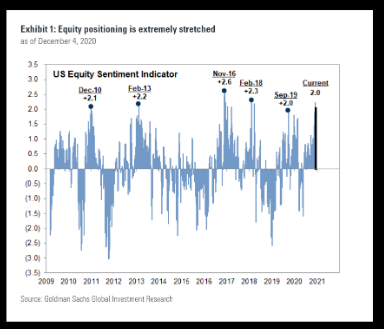

Analyst ratings and expectations can also have a significant impact on stock prices. When analysts upgrade or downgrade a stock, investors often follow suit, leading to changes in the stock price. Additionally, earnings forecasts and growth projections can influence investor sentiment.

For instance, if a company's management provides strong guidance for the upcoming quarter, investors might become more optimistic, leading to an increase in the stock price. However, if the company misses these expectations, the stock price could suffer.

In conclusion, understanding the factors influencing stock prices is essential for anyone invested in the financial markets. By examining market dynamics, economic indicators, company financial performance, sector and industry factors, and analyst ratings, investors can make more informed decisions. As the saying goes, "knowledge is power," and this knowledge can help you navigate the complexities of the stock market and potentially lead to greater success.

so cool! ()

like

- Top AR Companies in the US Stock Market: A Comprehensive Guide

- High Price Stocks in the US: Understanding the Market Dynamics

- The Two Major Stock Markets in the US: A Comprehensive Overview

- Total Value of the US Stock Market in 2013: A Comprehensive Analysis

- Stock.Invest Us: Unleashing the Power of Equity Investment in the USA"

- Stock Symbols List: Your Ultimate Guide to Understanding US Stocks

- Top US Stocks 2021: Unveiling the Market's Winners

- Understanding the Parallels: US OTC Stocks and Their Foreign Counterparts

- US Hemp Grower Stock: A Lucrative Investment Opportunity in the Growing Cannabis

- The Ultimate Guide to Retail Stocks in the US

- Best Momentum Stocks US Large Cap Current: Unveiling the Market's Top Perfor

- How to Buy Stocks in the US from India: A Step-by-Step Guide

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- US Stock Exchange Holiday List 2018: A Compreh"

recommend

Us Silver Gold Stock Prices: A Comprehensive G

Us Silver Gold Stock Prices: A Comprehensive G

Is NYSE a Major US Stock Market Exchange?

US Stock Market Hits All-Time High: What It Me

US Bank Stock Price Today Per Share: A Compreh

Title: Crown Castle US Real Estate Stocks: A G

US 30 Caliber Carbine Kahr Folding Stock: A Co

Trading on US Stock Exchanges: A Comprehensive

Title: "US Stock Market 50 Years: A L

US Companies Stock Plays Africa: A Strategic I

Latest US Stock Market News September 2025

Understanding the Factors Influencing Our Stoc

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- 2018 US Election: How the Stock Market Reacted"

- Market Predictions: US Stock Market 2024 So Fa"

- Top 10 Best Stocks to Buy Now in the US"

- Top 3 US Stock Market Indexes: A Comprehensive"

- Axsome Therapeutics: A Rising Star in US Biote"

- Us Food Company Stocks: The Ultimate Guide to "

- How to Buy Stocks in the US from India: A Step"

- Can a Non-US Citizen Buy US Stocks?"

- Total US Stock Market Capitalization in 2014: "

- US Stock Futures Rise as Investors Weigh Earni"