you position:Home > aphria us stock > aphria us stock

US Bank Stocks Win Streak: The Impressive Run Continues

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info: Win(1)Streak(1)Imp(4)Stocks(1629)The(1453)Bank(58)

The US banking sector has been on a remarkable winning streak in recent years, and this trend shows no signs of slowing down. From JPMorgan Chase to Bank of America, investors are reaping the benefits of a thriving industry. This article delves into the factors contributing to this success and explores the potential future of US bank stocks.

Economic Growth and Low Interest Rates Fueling the Streak

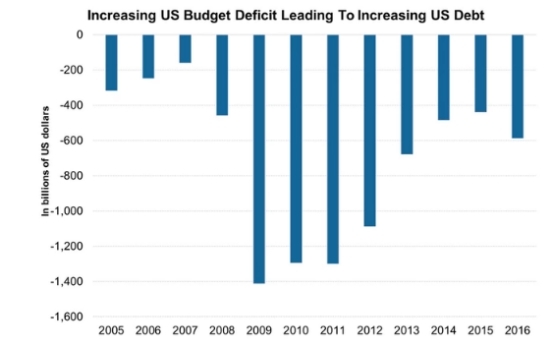

One of the primary reasons behind the impressive performance of US bank stocks is the robust economic growth and low-interest rate environment. The US economy has been on a steady upswing, with unemployment rates at historic lows and consumer spending on the rise. This has translated into higher profits for banks, as they enjoy increased demand for loans and other financial services.

Low interest rates have also played a crucial role. With the Federal Reserve keeping rates at historic lows, banks have been able to borrow money cheaply and lend it out at higher rates, thereby increasing their net interest margins.

Technological Advancements Boost Efficiency

Another factor contributing to the success of US bank stocks is the adoption of advanced technologies. Many banks have invested heavily in digital transformation, which has led to improved efficiency and customer satisfaction. From mobile banking apps to AI-driven customer service, these innovations have not only reduced costs but also enhanced the overall banking experience.

Regulatory Relief Creating a More Favorable Environment

The banking industry has also benefited from regulatory relief in recent years. The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in the wake of the 2008 financial crisis, imposed strict regulations on banks. However, as the economy has recovered, regulators have begun to ease some of these restrictions, allowing banks to focus more on lending and growth.

Key Players Leading the Charge

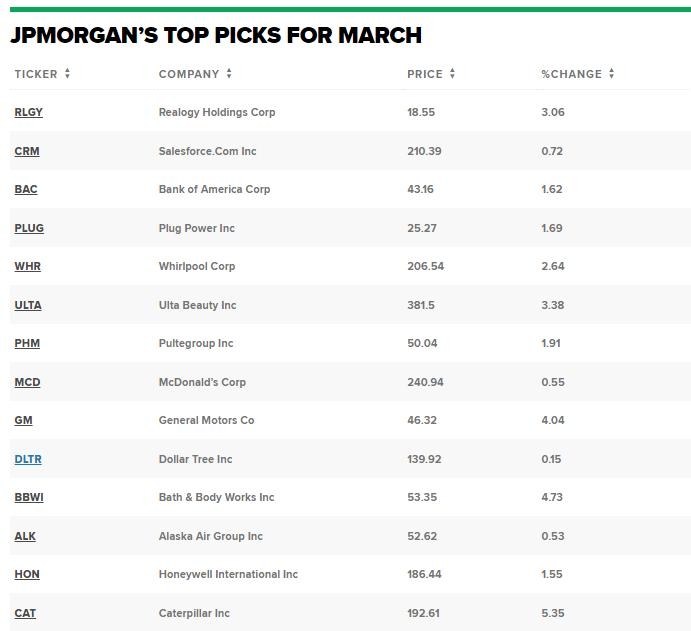

Several key players have been leading the charge in the US banking sector. JPMorgan Chase, for instance, has been consistently outperforming its peers, thanks to its diversified business model and strong capital position. Bank of America has also been a standout, with its robust revenue growth and cost-cutting measures.

Investment Opportunities Abound

Given the current trends, there are numerous investment opportunities in the US banking sector. Investors looking to capitalize on this winning streak can consider investing in large-cap banks such as JPMorgan Chase and Bank of America, as well as regional banks that are well-positioned to benefit from the ongoing economic growth.

Case Study: JPMorgan Chase

JPMorgan Chase is a prime example of a bank that has capitalized on the favorable economic environment. The bank has reported strong revenue growth, driven by its diversified business segments, including consumer banking, corporate banking, and asset management. JPMorgan Chase has also been actively investing in technology, which has helped it reduce costs and improve customer satisfaction.

Conclusion

The US banking sector's winning streak is a testament to the resilience and adaptability of the industry. With economic growth, low-interest rates, and technological advancements, there is no doubt that US bank stocks will continue to perform well in the years to come. Investors looking to capitalize on this trend should consider adding high-quality bank stocks to their portfolios.

so cool! ()

like

- Barron's US Marijuana Stocks: A Comprehensive Guide to Investment Opportunit

- Strong US Stocks Fundamentals: A Deep Dive into Market Stability and Growth

- Market Cap Weight of Top 10 Largest US Stocks: A Comprehensive Analysis"

- US News Best Stocks: Unveiling the Top Picks for 2023

- Understanding Tax Implications for US Investors in Canadian Dividend Stocks&q

- How Many Stocks in the US Market in 2021?

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol cfn:

- List All US Marijuana Related Stocks: Your Ultimate Guide

- Understanding the Dynamics of Listed Stocks in the US Stock Market

- Moving Stocks from Canada to the US: A Comprehensive Guide

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol amzn.

- Indian Stocks in the US Market: A Comprehensive Guide

recommend

Barron's US Marijuana Stocks: A Comprehen

Barron's US Marijuana Stocks: A Comprehen

Title: Nestle US Stock Symbol: A Comprehensive

Does the U.S. Stock Market Open Today? Underst

Understanding the PTC US Stock Price: A Compre

Title: US Overseas Stock Fund: A Strategic Inv

Best Dividend US Stock: How to Identify the Be

Real Estate vs. Stocks in the US: Which Invest

Unlocking the Potential of the Monat US Stock

US Silica Stock Forecast: A Comprehensive Anal

Sono Stock Price: A Comprehensive Guide to Son

Russia and US Stock Market: A Comprehensive An

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- US Large Cap Stocks: Market Cap Over $10 Billi"

- The NASDAQ Stock Market: A Hub of Innovation a"

- Barron's US Marijuana Stocks: A Comprehen"

- Best US Robotics Stocks: Top Picks for 2023"

- Mexican Stocks Trading in the US: A Comprehens"

- US Rail Stock: The Vital Role of Railroad Shar"

- Average Return of the US Stock Market from 200"

- Tomorrow: US Stock Market Drop – What You Ne"

- disney dividend"

- Maximizing Returns: Top Oil Companies in the U"